As realtor.com recently noted, the median price for rent hit its highest-ever recorded point in many parts of the U.S. Find out what this means for you if you’re a renter.

According to the 2021 report, rents increased by 8.1 percent from the year prior:

“Beyond simply recovering to pre-pandemic levels, rents across the country are surging. Typically, rents fluctuate less than 1 percent from month to month. In May and June, rents increased by 3.0 percent and 3.2 percent from each month to the next.”

If you’re renting and are apprehensive about climbing prices, now could be the ideal time to think about buying your first home. Though mortgage rates are also increasing, they remain in historically low territory. So, purchasing could be more affordable than you realize.

Confirmed: Monthly rent is higher than a monthly mortgage payment

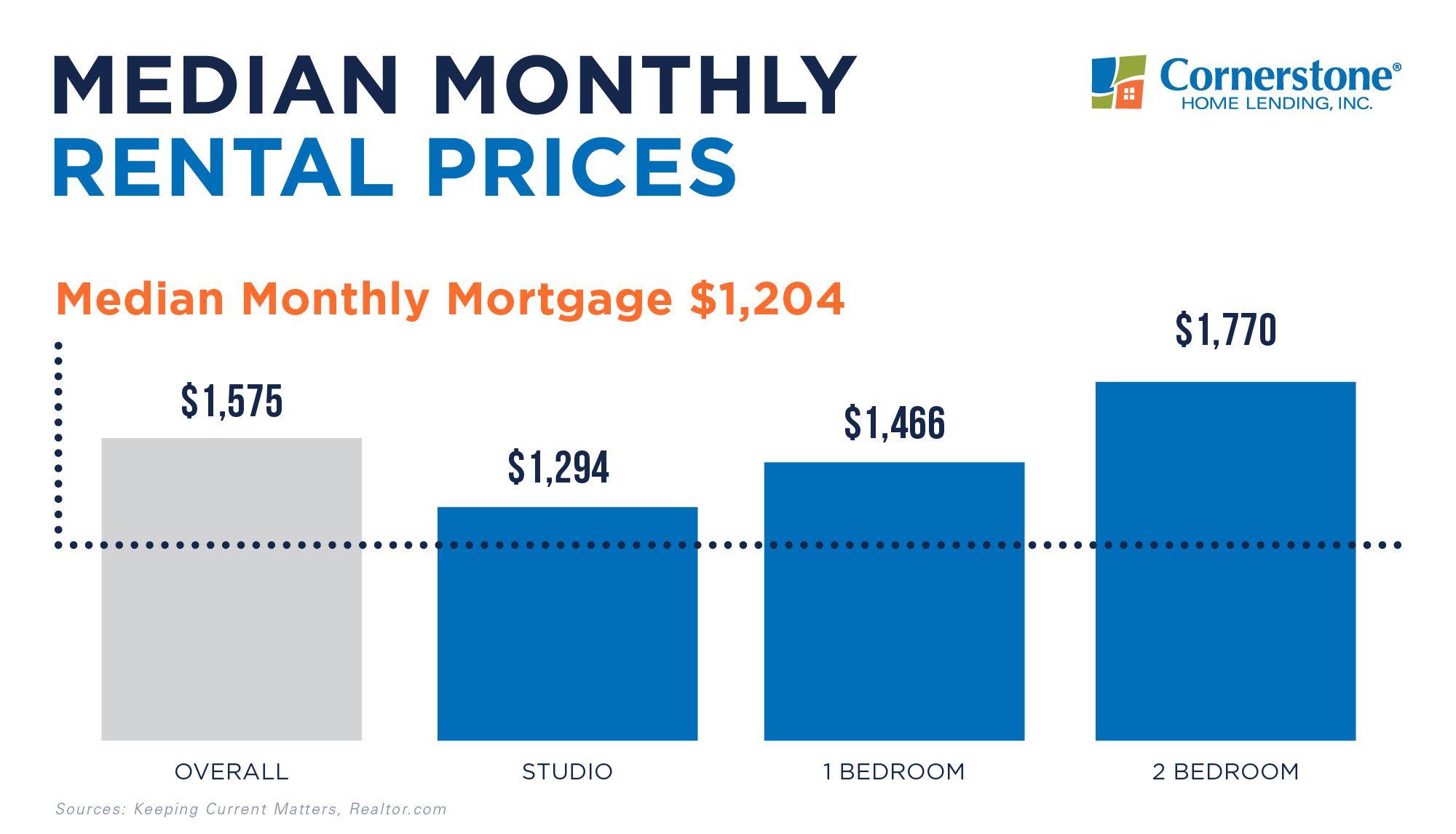

When weighing whether to continue renting or to buy your first home, the amount you pay each month is probably at the top of your list. Data from the National Association of REALTORS® (NAR) shows that monthly mortgage payments are also on the rise. But they’re still considerably cheaper than the typical monthly payment for rent.

NAR’s 2021 data found the median monthly mortgage payment to be $1,204. Compare this to the median national rent of $1,575, based on realtor.com data, within the same time frame.

To put it another way, a homebuyer could save about $371 a month by locking in a set mortgage payment instead of paying rent:

Here’s another example that shows similar findings: Redfin’s Rental Market Tracker, published in early 2022, found the average monthly rent to be $1,877. This is compared to the median monthly mortgage payment (for homebuyers who put down 5 percent minimum) of $1,553. Total monthly savings for a homeowner amounts to $324.

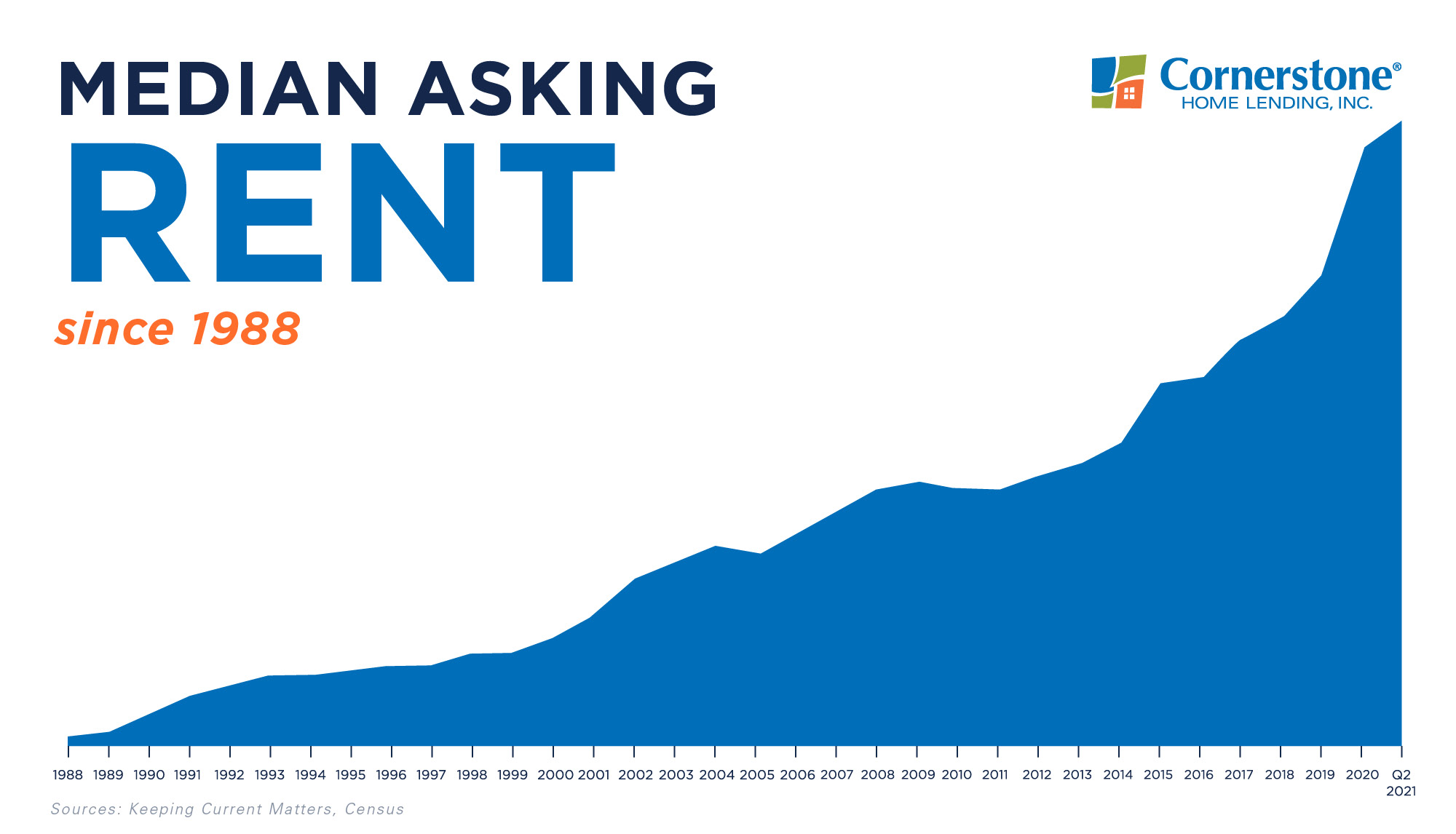

Surging rents are only likely to keep increasing. Historical data from the U.S. Census Bureau shows that median rent has been consistently trending upward since 1988:

This graph helps to depict one of the indisputable advantages of homeownership: having a stable monthly payment.

Find a better way home. Click here to fly into your mortgage.

As NAR’s Chief Economist Lawrence Yun states:

“…fast-rising rents and increasing consumer prices may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment.”

Renters aren’t happy with annual price increases. But when you buy your own house, you can lock in your mortgage rate for up to 30 years, ensuring your monthly payment remains the same. You’ll no longer have to worry about budgeting for yearly rent hikes. For many prospective homebuyers, this predictability brings priceless peace of mind.

As of 2022, homeownership continues to be a more affordable choice than renting in the majority of U.S. markets, just like it was in 2021. In their 2022 Rental Affordability Report, ATTOM Data credits the affordability of homeownership to rising wages and low mortgage rates that help to offset the home price growth seen nationwide.

In the last year alone, renters have lost out on $56,700

Not only is rent expected to be even higher a year from now, but there’s also the equity loss that comes with paying rent. Many call this the “real cost” of renting.

When you buy a home, your mortgage payment pays for your shelter. It functions as an investment too. Your investment naturally builds with each monthly mortgage payment you make, paying down your home loan and helping you to accumulate home equity. Homeowners’ equity is growing at a rapid rate thanks to near-record home price appreciation.

CoreLogic’s Homeowner Equity Insights report finds that:

“…the average homeowner gained approximately $56,700 in equity during the past year.”

When you rent, you’re helping to build your landlord’s equity — not your own. None of the monthly rent you pay will be returned to you as an investment. If you sign another lease, you’ll be paying a higher rent than you did the year before. You’ll also miss out on as much as $56,700 in potential home equity gains.

For many homeowners, this equity growth equates to financial freedom. What could you do with your home equity once it accumulates? Trading up to a larger or more desirable home, moving to your dream location (like the mountains or the beach), paying for education or a wedding, and starting your own business are just a few examples.

Let’s not forget that homeowners have the freedom to customize too. Once you own, you have full creative control of how you paint, upgrade, and renovate.

Find out if it’s the right time to buy in your area

Connect with a local loan officer and request your customized rent-versus-own analysis. Counting the cost with the help of a professional makes it easy to make your smartest choice.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.