It’s been a big year. As a result of the pandemic, mortgage rates dropped to new lows 16 times in 2020. Moving into 2021, rates are beginning to rise slightly as vaccines become more available — though they remain within “historically low” territory.

With mortgage rates as low as this, close to 13 million homeowners* still eligible to refinance could see substantial savings.

How to tell if the time is right

Refinance applications shot up 224 percent when rates dropped at the onset of the pandemic. A year later, and millions of homeowners could still take advantage. Black Knight’s recently released Mortgage Monitor Report* found that around 13 million homeowners with a 30-year mortgage may qualify for and benefit from refinancing.

There are a few ways to know if it’s the ideal time to refinance. You may:

- Be looking to lower your current interest rate.

- Be hoping to lower your monthly mortgage payment.

- Have a need for cash, i.e., covering unforeseen expenses or paying for college.

- Have improved your credit score.

- Need money for home improvements or upgrades.

- Need to consolidate your debts.

- Want to change your loan terms.

- Want to shorten your loan term and pay your mortgage off early.

Shortening a loan term can be a smart choice at a time when mortgage history is being made. Converting from a standard 30-year home loan to a 20- or even 15-year loan term could offer significant savings. This week’s average mortgage rate is around 3.05 percent.

Reduce a loan’s term, and your payment may not necessarily change, but you’ll pay off your mortgage sooner. This may save you upwards of $42,000 in interest.

Otherwise, you could keep your 30-year loan term and refinance to lower your monthly payment. Refinancing a $269,000 median-priced mortgage at roughly 4.5 percent interest to today’s rate of around 3.05 percent (with an estimated 3.23 percent Annual Percentage Rate) may make a monthly payment (estimated at $1,141) about $222 cheaper.** Annual savings could add up to over $2,600.

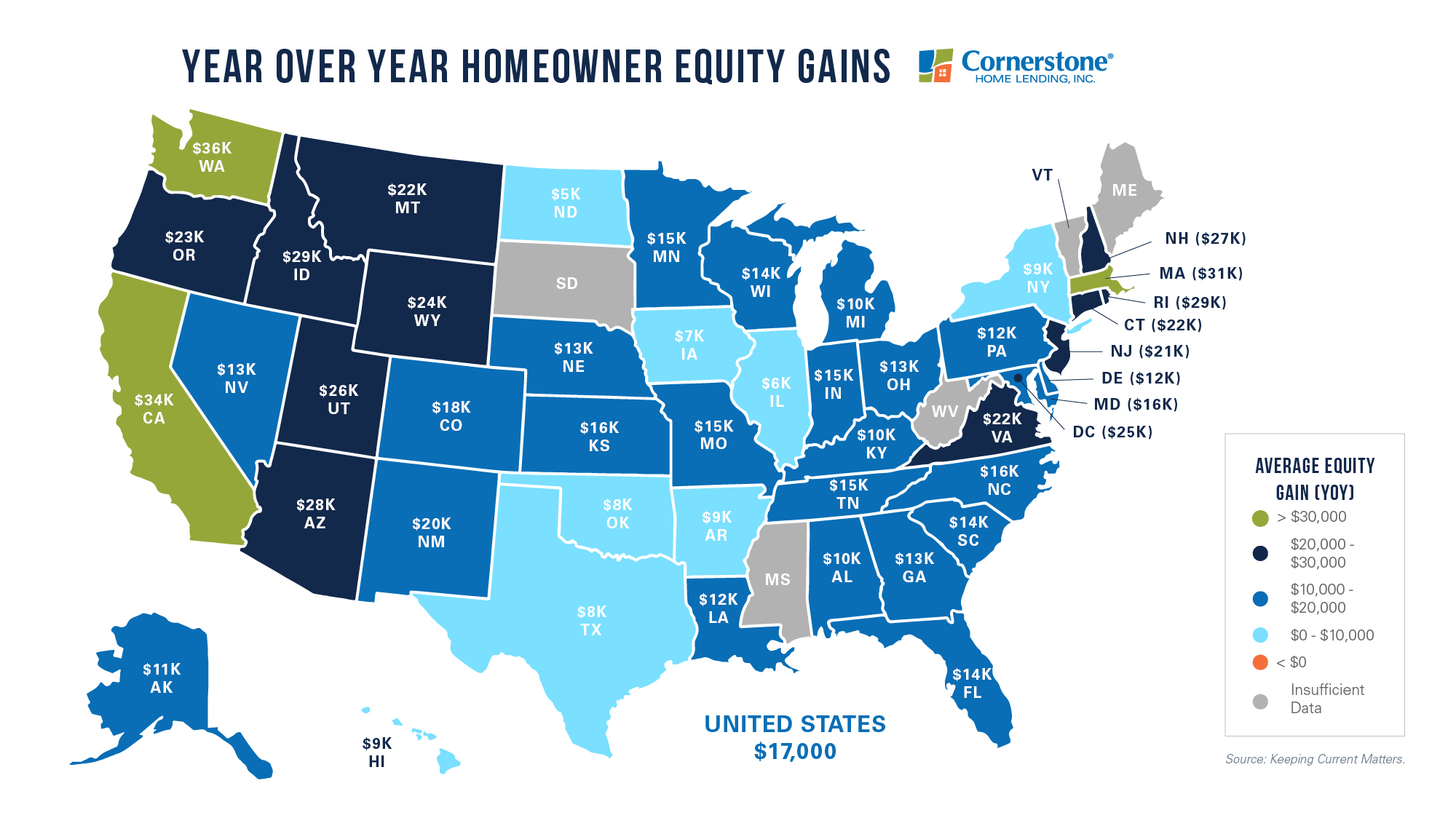

Tap into an extra $17,000

Refinancing can pay off when rates are low or if your home’s value has recently increased. With low inventory causing home prices to rise, this is likely.

The average home equity has risen an astonishing $17,000 (seen below). This factor alone may make more homeowners eligible to refinance:

Home equity is a portion of the total wealth you’ve accumulated as a homeowner. Refinancing is one of the most common ways to leverage this growth in your investment.

Compared to last year, the average equity is 10.8 percent higher. Accounting for the $17,000 in equity gains, the average homeowner with a mortgage may have $194,000 in equity available.

Since today’s rates are still at historic lows, it’s possible that you could refinance to access considerable cash, without changing your monthly payment. This cash can go toward college, renovations, vacations, and other big purchases. In the past year, many homeowners facing hardships have also used their equity to help cover household expenses.

As CoreLogic’s Chief Economist Frank Nothaft explained:

“Strong home price growth has created a record level of home equity for homeowners… This provides an important buffer to protect families if they experience financial difficulties and is one reason for the generational-low in foreclosure rates reported.”

When market mortgage rates are over 1 percent lower than your current mortgage rate — as is the case for millions of today’s homeowners — it’s a good idea to meet with your loan officer.

In fact, keeping the same mortgage rate for the life of a loan isn’t necessarily encouraged. It’s not an industry standard. As a rule of thumb, having a regular mortgage check-in can help ensure a loan’s numbers, and its savings, are still competitive.

If you’re shopping around, it’s always smart to request rate quotes from a minimum of three lenders. Once you get your quote, don’t just look at the rate. Comparing APRs (apples to apples) can give you a clearer picture of how much a mortgage actually costs, including additional expenses. Loan terms and other perks — like a lender that offers you access to the latest remote mortgage technology and has the in-house manpower to expedite your closing — might also influence your final pick.

Cash out or save thousands

Lock in a historically low mortgage rate today, and you’ll automatically lower your monthly payment. Or, you could reduce your loan term to see long-term savings or even cash out to pay for the unexpected. All while keeping your monthly payment the same. Contact your loan officer to learn about your options.

**MBS Highway estimate, for illustrative purposes only.

While refinancing could make a significant difference in the amount you pay each month, there are other costs you should consider. Plus, your finance charges may be higher over the life of the loan.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.