These are the highlights:

- The collective wealth among U.S. homeowners — stored as home equity — has boomed, big-time.

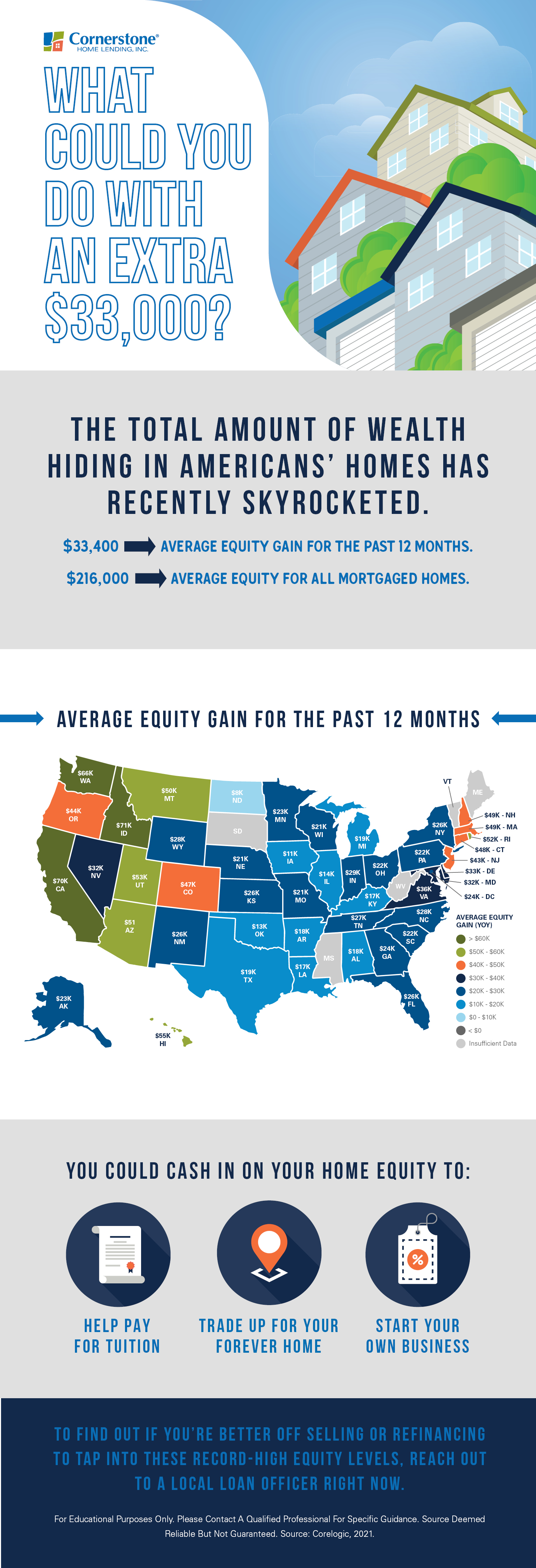

- Within the past 12 months, homeowners gained $33,400 in home equity on average; the average equity for mortgaged homes has risen to $216,000.

- Whether you opt to sell or cash in and refinance, count on the fact that your home equity gains could help you reach your future goals.

It literally pays to be a homeowner. Homeowners in the U.S. are breaking records and now have seen a nearly $1.9 trillion increase in available home equity since early 2020. Understanding what home equity means and when and how to use it can make it easier to decide what to do with your cash.

What the heck is home equity? A quick refresher

Here are five key facts to remember:

1. Home equity is the appraised value of your home minus what is owed.

- If your house was recently appraised at $300,000 and $100,000 is owed on your loan, it leaves $200,000 available in equity.

- Many lenders require that a borrower keep at least a 20-percent balance (80-percent LTV ratio) as a precaution, or else pay mortgage insurance.

2. A home with negative equity means a homeowner owes more on their mortgage than what their home is worth.

- Negative equity can occur when a home’s value declines — the opposite of the significant appreciation seen in today’s market.

- This also called an “upside-down” or “underwater” mortgage.

3. Home price appreciation helps your equity — and your wealth — increase.

- You build home equity through a combination of appreciation and reducing your mortgage principal (by paying your monthly mortgage payments).

- This ability to create wealth — and long-term financial stability — is one of the main reasons Americans prioritize homeownership and choose to become homeowners.

CoreLogic’s President and CEO Frank Martell says:

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who’ve experienced years of price appreciation.”

4. A cash-out refinance gives you access to tappable (available) home equity.

- Many homeowners “cash out” their equity with a mortgage refinance, while also making monthly payments more affordable with a better loan term and interest rate.

- Replacing an existing mortgage with a new one provides the difference in cash; a standard cash-out refinance will exceed the remaining balance by 5 percent or more.

What can you do with your equity? Homeowners most often cash in their equity to pay for big-ticket expenses, like:

- College tuition.

- Emergency savings.

- High-interest debt.

- Home renovation.

- Investment opportunities.

- Medical expenses.

- Special occasions or family vacations.

With a cash-out refinance, you can get up to 80 percent of your home’s value as cash and use it for any purpose.

There’s a better way to mortgage — and a faster way to refinance. Download LoanFly now.

5. Some homeowners also use home equity to upgrade to a new house before selling another.

- With a home equity loan, a homeowner can access the extra funds to purchase a new house before closing on their previous home.

- Typically, a homeowner needs to have at least 20-percent equity left over on their mortgage, along with any other funds needed to pay for additional fees attached to the new mortgage.

If you’re not happy with the home you’re living in — which may have been made all the more obvious by recent time spent sheltering in place — you could leverage your equity to sell and comfortably move up into the next price range. Your equity gains coupled with today’s historically low mortgage rates (that are soon expected to rise) can yield an automatic buying power increase.

As First American’s Chief Economist Mark Fleming explains:

“Existing homeowners today are sitting on record amounts of equity. As homeowners gain equity in their homes, the temptation grows to list their current home for sale and use the equity to purchase a larger or more attractive home.”

Tapping into your equity can be easy. Yet even as equity reaches record-breaking volumes, not all homeowners are using it. Much of this has to do with a simple lack of information. Homeowners may not know how much money they now have available to them.

If your home’s been making money as the market booms:

These extra funds could be there for the taking. Check in on your growing equity and get your questions answered fast. Connect with a local loan officer who can walk you through your options.

While refinancing could make a significant difference in the amount you pay each month, there are other costs you should consider. Plus, your finance charges may be higher over the life of the loan.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.