Here are some highlights:

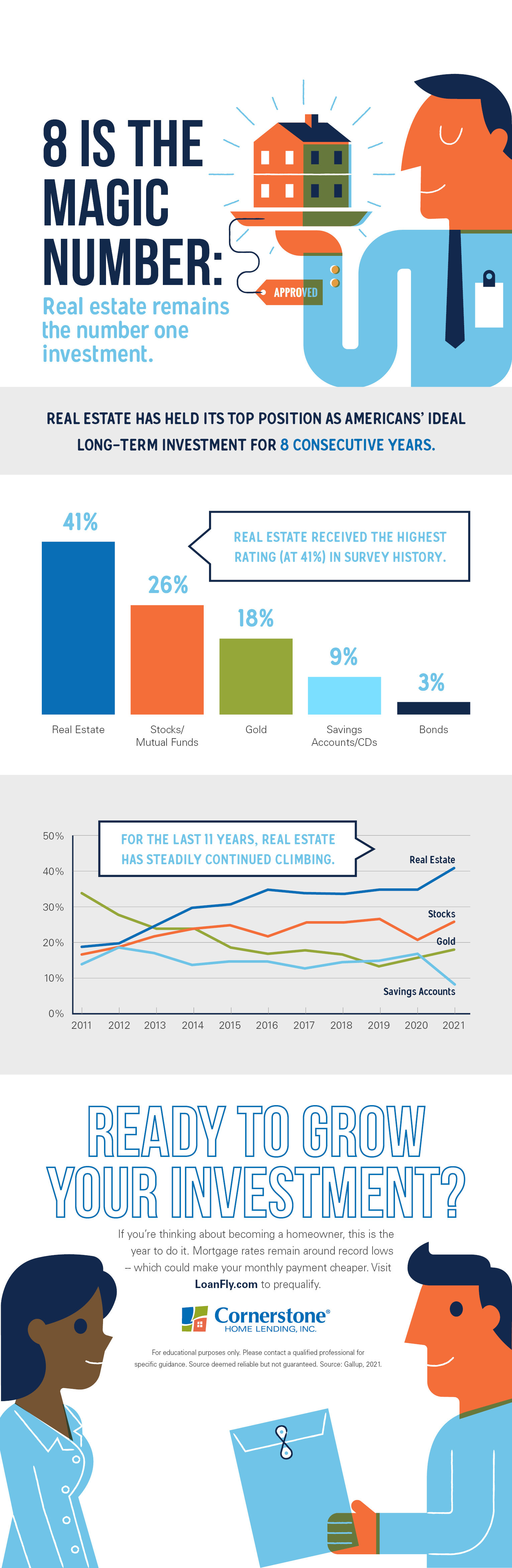

- For eight straight years, real estate has held its place at the top, being named by Americans as the preferred long-range investment.

- And for over a decade, real estate’s rating has continued to increase above gold, stocks, and savings accounts — now reaching its highest ranking in the Gallup survey’s history.

- If you want to begin building your investment (in the form of rapidly growing home equity), reach out to a local loan officer and prequalify.

Fact: Right now, 27.8 percent of income is needed to rent a house. But you only need 15.9 percent of your income to buy.* Download our free app to prequalify.

5 powerful ways homeownership pays off more than renting

Homeownership doesn’t just provide a sense of safety — it also offers multiple forms of financial stability. Like:

1. Your housing is typically your only leveraged investment.

If you own a home, you can amplify the amount of your home’s value that appreciates using a leverage factor. Putting down up to 20 percent may give you a leverage factor of five — so, you’ll get a 5-percent return on your home equity for the rise of every percentage point in your home’s value. Putting down up to a 10-percent down payment may give you a leverage factor of 10.

For instance:

- You may buy a $300,000 home and pay up to 20-percent down, or $60,000.

- If your home appreciates $30,000, its value increases by 10 percent.

- Accounting for your leverage factor of five, you’ll see a 50-percent boost in home equity.

As home prices appreciate, today’s homeowners are seeing significant equity gains in every state, with the average increase totaling $51,500.

2. You’re going to pay for housing, whether you rent or own.

It’s been argued that renting can save you on some of the extras, like home repairs and property taxes. But it’s important to remember that every prospective renter takes on all these extra expenses — including insurance, repairs, property taxes, and more — from their landlord.

Not only are these costs lumped into monthly rent already, but they’re added to a landlord’s monthly profit margin.

3. Owning helps protect against inflation.

You’ll see both rents and home values increase at or higher than the current rate of inflation. Your home’s value can hedge against rising inflation costs when you own instead of rent.

As finance guru Dave Ramsey notes:

“Rent rates will go up. Even if you found a killer deal in a hot area, inflation, competition, and rising property values will cause your rent to go up year after year.”

When you have a fixed-rate mortgage, you have a way to keep your monthly housing expense stable and feasible. Since 2012, rents have been soaring. Buying at today’s historically low rate may help you to lock in a predictable monthly mortgage payment equal to or less than what you were paying in monthly rent.

4. Owning works like a “forced savings” plan.

The latest research shows that a homeowner’s net worth is over 40-times greater than a renter’s. In fact, recent studies find that the longer you stay in your home, the more equity you can accumulate, adding up to $42,000 in just eight years.

Equity may increase to nearly $50,000 after owning a median-priced home for a decade. (Note that the current average equity gains in today’s market have already surpassed $50,000.)

5. Owning gives you substantial tax benefits.

The tax reform bill of 2018 limited some homeownership deductions in certain brackets, though there are still plenty of tax breaks for homeowners available.

But as the Urban Institute’s Christopher Mayer and Laurie S. Goodman wrote in their 2018 research paper, Homeownership and the American Dream:

“…the mortgage interest deduction is not the main source of these gains; even if it were removed, homeowners would continue to benefit from a lack of taxation of imputed rent and capital gains.”

The bottom line: Comparing apples to apples financially, homeownership always has been and will continue to be a smarter choice than renting.

Rent indefinitely or own your future?

Buying a home at today’s low rates isn’t just cheaper. It gives you the chance to quit paying your landlord’s mortgage and begin building your family’s investment instead. Find a local loan officer and find out why so many of our first-time buyers are surprised to hear they can afford a lot more than they expected.

*“Renting vs. buying: Who knew owning was almost 12% cheaper? [INFOGRAPHIC].” HouseLoanBlog.net, 2020.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.