The average FICO® credit score for closed loans recently hit 753, ICE Mortgage Technology’s latest Origination Insights Report shows.* Given that lending standards have become more stringent, many homebuyers are starting to worry that they might not have credit strong enough to get approved for a mortgage.

It’s true that tighter lending standards could pose a challenge for some borrowers. But many more may be surprised to learn about the loan options that still exist for homebuyers with less-than-perfect credit.

Fact: The average credit score is on the rise

This steady climb into healthy credit is an excellent indicator of our collective financial health. As the average American’s score increases, they’re able to build a solid foundation for the future. And as more homebuyers with healthy credit enter the market, a natural spike in the average FICO® score for closed loans* is likely to follow.

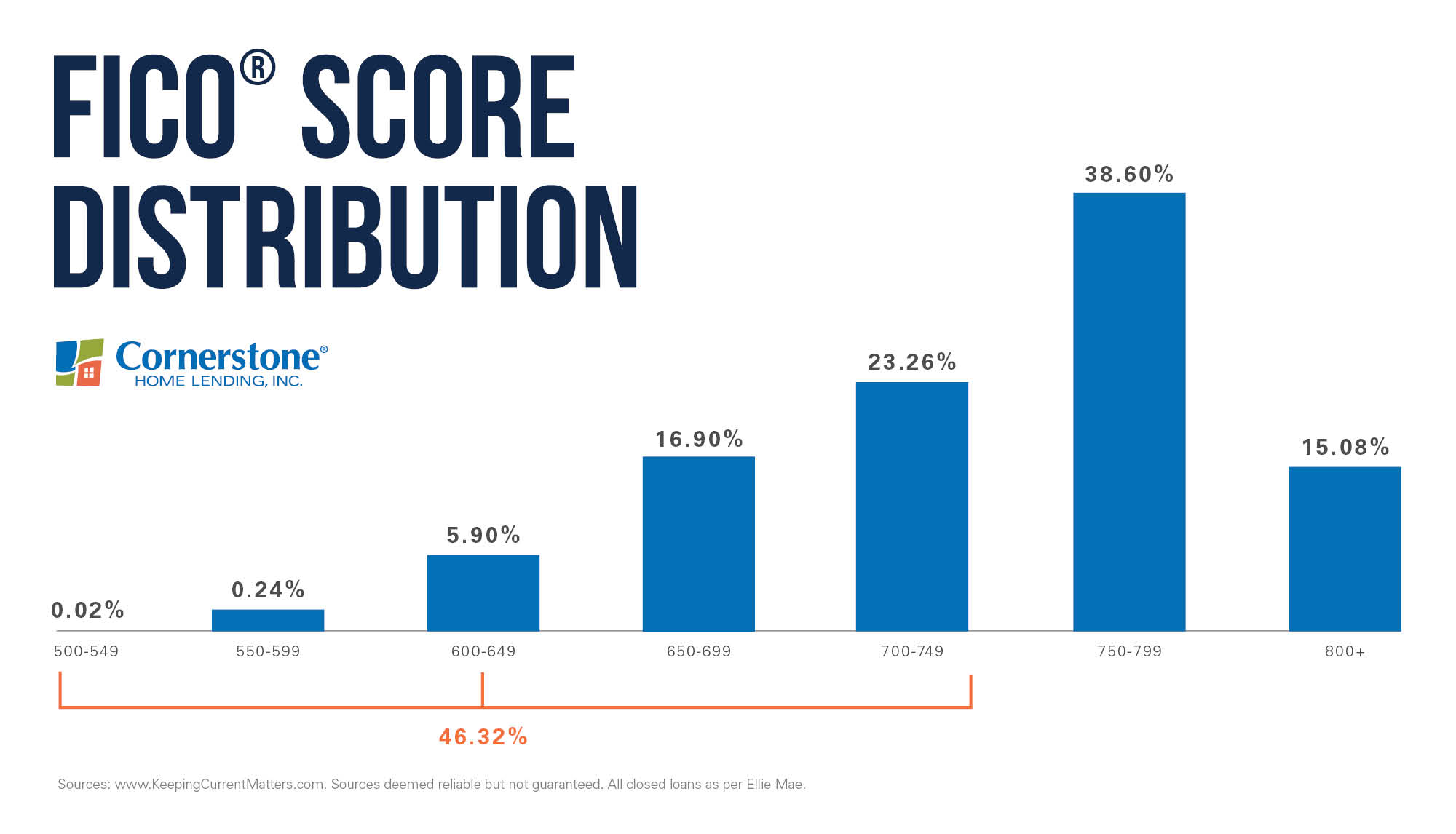

This is seen in the chart below:

If you have a credit score under 750, it’s understandable that you might interpret this data as saying that you can’t qualify for a home loan. But this isn’t necessarily true. Though most borrowers currently have a credit score over 750, there’s more that goes into a mortgage qualification than just your score. You may be happy to know that there are still many homebuyers with lower scores who successfully buy their dream houses.

What kind of loan can your credit score qualify you for? Find out now.

Experian, a leading business and consumer credit reporting bureau, explains the credit requirements for several loan types:

- FHA loans: “With a 3.5-percent down payment, homebuyers may be able to get an FHA loan with a 580 credit score or higher. If you can manage a 10-percent down payment, though, that minimum goes as low as 500.”

- VA loans: “VA loans don’t technically have a minimum credit score, but lenders will typically require between 580 and 620.”

- Conventional loans: “The most popular loan type typically comes with a 620 minimum credit score.”

- USDA loans: “In general, lenders require a minimum credit score of 640 for a USDA loan, though some may go as low as 580.”

There’s even a no-credit score loan program, typically available for a fixed-rate mortgage without a high balance. You may be required to provide two or more non-traditional payment references, including one that’s housing-related, in order to qualify.

If you’re like many buyers, you’ve had more time to save money and build your credit as a result of sheltering in place. A late 2020 survey showed that 68 percent of younger homebuyers said that last year’s stay-at-home orders made it easier to save up for a down payment.

According to Danielle Hale, realtor.com’s Chief Economist:

“If there is any silver lining to the current economic landscape, it’s that mortgage rates are hanging around record lows… Additionally, shelter-in-place orders helped many who were fortunate enough to keep their jobs save for a down payment — one of the largest hurdles of buying a home. The combination of low rates and the opportunity to save is enabling many millennials to move up their home buying timeline.”

Undoubtedly, having a stronger credit score can open the door to more loan options and more competitive terms when you apply for a mortgage, especially when lending practices are as strict as they are now. But as you prepare to buy a house, eliminate any confusion by reaching out to a professional who knows all about the ideal range of a credit score for a mortgage.

Even if your score needs work, don’t count yourself out. With rates at historic lows, today’s housing market still has plenty of opportunities for buyers at different credit levels.

Get your free credit score in a few minutes

Download LoanFly. Prequalify in minutes. Gain instant access to your free credit report. Connect with a local loan officer who can walk you through your options.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.