When the pandemic first hit in early 2020, mortgage forbearance plans were announced, allowing homeowners in crisis to temporarily stop payments. There were analysts who expressed concern that once forbearance plans expired, the real estate market could see a foreclosure surge, similar to what followed the housing bubble 15 years prior.

Thankfully, there are several compelling reasons why this doesn’t appear to be the case.

Don’t expect a wave of foreclosures: 5 supporting factors

A foreclosure surge is unlikely to happen because:

1. This time, fewer homeowners need assistance.

The housing crash of 2008 resulted in more than nine million households losing their homes to a short sale, foreclosure, or bank surrender. As mentioned, there were many who feared millions of homeowners would be in the same position this time around.

But today’s numbers indicate something different. Most homeowners whose forbearance plans are ending appear to have either paid up on their mortgage or have a plan in place from their lender that has enabled them to begin paying again. Recent data from the Mortgage Bankers Association (MBA) examined how homeowners concluded forbearance from June 2020 to November 2021.

According to the MBA, 38.6 percent of homeowners exited forbearance fully paid:

- 19.9 percent made monthly mortgage payments during forbearance.

- 11.8 percent were caught up on all overdue payments.

- 6.9 percent paid off their loan completely.

Forty-four percent of homeowners agreed to a repayment plan:

- 29.1 percent were granted a loan deferral.

- 14.1 percent were offered loan modification.

- 0.8 percent utilized a different type of repayment plan.

Only 0.6 percent sold their home in a short sale or used a deed-in-lieu (a title transfer of the home back to the lender to relieve mortgage debt). Roughly 16.8 percent of homeowners ended their forbearance in crisis and without having a plan to mitigate loss in place.

2. Those still in forbearance are able to negotiate a plan for repayment.

Mortgage forbearance numbers currently sit at 790,000. These homeowners remaining in forbearance still have an opportunity to work with their mortgage servicing company to come up with a feasible repayment plan. Servicing companies are motivated by pressure from state and federal agencies to comply.

As Rick Sharga, RealtyTrac Executive Vice President, recently tweeted:

“The [Consumer Financial Protection Bureau] and state [Attorneys General] look like they’re adopting a ‘zero tolerance’ approach to mortgage servicing enforcement. Likely that this will limit #foreclosure activity for a good part of 2022, while servicers explore all possible loss [mitigation] options.”

To find out more, read the New York State Attorney General’s warning.

3. There’s more than enough equity for most homeowners to sell.

The 16.8 percent of homeowners who exited forbearance without negotiating a repayment plan still have options. Most homeowners have accumulated a large amount of equity, enough to sell their houses and leave with cash at closing instead of moving into foreclosure.

Home prices have risen rapidly within the past two years, providing the average homeowner with record equity gains. Frank Martell, CoreLogic CEO and President, confirms:

“Not only have equity gains helped homeowners more seamlessly transition out of forbearance and avoid a distressed sale, but they’ve also enabled many to continue building their wealth.”

With mortgage rates still historically low, now’s a prime time to sell and relocate. Connect with a local loan officer to find out how.

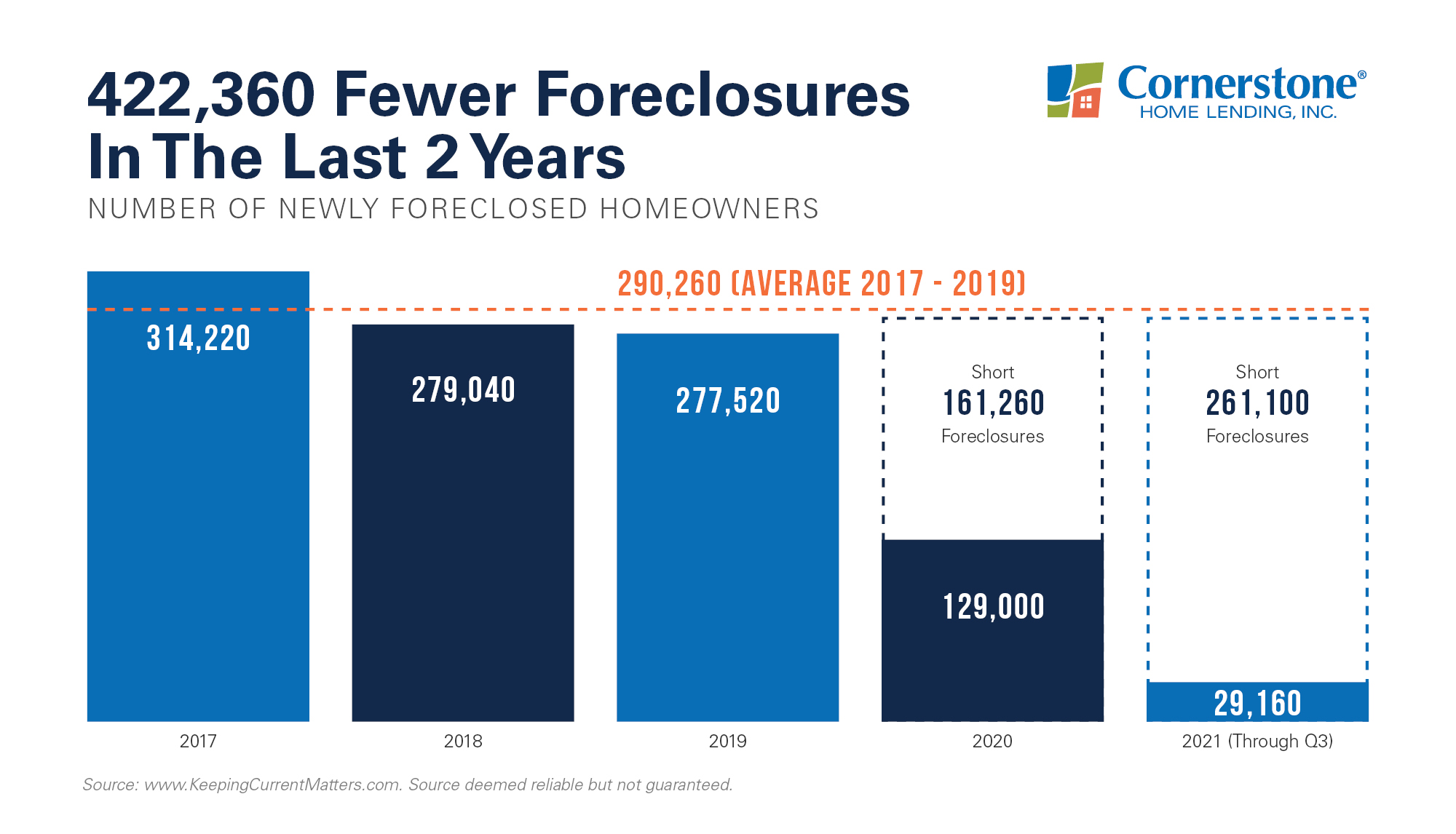

4. In the past two years, there have been significantly fewer foreclosures.

A rarely-reported benefit of these forbearance plans is that they enabled homeowners already experiencing financial troubles before the pandemic to take advantage. Struggling homeowners had two additional years to work on their finances and come up with a plan for repayment. This stopped more than 400,000 foreclosures (the typical amount) from entering the market.

Here’s a graph illustrating this:

Without forbearance, the housing market would have absorbed these foreclosed properties.

5. Today’s market can handle a million (or more) new listings.

When the market was flooded with foreclosures in 2008, these homes only added to the surplus of homes listed for sale. This created a nine-month housing oversupply; anything in excess of a six-month supply can cause home prices to drop.

We’re seeing the opposite right now. The Existing Home Sales Report from the National Association of REALTORS® (NAR) shows that:

“At the end of December, the inventory of unsold existing homes fell to an all-time low of 910,000, which is equivalent to 1.8 months of the monthly sales pace, also an all-time low since January 1999.“

To maintain balance, the housing market requires a six-month inventory supply. At a 1.8-month supply, today’s market is drastically depleted. Even if a million houses were listed, it still wouldn’t create the amount of inventory needed to satisfy current levels of buyer demand.

Bottom line? The end of forbearance is not the end of the housing market

Sharga concludes: “The fact that foreclosure starts declined despite hundreds of thousands of borrowers exiting the CARES Act mortgage forbearance program over the last few months is very encouraging. It suggests that the ‘forbearance equals foreclosure’ narrative was incorrect…” If you have questions about forbearance, selling, or refinancing, contact a local loan officer now.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.