There’s always discussion to be had about the financial advantages of homeownership versus renting. But one aspect is usually ignored when this topic comes up for debate: the ability to create wealth by becoming a homeowner.

‘Homeownership is a key pathway to building wealth,’ researchers say

Recent research from the National Association of REALTORS® (NAR) shows that:

“Homeownership is a key pathway to building wealth and narrowing the racial income and wealth inequality gap. Housing wealth (equity) accumulation takes time and is built up by price appreciation and paying off the mortgage.”

A home equity increase can help to grow the wealth of the person who owns the home. As this wealth accumulates, it can be handed down to the next generations.

The Federal Reserve goes on to say in the addendum to its Survey of Consumer Finances:

“There are numerous ways families can transmit wealth and resources across generations. Families can directly transfer their wealth to the next generation in the form of a bequest. They can also provide the next generation with inter vivos transfers (gifts), for example, providing down payment support to enable a home purchase or a substantial wedding gift.”

Another means by which wealth supports generations to come (factoring in the added net worth produced by a home equity increase), the Federal Reserve explains, is through indirect investments. A family may invest in education by funding private school or college tuition, for example, which can increase a child’s ability to generate wealth in the future.

We have a free mortgage app that makes prequalifying fast and easy. Did we just become best friends?

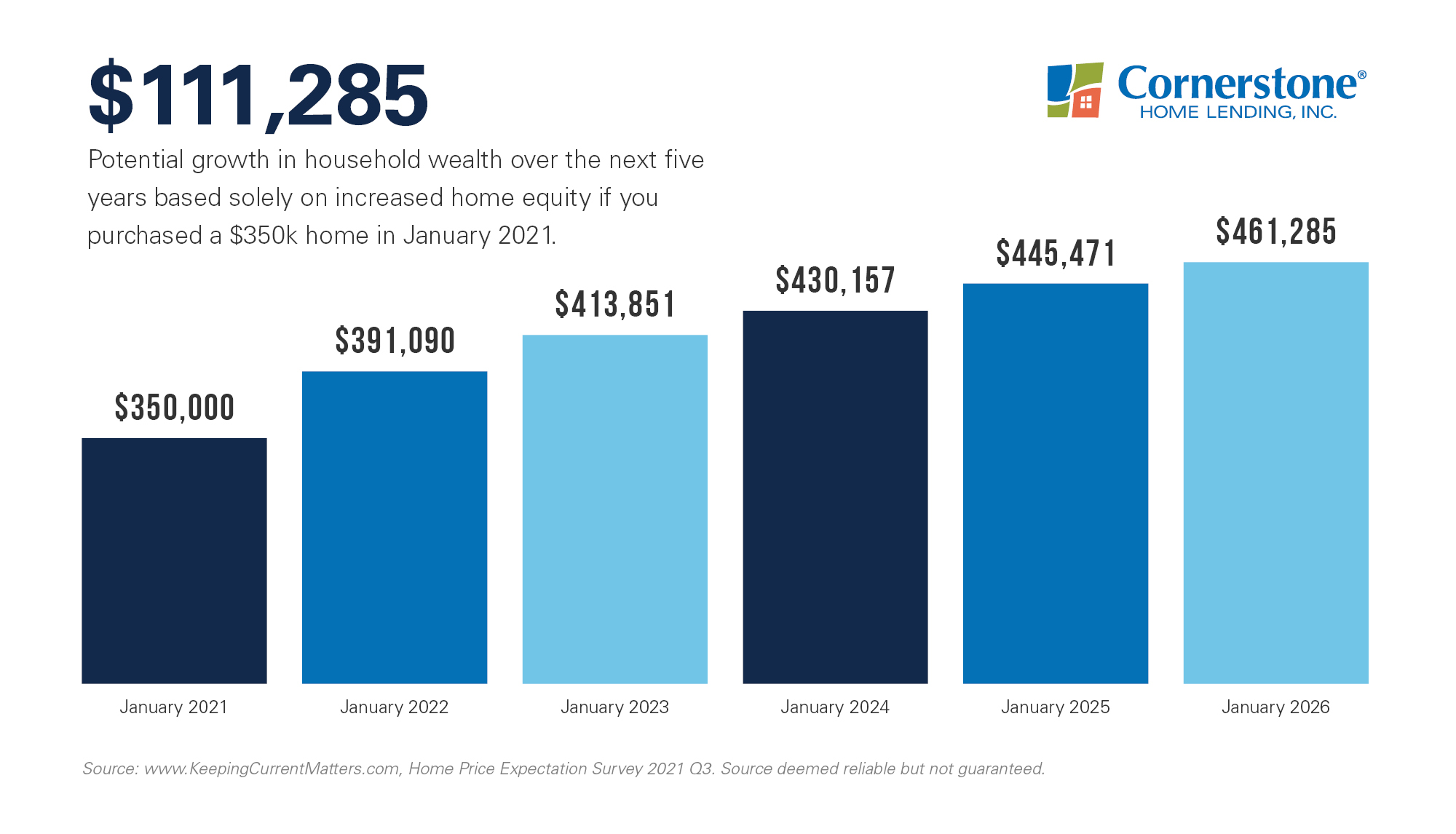

Here’s a breakdown of how your home equity may rise within a few years when you become a homeowner.

The NAR data finds the average homeowner’s equity gain for the past five years to be $139,134, rising to $218,505 for the past 10 years. The article concludes that:

“Homeowners who purchased a typical single-family existing home 30 years ago at the median sales price of $103,333 with a 10 percent down payment loan and who sold the property at the median sales price of $357,700 in 2021 Q2 accumulated housing wealth of $349,258.”

Owning a home helps to grow household wealth, which also makes it possible to move up, often effortlessly, to a dream home. Mark Fleming, First American’s Chief Economist, states:

“As homeowners gain equity in their homes, they are more likely to consider using that equity to purchase a larger or more attractive home — the wealth effect of rising equity.”

If you feel like you’ve missed out on the last three decades of equity gains, there’s no need to panic. Economic authorities still anticipate significant equity growth for at least five more years.

Pulsenomics’ latest Home Price Expectation Survey, polling more than 100 economists, market and investment strategists, and real estate professionals, projects that home values (and, subsequently, equity) will rise in the following increments:

- 2021: 11.74 percent

- 2022: 5.82 percent

- 2023: 3.94 percent

- 2024: 3.56 percent

- 2025: 3.55 percent

Amazingly, home prices have appreciated for the past 116 months straight. Pulsenomics’ survey projects a slight depreciation – or slowing — in the next years ahead, though not a deceleration. More than 100 experts believe that our housing market isn’t expected to see any price depreciation.

As a buyer, it may help to know that housing prices aren’t likely to drastically drop any time soon. That’s exactly what the authorities say will not happen.

Black Knight data also shows the typical annual home value appreciation from 1995 to 2020 to be 4.1 percent, in line with these latest forecasts. With this in mind, it can be smart to purchase a house now and begin building equity before home prices climb any higher.

For the next five years, the survey projects an overall appreciation of 31.8 percent. Taking into account these estimates, this graph depicts the equity growth a home purchaser could amass, using the example of a $350,000 home:

This adds up to a potential home equity (or wealth) increase of $111,285 in just five years.

The numbers prove that homeownership offers one of the smartest ways to build wealth over the long term. This household wealth can positively impact future generations. For many families, the single greatest investment you’ll have is your home. As this investment grows in value — as is predicted — you’ll also find yourself with more financial flexibility, options, and freedom.

LendingTree’s recent survey confirms this: 41 percent of people say they’d rather own than rent because homeownership helps grow wealth over time.

Let’s take the first step together.

Join thousands of happy homebuyers who’ve used LoanFly to prequalify from anywhere. Connect directly with a local loan officer you can trust.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.