Are we entering a housing bubble again? That’s the question on every homebuyer and seller’s mind. No matter what the headlines may say, experts have answers that can help you enter the market with confidence.

Lawrence Yun, NAR’s (National Association of REALTORS®) Chief Economist, recently stated:

“[This] is not a bubble. It is simply lack of supply.”

Yun said this in response to the high homebuyer demand and rising housing prices we’re currently seeing — which he blamed simply on a shortage of inventory. The housing market right now is actually stable and has been a helpful driver of our economic recovery. Home prices are climbing because of record-low inventory levels that can’t meet the needs of today’s buyers.

Can the market keep up its momentum?

According to NAR’s Existing Home Sales Report, sales have declined 3.7 percent from just a month before. It’s the second month in a row in which sales have dropped. Because of this, projections have been made that the market boom may be slowing.

This brings us back to Yun’s explanation. Buyers don’t have enough houses to choose from. Compared to last spring, there are 410,000 fewer single-family homes on the market.

As Yun explained in the Existing Home Sales Report:

“The sales for March [2021] would have been measurably higher, had there been more inventory. Days-on-market are swift, multiple offers are prevalent, and buyer confidence is rising.”

The Census Bureau’s Monthly New Residential Sales Report for March supported Yun’s clarification. Over that month, new build home sales rose 20.7 percent.

Demand for homes is still strong. As more adults receive vaccines and job growth continues to show promise, inventory of existing homes should rise in the months ahead.

Prequalify remotely to make buying a home in today’s market easy and fast.

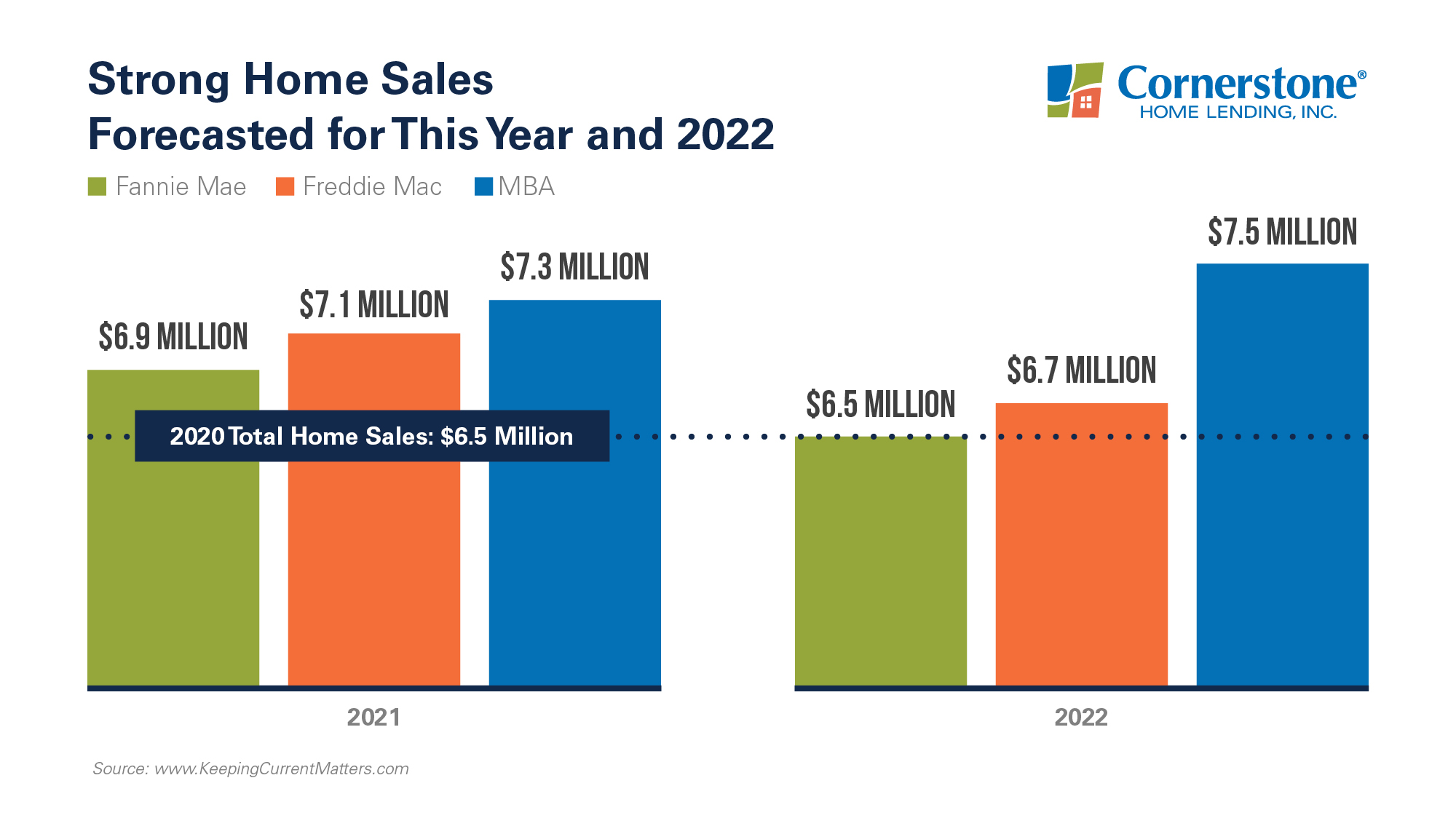

Though we’re not in a housing bubble, what will happen with home sales moving forward? Major housing authorities like Freddie Mac, Fannie Mae, and the MBA (Mortgage Bankers Association) have all agreed that total sales (including existing and newly constructed homes) will continue this trajectory for the next two years.

This graph depicts these forecasts:

While the market is tight, there’s great financial incentive to jump into it. Homeownership allows you to build wealth – whether you plan to buy a home for the first time or sell and move up to a larger place. Experts also anticipate that home prices will keep appreciating for the next few years.

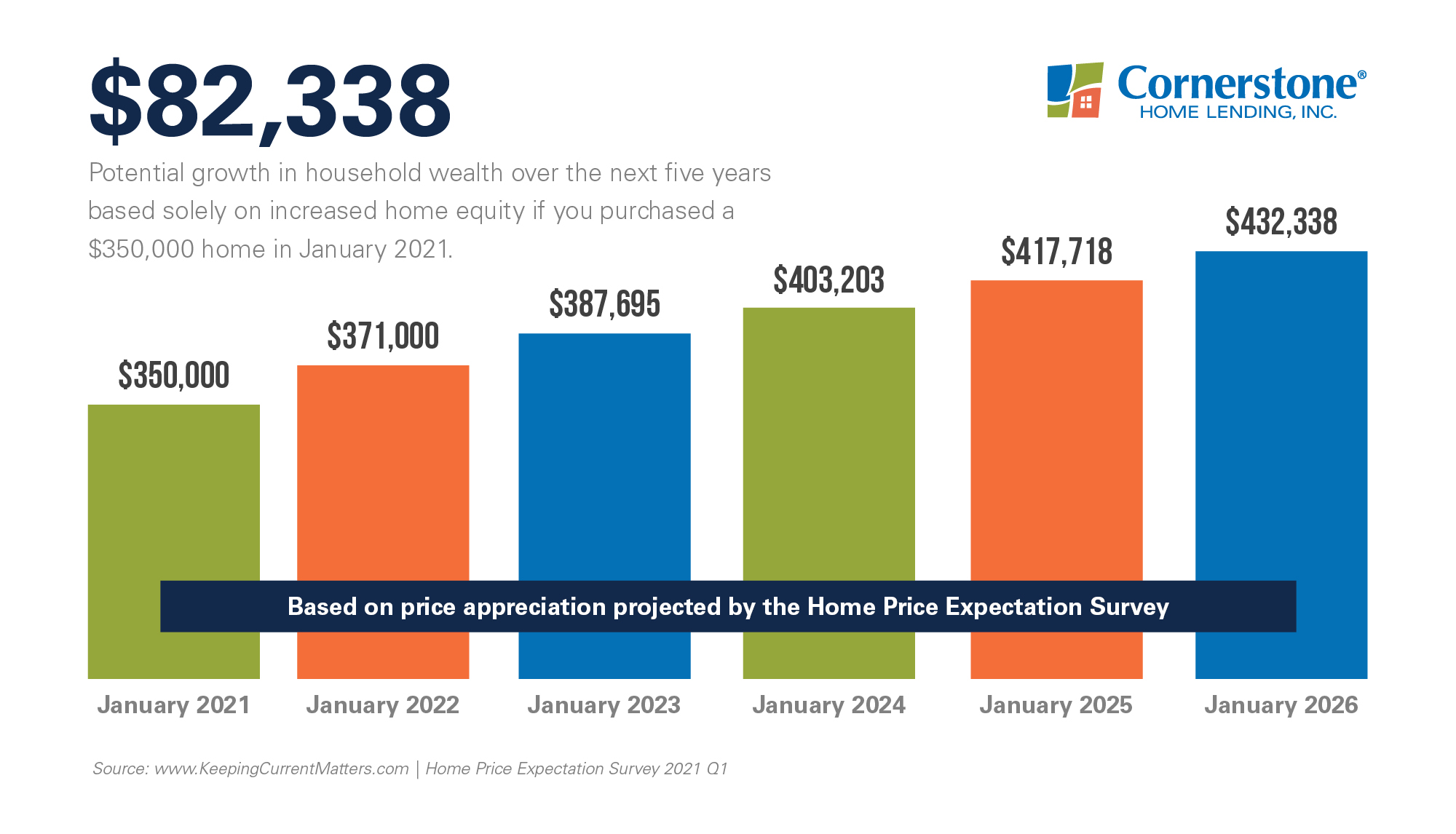

The latest Home Price Expectation Survey, gathering input from more than one hundred economists, investment and market professionals, and real estate authorities, projects this price appreciation to be:

- 2021: 6 percent

- 2022: 4.5 percent

- 2023: 4 percent

- 2024: 3.6 percent

- 2025: 3.5 percent

This graph highlights how much equity a homebuyer could accumulate, based on these annual estimates and calculated using an example of a $350,000 house:

Within five years, your net worth could grow by more than $80,000 as a homeowner. That’s roughly $16,000 per year. When you’re counting the cost of buying a home, this number must be factored into the equation.

It’s no wonder that almost all Americans (93 percent) believe that owning a home is a better bet than investing in stocks. The Federal Reserve Bank of New York’s new SCE Housing Survey shows that Americans find housing prices to be less volatile than stocks — with the added bonus of also providing a stable environment you can live in.

Show your mortgage who’s boss

Download LoanFly. (It’s free.) Input a few details. Prequalify to buy your dream house from anywhere. Get your mortgage moving so you can start building equity faster.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.