In unpredictable times like these, it’s essential to minimize our fears by staying educated on the data. Reviewing historical trends and delving into past peaks and valleys can give us more confidence in understanding what lies ahead.

Fears of a global recession are a concerning part of today’s conversation. Looking objectively at previous downturns can tell us more about how our housing market could successfully withstand this storm.

3 indicators show there’s no need to worry about another housing crisis

Consider that:

1. Today’s market is significantly different from 2008.

It’s hard to forget what happened in 2008. But the current market conditions are a far cry from when housing prompted the Great Recession. Easier access to mortgages, rapidly appreciating home prices, equity over-use, inventory surplus, and many other factors led to the crisis 12 years before. None of these issues are at the forefront right now. It’s comforting to know the housing market isn’t going to set us back to 2008.

Should there be a recession, Realtor.com’s Chief Economist Danielle Hale explains:

“It will be different than the Great Recession. Things unraveled pretty quickly, and then the recovery was pretty slow. I would expect this to be milder. There’s no dysfunction in the banking system, we don’t have many households who are overleveraged with their mortgage payments and are potentially in trouble.”

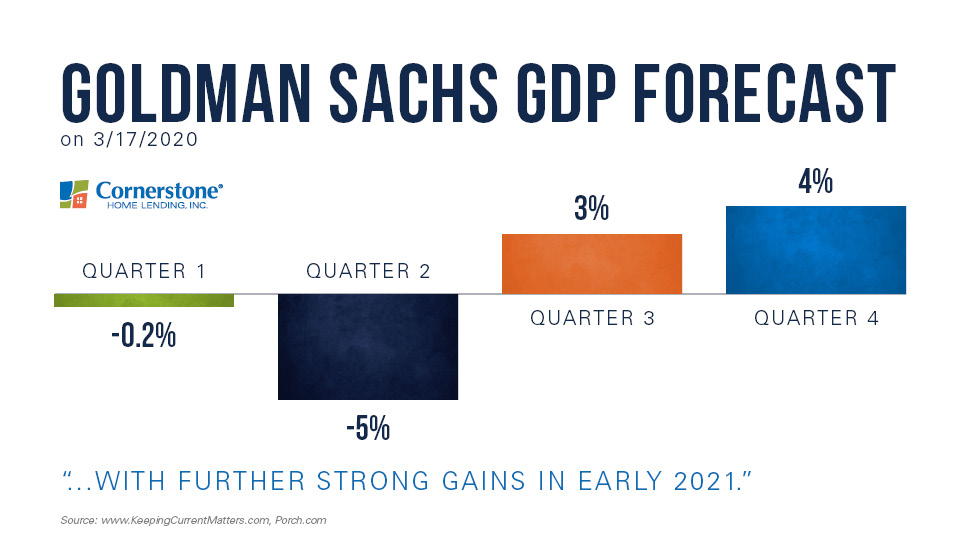

This week’s Goldman Sachs GDP Forecast also suggested that, while immediate growth isn’t anticipated, gains are predicted moving into the second half of 2020 and are only expected to strengthen by early 2021.

Expert input underscores that what we’re seeing is a temporary moment in time, not a full financial fallout. A drop like this will bounce back quickly, much unlike the 2008 crash that required nearly 4 years to recover. Plenty of short-term financial difficulties are possible. But even a pending potential for recession within the year won’t cause anywhere near the long-term damage we saw from 2006 to 2008.

Did you know? You can still get the same level of five-star support from your loan officer without leaving the house. Stay in touch remotely.

2. A recession doesn’t guarantee a housing market crash.

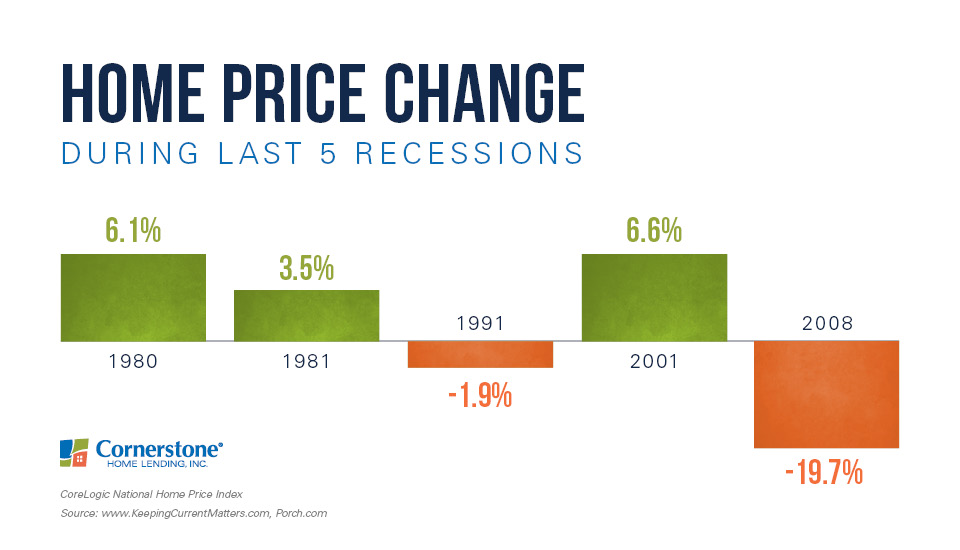

From there, we can review the five previous recessions in our nation’s history. In the past three, property values actually increased. While home values did drop by close to 20 percent in the last recession, 2008 was different for the many reasons outlined above. Residential real estate depreciated just once — by under 2 percent — in the last four recessions.

Home values rose by 3.5, 6.1, and 6.6 percent in the other three recessions, depicted below:

Home price appreciation has accelerated lately, but it’s not anywhere near the price surge preceding 2008’s crash. Current appreciation is higher than what’s considered normal appreciation at 3.6 percent. Still, residential home values aren’t dramatically climbing as seen in the early 2000s.

3. We can have confidence in the facts.

The economic concerns about the global repercussions of COVID-19 are warranted. The unknown is scary, especially when the health and wellbeing of our loved ones are on the line.

Christopher Condon writing for Bloomberg states:

“Several economists made clear that the extent of the economic wreckage will depend on factors such as how long the virus lasts, whether governments will loosen fiscal policy enough and can markets avoid freezing up.”

We can’t know exactly how the coronavirus will impact the economy and the housing market. But we can be confident in the fact that housing isn’t a contributor.

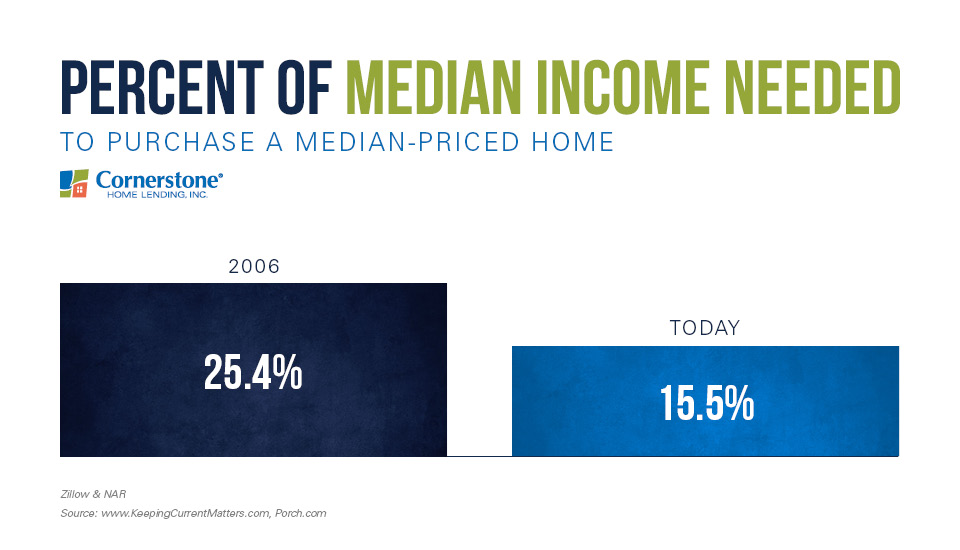

There’s still a housing inventory shortage, compared to the inventory surplus seen prior to 2008. Home prices remain high today. But unlike 2008 when wages were low and mortgage rates were over 6 percent, wage increases and historically-low rates at about 3.5 percent have now made it more affordable to purchase.

This graph highlights the difference:

Today’s homeowners also aren’t tapped out when it comes to their home equity. Quite the opposite. Homeowners are currently equity-rich, attributed to rising home prices over the past few years. Over 50 percent of homes in the U.S. have more than 50 percent equity.

In 2008, home values went into a freefall. Sellers found themselves owing an amount on their mortgage that exceeded their home’s value, known as negative equity. Some owners opted to walk away, triggering an influx of foreclosed and short sale listings. Selling these distressed properties at a massive discount tanked the value of other nearby houses. Based on the many factors mentioned, this crash couldn’t happen today.

Record-low rates create ‘once-in-a-lifetime’ window of opportunity

It’s healthy to want to avoid making the mistakes that contributed to 2008’s housing crisis. But reviewing these charts can ease your fears. Current mortgage rates sit near their lowest point in housing history. Buying a home right now provides a unique chance to lock in a rock-bottom rate and an affordable payment, making monthly bills more manageable. Click here to get started.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.