In May, pending home sales rose by 44.3 percent. This registered the biggest month-over-month gain since January 2001, when the National Association of Realtors (NAR) began tracking the metric in their index. Learning more about what pending home sales are can shed light on why our current rebound is so important.

There’s evidence that housing could rescue our economy

The NAR explains that the Pending Home Sales Index (PHS) is:

“A leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.”

Pending home sales is a critical marker in real estate that decides the strength of the market. It gauges the number of existing homes that went under contract in a certain month, as mentioned above.

The final step that a buyer takes to purchase a home is closing on their loan. This can happen, according to the national average, in up to two months after signing a contract or in a few weeks, depending on the speed of the lender.

Do you know if it’s more affordable to rent or to buy?

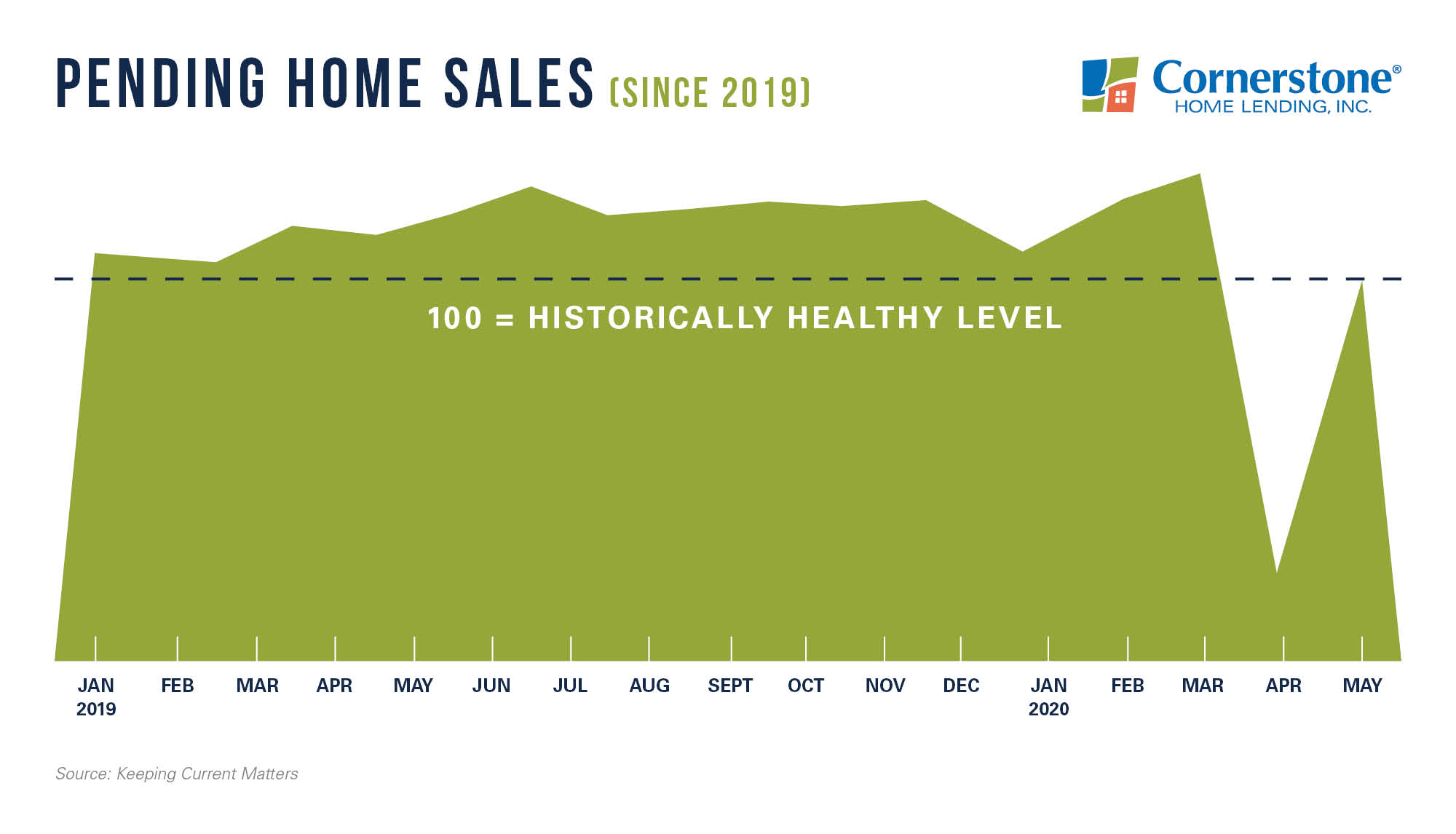

So, what makes this rebound important? There was a sharp two-month drop in pending home sales following the COVID pandemic and the pausing of the economy.

But as the graph below shows, this number greatly increased as of May 2020:

The spike indicates that homebuyers are returning to the market and purchasing houses. NAR Chief Economist Lawrence Yun states:

“This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership… This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.”

But to keep up this trajectory, we need more homes for sale to become available. Yun goes on to say:

“More listings are continuously appearing as the economy reopens, helping with inventory choices… Still, more home construction is needed to counter the persistent underproduction of homes over the past decade.”

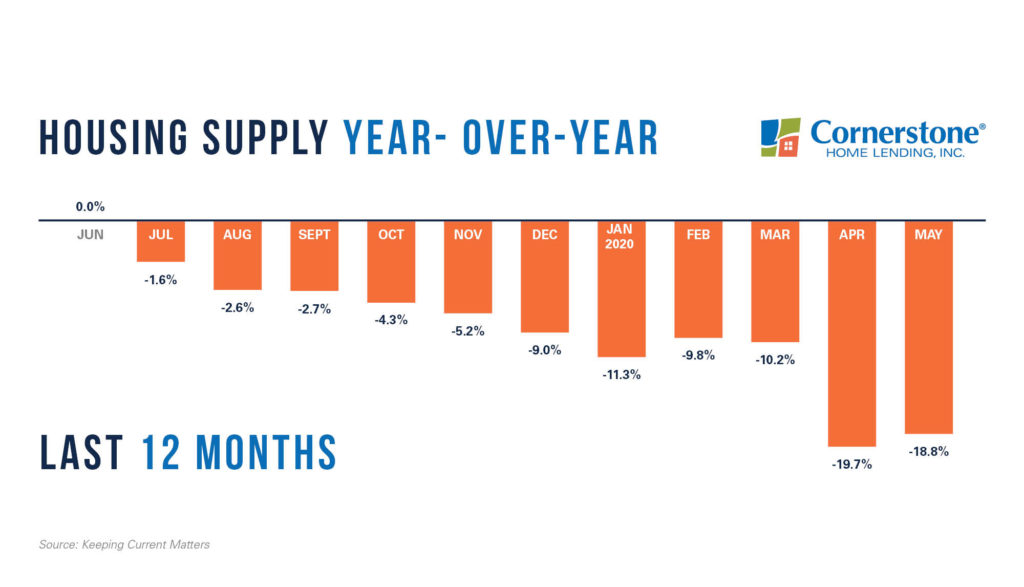

Continuing through this year, we can expect to see a growing number of new homes under construction. This can help offset some of the inventory deficit, albeit a small amount. The current lack of inventory still presents a challenge, but it also brings an opportunity for homeowners hoping to sell.

The graph below highlights how, in the past 12 months, the supply of houses for sale has declined year-over-year and is not able to meet homebuyer demand:

Real estate experts remain optimistic about the second half of 2020. The housing market recovery is taking place faster than anticipated. Mortgage rates remain at record lows, drawing more homebuyers. Sellers who put their plans on hold because of the pandemic could see a quick turnaround by jumping back into the market.

Yes, we have remote loan technology

And we’re doing everything in our power to ensure our mortgage processing stays speedy while keeping you and your family safe. Whether you plan to buy or sell, you can take the first step and get prequalified without meeting face-to-face.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.