The highlights:

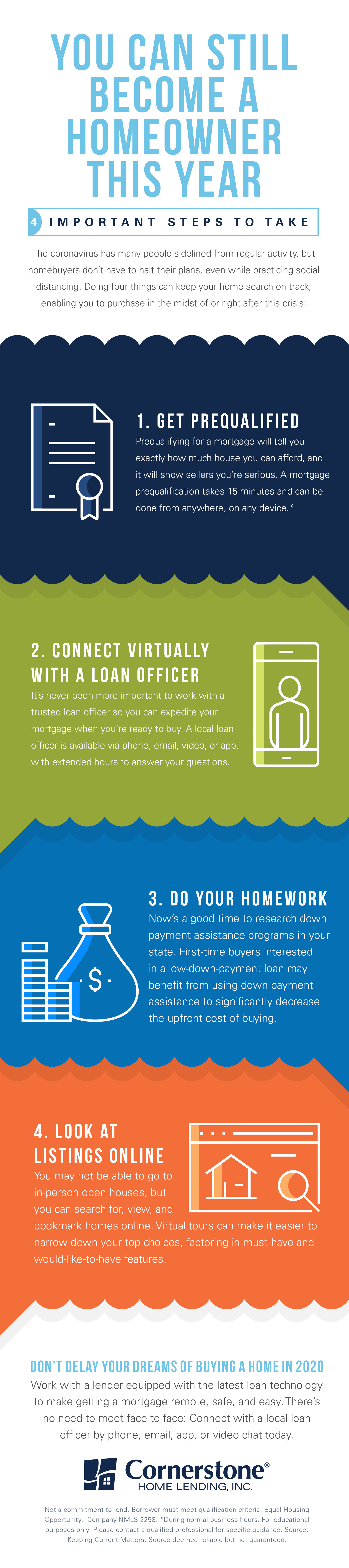

- Don’t pause your plans of homeownership just because you’re practicing social distancing.

- Taking several strategic steps right now can keep your home search active.

- Reach out to a local loan officer, find out about helpful resources for down payment assistance and more, and get prequalified as soon as possible.

Recession does not equal a housing crisis. With mortgage rates at historic lows, it’s an ideal time to get prequalified.

Why shocking headlines might not reflect the full picture

All around the world, anxiety levels are high. The pandemic health crisis must be contained, while trying to mitigate its impact on the economy.

Alarming headlines are everywhere. Bad news sells more than good. At times like these, it’s helpful to gain perspective from the whole story.

The CDC (Centers for Disease Control and Prevention) and the WHO (World Health Organization) are the most reliable sources of information related to COVID-19. As for the economic effects of the virus, it’s harder to find trustworthy resources that give insight into our current situation.

Here is one example: Goldman Sachs predicts the largest GDP drop in nearly a century.

The headline is correct, but it doesn’t include the fact that Goldman Sachs projected the economy will rebound well in the second half of the year. GDP will rise 12 and 10 percent in the third and fourth quarters, respectively.

John Burns Consulting’s research on home values, the economy, and pandemics supports this fact:

“Historical analysis showed us that pandemics are usually V-shaped (sharp recessions that recover quickly enough to provide little damage to home prices), and some very cutting-edge search engine analysis by our Information Management team showed the current slowdown is playing out similarly thus far.”

It’s not the end. In the next few months, the economy will be affected, but soon after, we’ll see it recover.

What does ‘business as usual’ mean? We’re not going anywhere

We know homebuyers need more support during uncertain times. That’s why our team is available weekdays, weekends, and evenings. We’re staying up and running — and even extending our hours — so we can still provide the same five-star support while processing mortgages remotely. Download LoanFly to connect with a local loan officer and speed through prequalification to closing in as little as 10 days.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.