Mortgage rates have dropped over a full percentage point within the past year, hitting new lows 16 times. This is a strong driver toward homeownership: Today’s lower rates give consumers even more benefits.

Let’s take a look at the top three:

- Downsize or move up. Low rates open up opportunities to sell and move into a new house, whether it’s bigger and better or smaller and located in a more desirable place. You could put your equity gains (soaring to an impressive average of $17,000) from your current home toward a new down payment — securing more room if you’re working at home or have kids learning remotely.

- Purchase your first home. The non-financial and financial benefits of becoming a homeowner are well-documented. But what matters is deciding when the timing is right. This is only for you to determine, but it may help to know that now is an ideal time to purchase if you feel that other factors fall into place. Take a closer look at how much it could cost you to wait.

- Refinance. If you’re already a homeowner, it may be helpful to think about refinancing. This can be a smart way to lock in a lower rate, along with a lower monthly payment, and see substantial savings over time. But upfront closing costs may also apply. You can read on to answer the question: Is refinancing right for you?

Are you going to save more money if you trade up, rent, or buy? There’s only one way to decide.

Why 2021 could be a great year for anyone who’s ready to buy

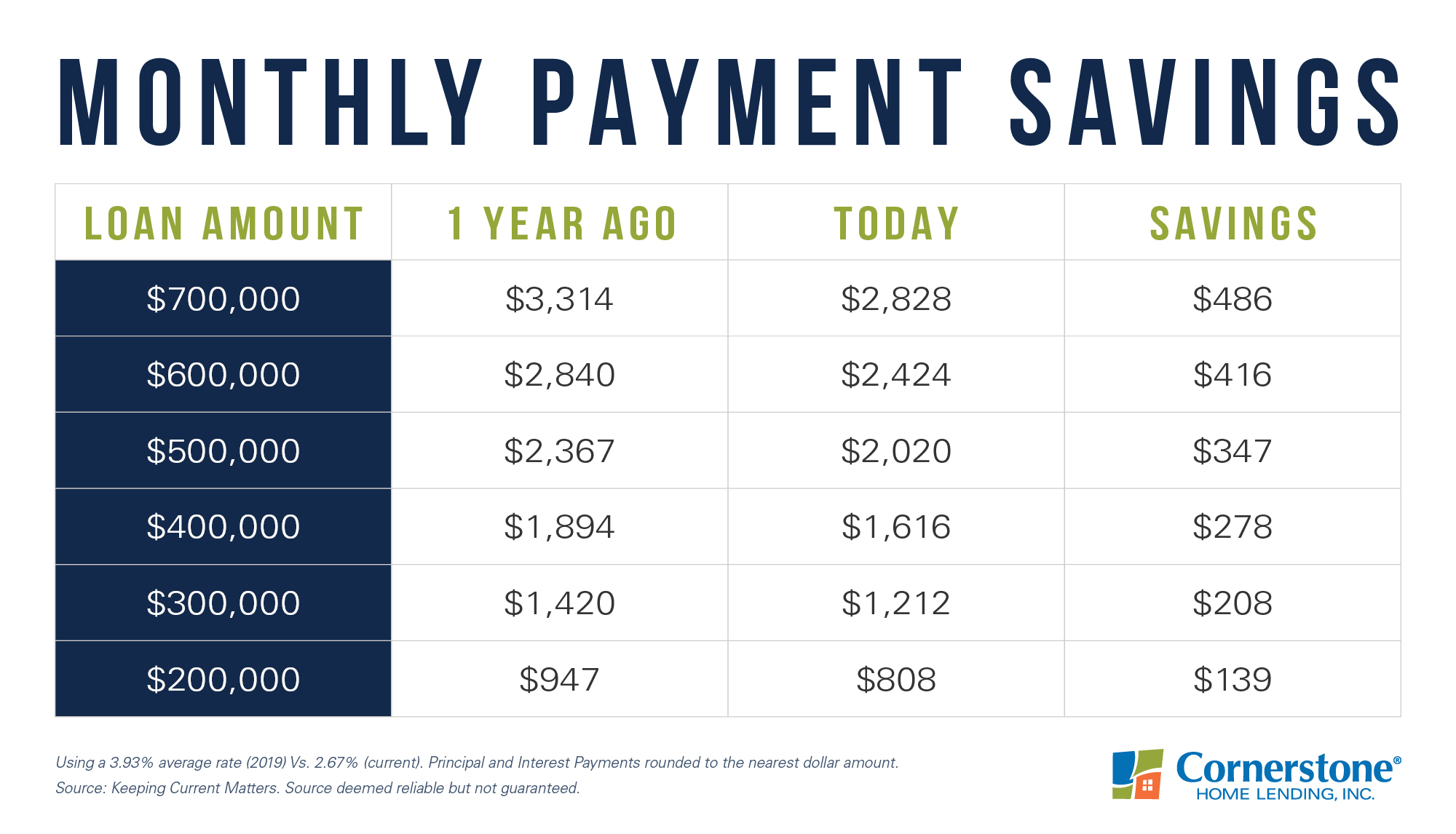

A little over a year ago, mortgage rates were significantly higher, sitting at around 3.93 percent. You, like many people, may have been waiting for market conditions to improve to make your move. Current record-low rates have helped homeownership to become more affordable and attainable than it was just one year before.

This chart depicts how much you might save when buying at today’s (early 2021) rates compared to the amount you could have paid last year, also depending on your home’s purchase price:

This is a time when you’re likely to get more house for your money and may also pay less each month for your mortgage.

Today’s rates are historically low: See how much you could save

Getting prequalified is the first and most important step to take to find out how much more house you can afford at today’s low rates. It’ll also provide you with your new house-hunting price range. The icing on the cake? It takes just a few minutes. Using our free LoanFly app, you can prequalify from anywhere. Make 2021 your year to buy.

While refinancing could make a significant difference in the amount you pay each month, there are other costs you should consider. Plus, your finance charges may be higher over the life of the loan.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.