Here are some helpful takeaways:

- Whether your job is on hold or business has taken a hit, know that we’re all in this together. Many Americans are doing their best to roll with the punches by using their stimulus checks to explore new remote work opportunities.

- Some of these gigs could become permanent, uncovering an untapped area of interest. Other jobs may serve their intended purpose – functioning as a temporary side hustle to bring in some extra income.

- Gig work is frequently used in times of financial stress. A late-2019 report from JPMorgan Chase Institute showed that an income dip of 10 percent in 10 weeks is normally enough to push a worker toward the gig economy.

Have questions about how income changes can impact getting a mortgage? Connect with a local loan officer and find answers.

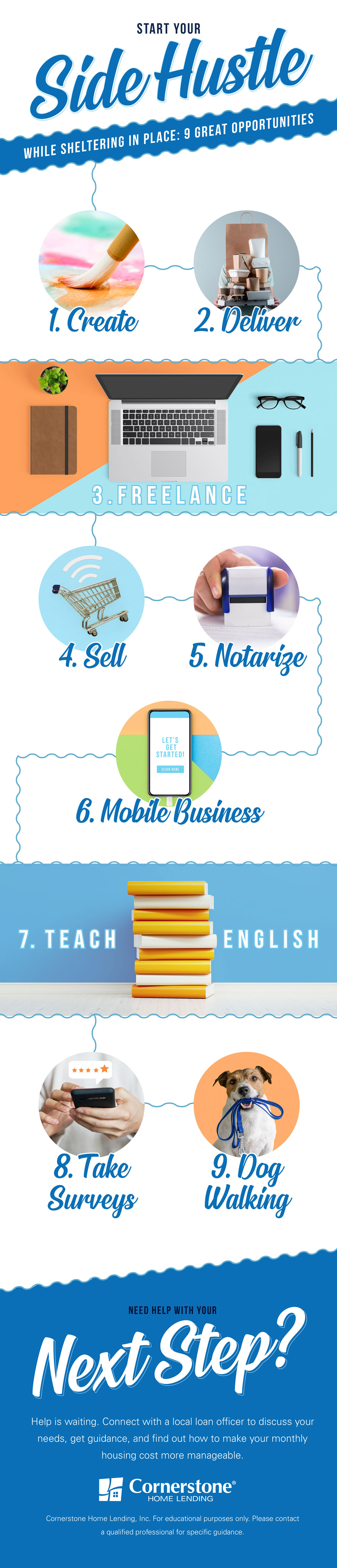

9 solid side hustle opportunities gig workers swear by

Power up your laptop, turn on the next show in your queue, and start job-hunting:

1. Create.

Sell your wares on Etsy or Craigslist without leaving the house. Or, make a video of yourself completing a pet project — like knitting a poncho or sketching a caricature — and set up an online course that requires paid admission. Nowadays, there’s also more demand for one-on-one instruction via Zoom or Skype.

2. Deliver.

Think Instacart, Postmates, or DoorDash. During this time of social isolation, Instacart’s volume has unsurprisingly spiked by over 400 percent. Instacart has recently begun hiring hundreds of thousands of new workers, with wages averaging at $10 an hour.

3. Freelance.

It might be time to market that skill you’ve always been thinking about monetizing: writing, editing, coding, graphic design, or working as a virtual assistant. Upwork is a great starting point for a variety of talent: Make your profile and set your own hourly rate.

4. Go mobile.

When precautions are taken, mobile business concepts like pet grooming, house cleaning, auto detailing, handyman services, and even pop-up porch photography may translate well to serve families sheltering in place. Look into operating as a sole proprietor, create a simple website or blog, and advertise locally.

5. Notarize.

A handy skill to have on file for part-time work that can turn into a full-time gig, notary training varies by state. Training may cost less than $100 and take just a few hours. Right now, the need for remote online notaries is booming. Once certified, you can set your own fee and could make several thousand dollars a month.

6. Sell.

Set up a profile on VarageSale or use Facebook Marketplace. Kill two birds with one stone: Declutter your home and turn a profit by selling items of value you no longer need. The upside is that more people are browsing online these days. The downside is that you’ll still need to sanitize and limit social contact when meeting to make a sale.

7. Take surveys.

Consider this the “micro-gig” economy. By signing up for a site like Clickworker, you can perform a variety of small tasks – like testing apps and taking surveys – for compensation. You get to decide your work quantity and schedule, with the potential for higher earnings based on your number of assignments.

8. Teach English.

VIPKID is one of the more popular online tutoring options, allowing you to teach English to children in China. The catch? You’ll have to get up pretty early because of the time difference. But the pay might be worth it: You could earn up to $22 an hour.

9. Walk dogs.

Now that we’ve adjusted to our new normal of being home 24/7, more people may be willing to outsource their household and pet-related duties. This may be especially true for neighbors with a full workload or limited mobility. Post your services on your neighborhood’s Facebook group or in the NextDoor app and set your hourly rate.

Reach out today and thank yourself later

There’s no doubt that this is a time when American workers have questions. If you were planning to buy a home this year, you may have concerns about your income stability. Let us walk you through it. Get in touch with a local loan officer who can assess your unique financial situation, provide some affordable housing options, and help you find your answers.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.