This has been a time of change. In the past year, you may have experienced significant shifts in employment, had a baby, or reached retirement age. You, like many people who’ve spent more time at home, might also be thinking about renovating to create extra space.

The events that happened over the past year and a half may have altered the course of your life completely. And yet, your mortgage remains the same.

Life changes. So should your mortgage.

Unlike a fine wine, a mortgage might not get better with age. The mortgage you signed up for five, 10, or 20 years ago most likely does not reflect the latest market interest rates and may not match your current financial needs.

Throughout the pandemic, mortgage refinancing made headlines as interest rates plummeted, staying below 3 percent. As expected, rates have now begun to move upward, though they still remain in historically low territory.

When rates go down, refinancing numbers go up. By definition, refinancing is using a new home loan to replace and pay off your current mortgage. Lower rates mean you could get a better deal, and a lower monthly payment, on a new loan when you refinance. Right now, as many as 16.7 million homeowners may be eligible to refinance, with potential savings of around $300 a month.

A quick checkup is really all it takes to see if you could benefit:

- Scheduling a mortgage review with your loan officer will tell you if your home loan is still the right fit.

- Depending on your mortgage terms and life changes, refinancing might shave a few hundred dollars off your monthly payment.

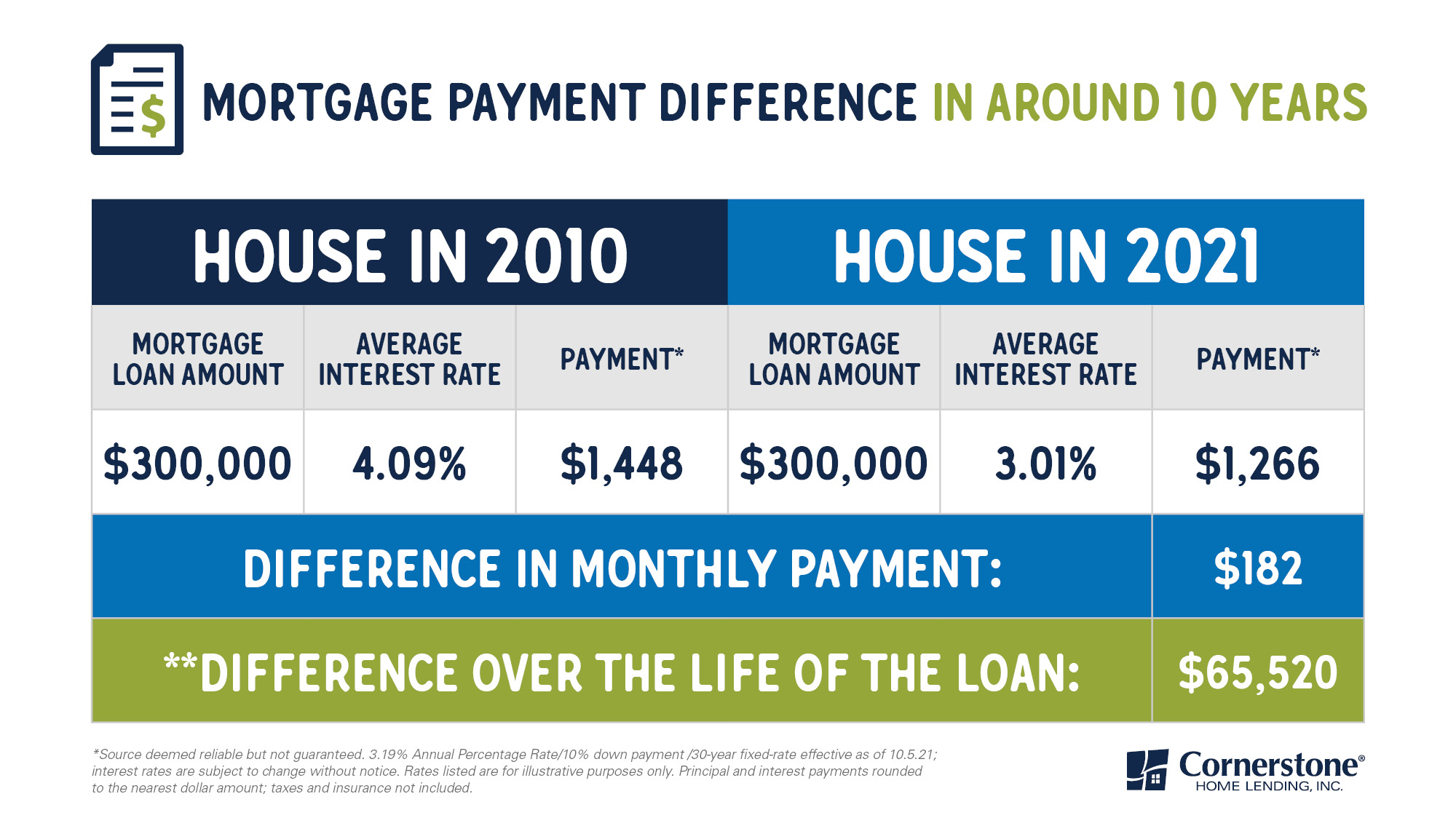

Refinancing at today’s rate, compared to 10 years ago, could save you thousands over the life of your loan:

Current mortgage rates may be much lower than when you closed, even if it was just a year or two ago. Reviewing your mortgage with your loan officer will give you a chance to crunch the numbers, look at scenarios, and decide if a refinance could help.

8 questions can tell you if your mortgage needs a tune-up

Remember, a mortgage usually isn’t something that gets better with time. If anything, your mortgage is more likely to grow stale and outdated when it’s left unattended.

To determine if your mortgage needs attention, give your loan officer a call or send an email. Then ask yourself these questions:

- What’s the approximate value of your house? (If you don’t know, your loan officer can help answer that.)

- Has your family size changed in the past year?

- How much longer do you plan on living in your house?

- What are your goals in the next three to five years?

- In the last 12 months, have there been any big changes to your income or employment?

- Have there been any big changes to your savings, checking, or investment accounts?

- Have you taken on any new long-term debts?

- Did you pay off any existing debts in the past 12 months?

Your loan officer will want to know the answers to these questions, down to the last detail. The reason being: Different mortgage refinance programs provide different benefits to different people, based on the answers to the questions listed.

For instance, you might want to:

- Tweak your mortgage. Refinancing may help you lower your interest rate and save on your monthly payment.

- Shorten your loan term. Refinancing to reduce the length of your mortgage, from a 30- to a 15-year loan, could help you pay it off sooner.

- Consolidate debt. Refinancing could also consolidate multiple loans into one home loan — with a potentially lower rate.

- Get a new loan type. Maybe you don’t need to lower your interest rate, but you could refinance to change an adjustable-rate loan to one with a fixed rate.

- Tap into equity and renovate. Cash out some of your home’s equity (very likely to have increased) for big expenses like college, medical bills, or renovations.

- Drop your PMI. Find out if you can request early cancellation of your Private Mortgage Insurance (PMI) and potentially save hundreds a month on this added cost.

Even if you’re not interested in or eligible for a refinance, you may have questions about paying ahead on your mortgage — another common topic covered in a mortgage review. If you’ve had recent changes in income, debt, or savings, your loan officer can suggest the pay-down plan that makes the most sense.

If you’ve just closed, it may not be time for a mortgage review yet. But you can use our post-closing checklist to get your home in order:

- Change your locks.

- Change your address on your driver’s license.

- Apply for your homestead exemption.

- Purchase a fireproof box for your important documents.

- Read through your home warranty and homeowner’s insurance policies.

- Set up pest control and other seasonal maintenance.

- Test your smoke alarms and replace batteries.

- Put your annual mortgage review on your calendar.

Most of us are vigilant about going to the doctor for our annual checkup, and yet, we don’t apply the same logic to our mortgage. It’s a good practice for all homeowners to put an annual mortgage review on their calendar — especially now, when refinancing at historically-low rates is likely to help.

The latest Profile of Home Buyers and Sellers from the National Association of REALTORS® also shows that homeowners are staying in their homes for longer — 10 years on average. This is a notable increase from previous averages of around six to seven years. If you’re not ready to make a move, you could still see benefits by shaving extra costs off your mortgage.

Have you scheduled your annual mortgage review yet?

Savings. Security. Peace of mind. That’s what you can expect when you check in with your loan officer and request an annual review of your mortgage. With all the change going on in our world, chances are the loan that was working for you a year ago is no longer relevant.

While refinancing could make a significant difference in the amount you pay each month, there are other costs you should consider. Plus, your finance charges may be higher over the life of the loan.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.