One of the biggest stories making headlines over the last year is the boom of the residential housing market. A major part of the conversation is home price appreciation. As the latest indices show, home prices have skyrocketed. To provide education on the current market and what lies ahead, here’s what to tell your clients.

This is a roundup of today’s year-over-year home price increases:

- FHFA’s (Federal Housing Finance Agency) House Price Index (HPI): 18.8 percent

- S&P Case-Shiller’s S. National Home Price Index: 18.6 percent

- CoreLogic’s Home Price Insights Report*: 18 percent

There are significant spikes in all price brackets throughout the country. Suffice it to say, no matter where you work, your buyers and sellers are bound to be affected.

Brand-new housing market predictions to share with your clients

As you know, educating clients is one of the most effective ways to reinforce your ability as an agent. Communicating market data via graphics offers a user-friendly (and attention-getting) way to do this.

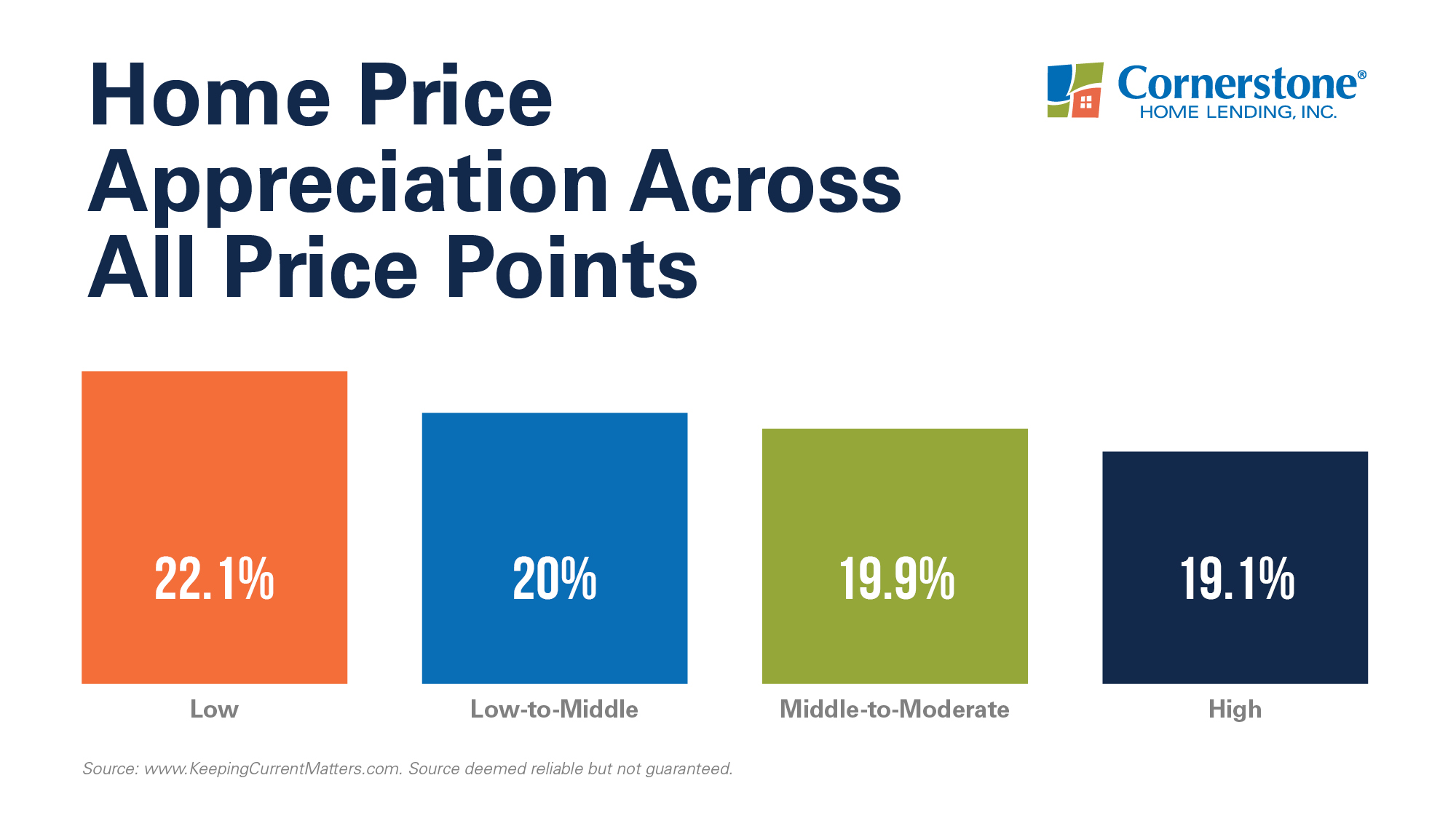

Your sellers may appreciate seeing the latest from CoreLogic’s Home Price Index, showing dramatic equity gains and a minimum of a 19-percent year-over-year increase in every price range:

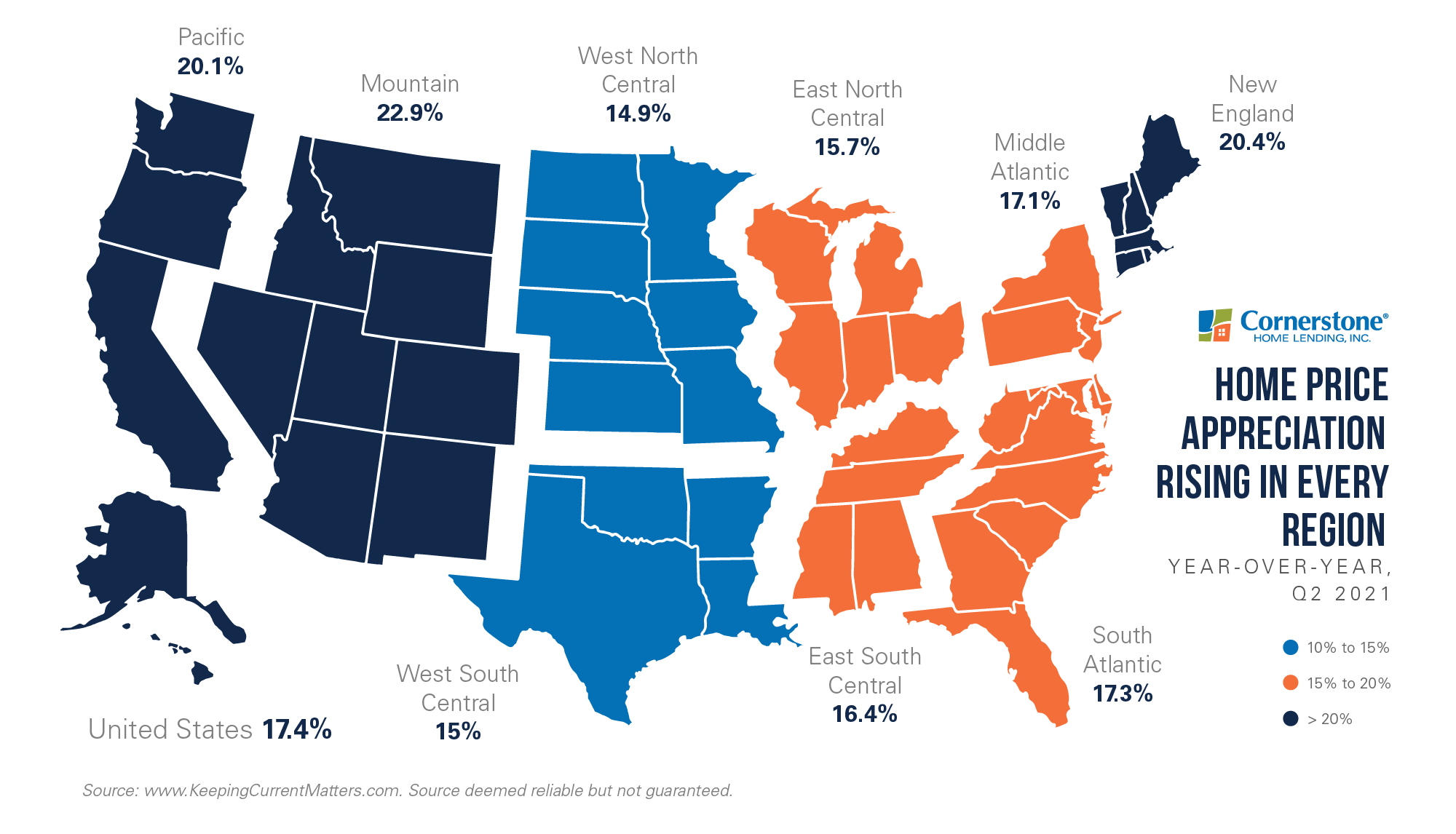

This price growth is seen in every region in the U.S., with a minimum of a 14.9-percent increase, based on FHFA numbers:

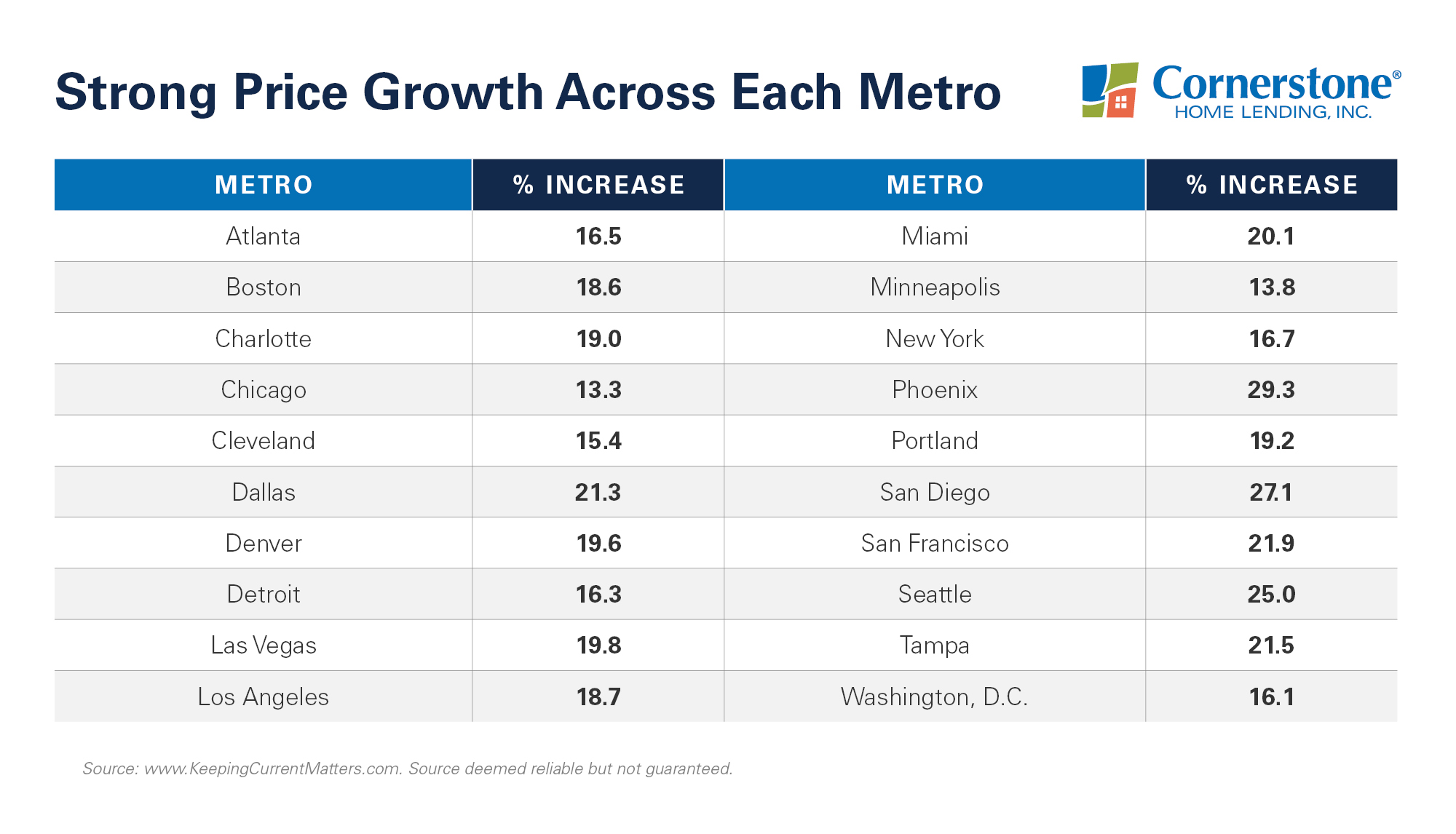

Not only that, but S&P Case-Shiller data shows a minimum of a 13.3-percent price increase in all major metro areas:

Have you ever thought about partnering with us? We treat our realtor partners like family.

So, what about the housing market predictions for 2022? It may help to remind your clients of the age-old economic law: Prices rise and fall based on supply and demand. We’ve seen strong demand for single-family homes throughout the past 18 months. Housing supply has hovered around historic lows, but thankfully, there’s good news on the horizon.

Realtor.com confirms:

“432,000 new listings hit the national housing market in August, an increase of 18,000 over last year.”

But there’s still expected to be a supply shortage in contrast to 2022’s anticipated buyer demand. CoreLogic states*:

“Given the widespread demand and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.”

However, most housing market forecasts predict that home price growth will begin to level out next year. The Home Price Expectation Survey, polling more than 100 housing market analysts, economists, and investment strategists, foresees an appreciation of 5.12 percent in 2022.

Compare this to four other 2022 forecasts from major housing authorities:

- NAR (National Association of REALTORS®): 4.4 percent

- Fannie Mae: 5.1 percent

- Freddie Mac: 5.3 percent

- MBA (Mortgage Bankers Association): 8.4 percent

Your clients will be happy to hear that, unlike the record peaks seen in 2021, home price appreciation is likely to slow down in 2022. But it should still be higher than the annual 4.1-percent average recorded for the past 25 years.

In summary:

- Clients looking to sell have seen substantial equity gains that they can cash in on to move up to the next price range.

- Clients looking to buy may be better off purchasing now as home prices are likely to rise into the next year.

What about those homebuyers experiencing buyer fatigue, the ones who’ve been finding it difficult, if not impossible, to get into their dream house? This is a great time to extend your empathy, while also establishing realistic expectations.

The reality is that a combination of low housing inventory and high buyer demand has created a competitive environment, where bidding wars are common. If you have clients who’ve been shopping for several months or longer, they’re bound to be feeling the frustration.

That’s why these housing market predictions are so important to share. Housing authorities confirm that inventory is slowly starting to increase, and price appreciation should moderate in the year ahead. Builder confidence is also strong because of a low volume of resale inventory.

Whether it’s through email, text, or social, keep your clients encouraged by keeping them up-to-date. You can successfully address buyer fatigue by being upfront, providing the latest data, and equipping clients to make confident decisions.

For clients who may be reluctant to purchase at the “height of the market,” remind them that this is not the height. As inventory increases, experts predict a gradual slowdown in appreciation. Yet, home values are still expected to rise for the next five years. Ease fears by letting clients know we’re not in a bubble — and aren’t likely to crash.

Are you happy with your lender?

If the lender you work with doesn’t offer: super-speedy in-house processing and expedited closings, strategies to help you get referrals and grow your business, and the kind of bend-over-backward service your clients will be hard-pressed to find anywhere else, you deserve better. Click here to partner with a lender that cares.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.