The headlines talking about low housing inventory and high homebuyer demand are everywhere. Whether you’re a first-time buyer seeking a starter home or a homeowner hoping to downsize, you could sidestep this issue by including condominiums (condos) in your home search.

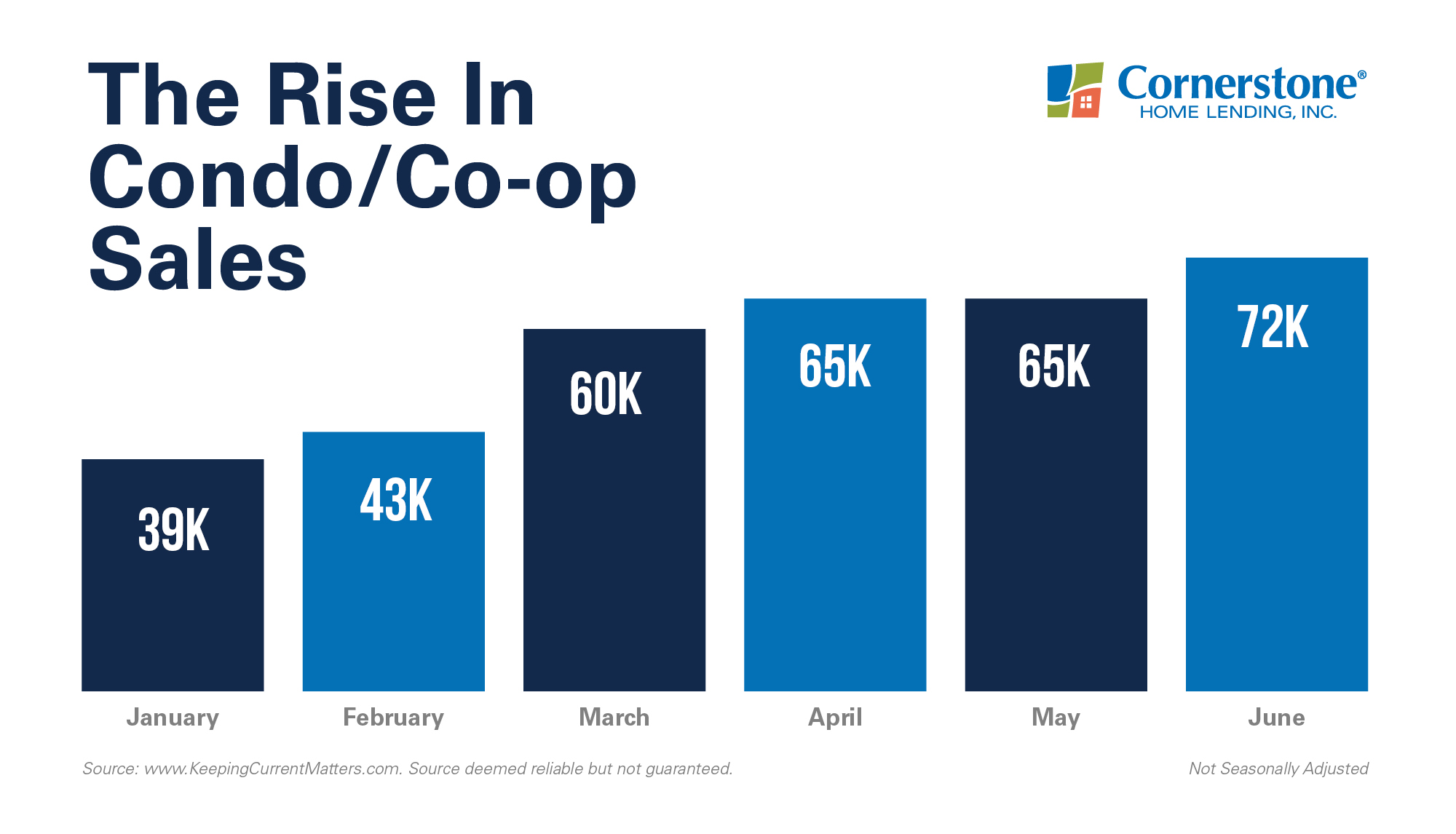

Housing trends show that condo popularity is growing. Data from the latest National Association of REALTORS® (NAR) Existing Homes Sales Report indicates that condo sales increased within the first half of 2021:

Should you buy a condo, and what are its benefits? Let’s discuss the biggest payoffs of condo living to see if it’s the right move for you.

3 reasons more homebuyers are considering condos

You, like many homebuyers, might prefer to buy a condo because:

1. It’s affordable.

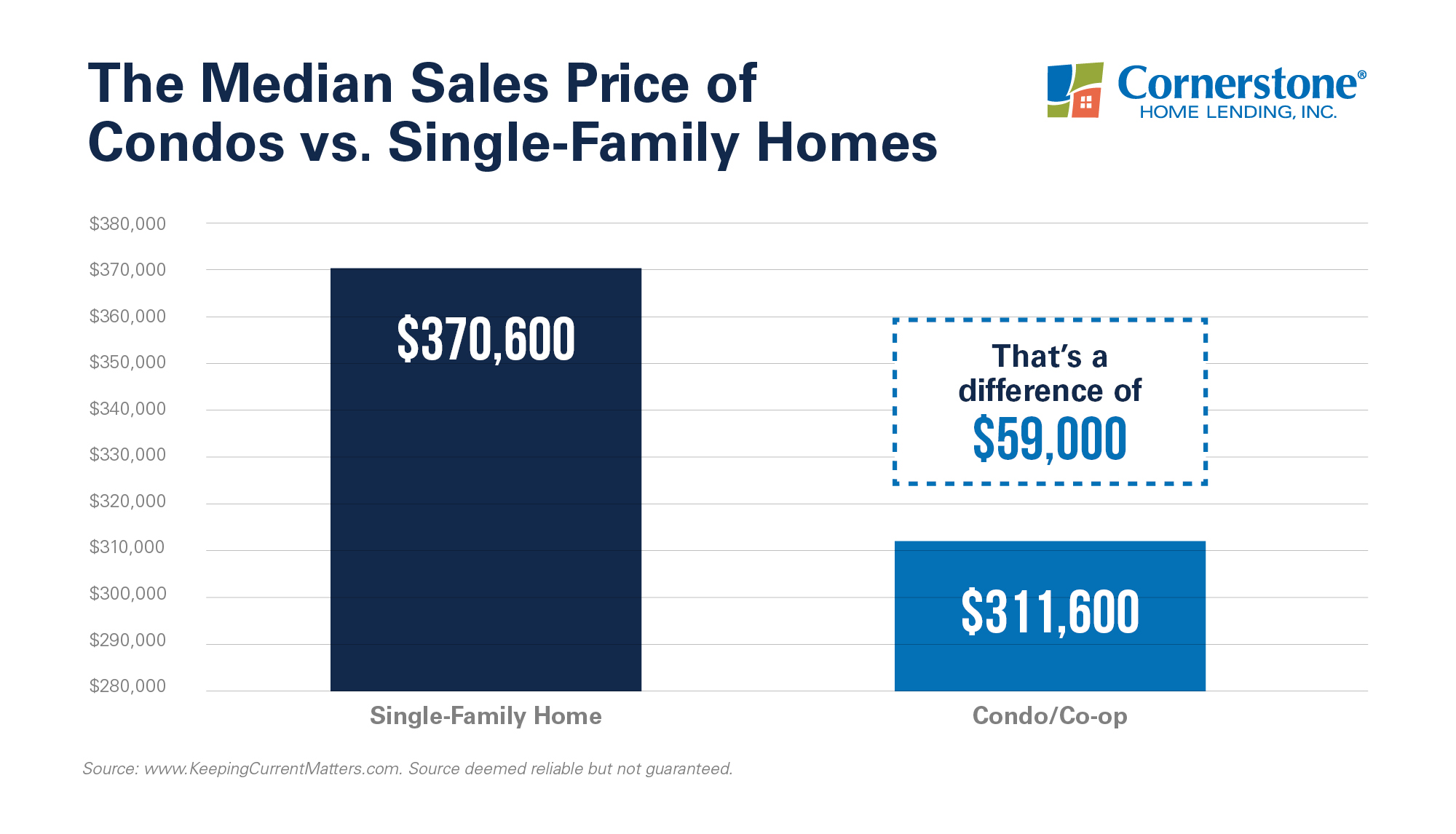

NAR’s report shows the median sales price for a condo to be about $59,000 less than the median sales price for a single-family home:

This creates an excellent opportunity for first-time homebuyers, as well as buyers with minimal savings for a down payment or homeowners who want to save and downsize. A new National Association of Home Builders (NAHB) study finds that at least 12 percent of buyers want less and would prefer to have a smaller house.

Because bigger isn’t always better. Prequalify for your condo now.

2. It’s low-maintenance.

A lighter load is known to be another major advantage of condo living. Typically, a condo’s exterior maintenance is taken care of by an HOA (requiring dues), or Homeowner’s Association. This care may include landscaping and roof, walkway, and siding upkeep and cleaning.

If you’re not ready to take on the maintenance of a standalone home and would prefer a hands-off approach to your upkeep, a condo may be the perfect fit for you. Without exterior maintenance to worry about, you’ll have extra time and energy to focus on yourself, your family, and your hobbies.

3. It has amenities.

Speaking of free time: You can now use it to enjoy all the extras built into your condo community. A pool, a rentable clubhouse, a dog park, and a grilling area with picnic tables are just a few examples.

If you prioritize social connection and like to host events, a condo may provide you with even more options to connect with friends and get to know your neighbors. Many condos also have on-site gyms and patrolling security.

It all comes down to your preference – though it helps to consider condos as an affordable choice with multiple built-in features that may enhance your lifestyle.

“Condominiums, or condos, can be great alternatives to detached homes. City dwellers, singles, couples, seniors, and many others may find condos that suit their needs and budgets. Others may simply prefer low-maintenance living. Buyers who feel ‘priced out’ of homes may discover condos offer an affordable homeownership alternative.”

If you’re renting, you could buy a condo to escape the trap of rising rents. Recently, rent prices climbed to their highest recorded point in many parts of the U.S.

A report from realtor.com confirms that rents increased by 11.5 percent compared to the same time the year before, noting:

“Rents across the country reached new highs in August, growing by double digits for the first time on record… Now, the national rent has reached $1,633, up 11.5 percent ($169) year-over-year, and is growing over three times as fast as the 3.2 percent growth rate seen just before the pandemic hit in March 2020.”

This makes monthly rent higher than a monthly mortgage payment.

While monthly mortgage payments have also begun to rise, NAR statistics still show that they are far lower than the typical monthly rent. According to NAR’s most recent data on homes closed, the median monthly mortgage payment is estimated to be $1,225. The median national rent, in comparison, has reached $1,633, based on realtor.com’s latest numbers.

To put it another way, the homebuyers who’ve recently purchased a house have been able to lock in a monthly mortgage payment that’s around $408 lower than what renters are now paying. The savings may be even more if you buy a condo.

Owning a home also addresses another serious concern with renting: monthly stability. The median asking rent has been steadily rising for decades — since 1988. When you purchase a home or condo, you’ll likely lock in your mortgage rate for the next 30 years, creating a stable monthly payment for the same amount of time. Instead of worrying about a monthly rent increase, you’ll have peace of mind.

Say buy-bye to renting. Say hello to happy living.

A secure monthly payment. The ability to build equity. Freedom to paint your walls however you please. Support from your community. No wonder condo owners are so happy.* To find out how much you can afford, prequalify now.

*”Community Associations Remain Preferred Places to Call Home.” Zogby Analytics for the Foundation for Community Association Research, 2020.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.