“What house can I afford?” You’re in good company if this question has crossed your mind. The past year has placed even more importance on the quality and functionality of our homes, causing many renters to reassess their current living conditions and make the move toward homeownership.

Learning more about housing affordability, especially in today’s competitive market, is a must. It’ll help you understand how much to budget for your monthly housing expense. It’ll also provide encouragement that you’re using your time wisely to shop in the right price range.

‘What house can I afford?’ comes down to 3 factors

Three main variables determine how affordable a home is to buy:

- Mortgage rate

- Mortgage payment (based on a percentage of your income)

- Housing prices

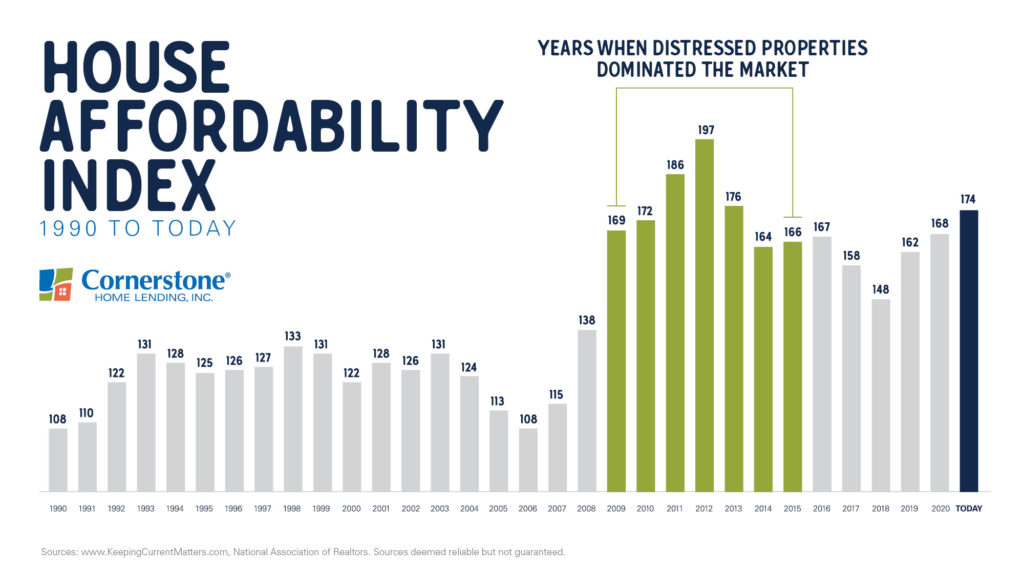

The Housing Affordability Index produced by the National Association of REALTORS® (NAR) accounts for these top three factors, using a total housing affordability score to gauge this.

As NAR explains, its index:

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

NAR methodology shows:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20-percent down payment.”

To sum it up: When the index is higher, it’s more affordable to buy a house.

Prequalifying for a mortgage never felt so easy. Get started now.

This graph illustrates the Housing Affordability Index over the past three decades:

Today’s affordability is depicted in dark blue. As you can see, houses right now are more affordable than what they’ve been at any time since the previous housing crash. At that time, short sales and foreclosures (also called distressed properties) flooded the housing market. These distressed properties sold at hefty discounts, which hadn’t been seen in the real estate market for close to a century.

So, what’s making homes so affordable? While there are three components that go into the affordability equation, the one currently holding the most weight is historically low rates. This factor alone supports why it’s more affordable to purchase a house right now than at any other point within the past eight years.

Whether you’re thinking about buying your first house or selling and moving into your forever home, it’s critical to grasp how affordability can influence the overall cost of your house. Keeping this in mind, buying when mortgage rates hover around all-time lows, as they do right now, could potentially cut the total cost of your mortgage by thousands.

Time is of the essence to take advantage of this unique opportunity for savings. What will happen to affordability if, as predicted, mortgage rates and home values rise? If both of these factors increase, which is likely to happen within the year, you’ll find yourself paying much more for your mortgage.

Here’s a quick example:

- Let’s say you buy a $325,000 house this month at a 3-percent 30-year fixed mortgage rate, after putting 10-percent down. (Annual Percentage Rate estimated at 3.18 percent.)

- Your estimated monthly principal and interest payment would be $1,233.*

If you bought the same house in a year, its price may rise to roughly $350,025 at a forecasted 3.6 percent mortgage rate. This may bring your monthly payment up to $1,432. (Annual Percentage Rate estimated at 3.78 percent.)

As a result, you’d be paying $199 more per month for your mortgage. This adds up to an extra $2,388 per year, totaling at $71,640 more over the life of your mortgage.

Not only that, but you’d be missing out on an estimated $25,000 gain in home equity, resulting from home price appreciation. Meaning, you’d have lost out on a small fortune — close to $100,000 in net worth — by waiting until next year to purchase.

Buying a house now could save you big-time

Historical trends on housing affordability show that purchasing a home in the current market may help you save significantly more money over time. Want to know exactly how much you can expect to save? Take a moment and prequalify.

*MBS Highway payment estimate, rounded to the nearest dollar amount. Rates listed (as of 7/14/2021) are for illustrative purposes only and are subject to change.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.