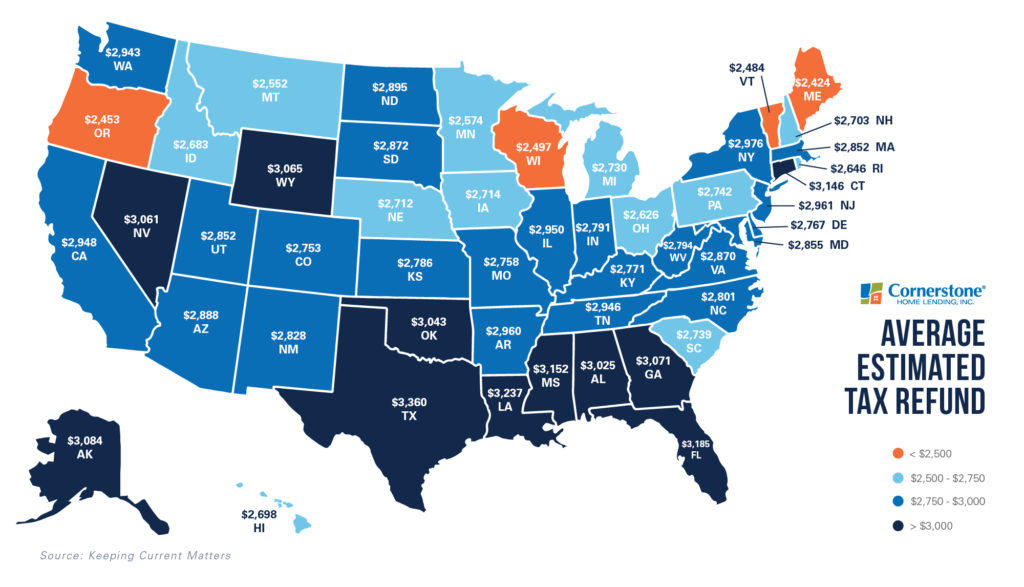

As an American taxpayer, you could expect to get back an average tax refund of $2,925 this year, according to IRS data.* A significant number of people may also have extra savings from stimulus checks received in 2020 and 2021.

Because of the impact of the pandemic, taxpayers again have more time to file this year. The IRS has extended the tax deadline from April 15 to May 17. (Those affected by the Texas winter storms have a deadline of June 15, 2021.)

Average tax returns may make it up to 82% easier to buy

Tax returns are most often thought of as extra cash that can be put toward big-picture goals. You might be hoping to buy a house in 2021 or sell your home and trade up. If so, you may be looking at enough funds to cover some or all of your down payment.

To help supplement your tax return, stimulus savings may be a sound option. Of the households sent last year’s stimulus check, the National Bureau of Economic Research’s recent paper noted that “one-third report that they primarily saved the stimulus money.” Are you among those who’ve saved your economic impact payments? You might consider putting this toward your down payment or closing costs.

Here’s a map that shows the average projected* tax return 2021 by state:

Many first-time homebuyers are still under the impression that a 20-percent down payment is required to buy a house. But mortgage programs from Fannie Mae, Freddie Mac, and the Federal Housing Authority (FHA) all have minimum down payment requirements as low as 3 percent. For the veterans and active duty service members who qualify, VA loans may also require no down payment.

Putting your tax refund toward your down payment can be a brilliant thing. Prequalify to find out how.

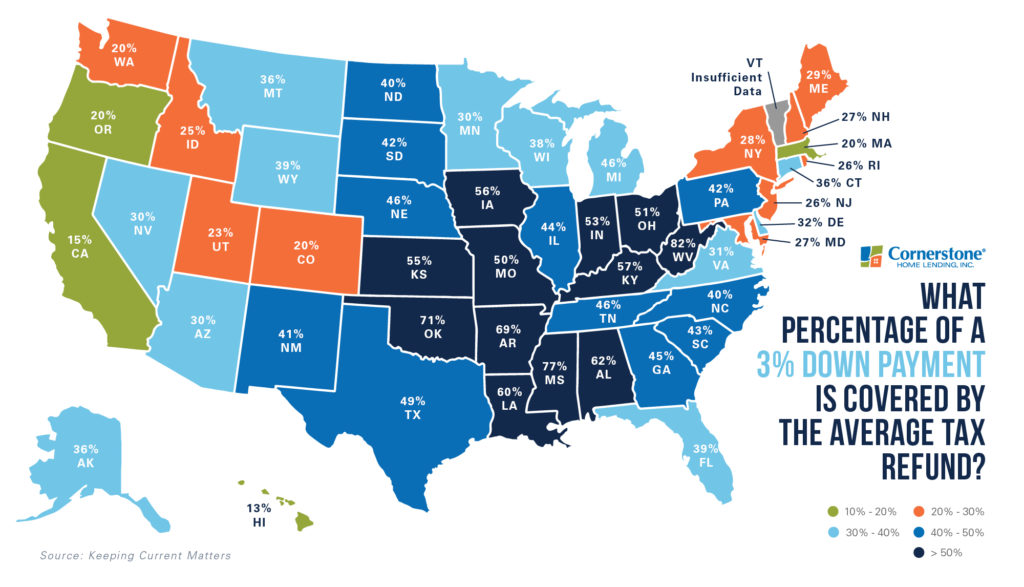

Let’s say you used this year’s tax return to begin saving for a down payment. How close would that get you to a minimum of 3-percent down?

On this map, you’ll see the percentage the average tax return covers of a 3-percent down payment, based on median home prices in that state:

The higher the percentage of a state, the closer your tax return will move you toward owning a house. If you live in a state like West Virginia, for example, using your tax return 2021 to save for a down payment could get you 82-percent closer to your brand-new place.

Amazingly, even the circumstances of the past year haven’t affected Americans’ view on owning a house. In a recent realtor.com survey of prospective homebuyers, it showed that the primary reason today’s first-time buyers still want to purchase is just that: to become a homeowner.

In fact, three of the top four survey responses spoke to homeownership’s financial benefits. Fifty-nine percent of respondents said, “I want to be a homeowner.” Whereas, 33 percent stated, “I want to live in a space that I can invest in improving.” Thirty-one percent said, “I need more space.” And 22 percent stated, “I want to build equity.”

The survey also found that young homebuyers, especially, had a strong belief in homeownership. This is contrary to what experts have predicted about the millennial generation’s relationship to renting. Sixty-two percent of millennials said that their desire to become a homeowner is their number one reason for buying a house.

George Ratiu, realtor.com’s Senior Economist, explains:

“Americans, even millennials who many thought would never buy, have a strong preference for homeownership for the same reasons many generations before them have. To invest in a place of their own and in their communities, and to build a solid financial foundation for themselves and their families.”

If you too have dreams of homeownership, it’s likely that leveraging this year’s tax return can help make it happen.

Not your average mortgage lender: We can get you home faster

The short version: We bend over backward for our borrowers, moving you from contract to close at an incredibly fast pace. The long version: Because of our speedy in-house processing, exceptional attention to detail, and integration of the latest technologies (hello, LoanFly!), we’re beating the 52-day industry closing standard by several weeks.** Got your tax return handy? Learn more about our low- and no-down-payment mortgages when you prequalify.

**“Origination Insight Report.” ICE Mortgage Technology™, March 2021.

For educational purposes only. Cornerstone Home Lending and its affiliates do not provide tax advice. Please consult your professional tax advisor for specific guidance.

Sources deemed reliable but not guaranteed.