While stay-at-home orders hampered the market in the spring, homebuyers are reemerging. Those who don’t might keep dreaming, bookmarking the homes they hope to buy.

But as housing market activity resumes, plenty of prospective buyers may be dreaming for longer than necessary — putting off a purchase because homebuying seems confusing. Working with a reliable professional can address any concerns and make the process of homeownership simple.

Young buyers want to know more

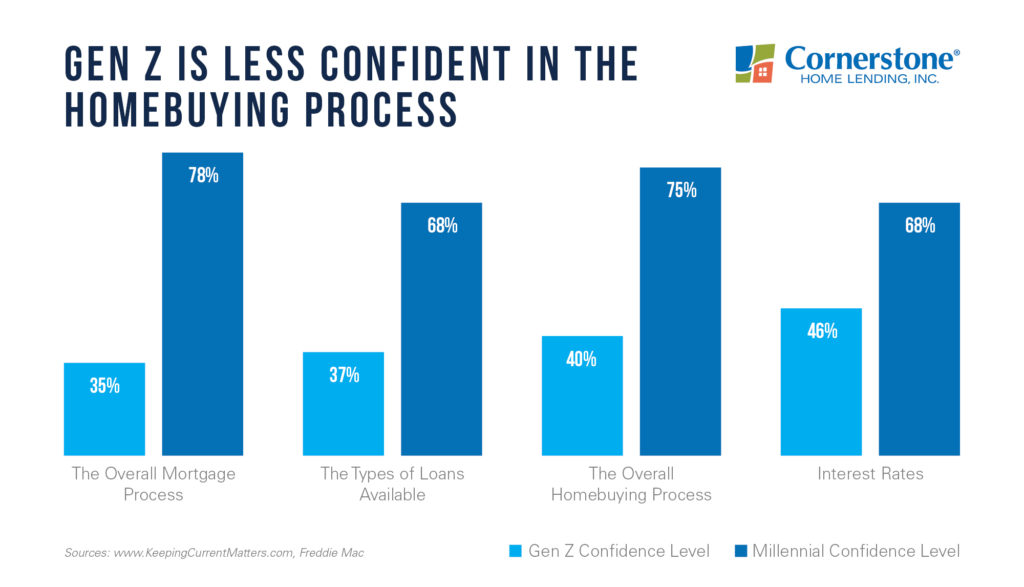

Freddie Mac and Ipson conducted a survey in 2019 on Gen Z and Millennial homebuyers’ confidence level regarding buying a house.

This graph breaks down the results, showing that a significant number of younger homebuyers don’t feel confident about several steps involved in homebuying:

These match the results of a 2020 TD Bank survey, showing that three-quarters of young first-time buyers who planned to purchase within the year felt overwhelmed by the process. Recent adjustments required to contain COVID might only add to the confusion.

Taking into account the process of buying a house and getting a mortgage, there are up to 230 steps that need to take place. Here’s where the shortcut comes in: Having the help of a trusted loan officer can take most, if not all, of these steps off your plate.

You won’t have to figure it out alone to successfully own a house. You’ll be guided and also given the technology to streamline the mortgage process. Meanwhile, your loan officer will be working hard behind the scenes to expedite the more complicated aspects of buying a house.

These steps can also change at any point in the process, for any number of reasons. Depending on desires, life circumstances, loan type, mortgage terms, and the current state of the housing market, your path can vary. This makes professional support and guidance key.

There’s a reason our borrowers keep coming back. Find a local mortgage broker and get connected remotely.

Freddie Mac survey participants also voiced concern about understanding different home loan types. Speaking with your loan officer can help you decide which mortgage works better for you.

These are some of the basics:

- Conventional: Often used by repeat buyers who’ve had time to establish their credit, this type of loan typically requires a bigger down payment to buy. Putting equity, or profits, from the sale of a previous home toward a down payment can also help.

- FHA: The Federal Housing Administration, or FHA, backs this loan that’s ideal for first-time buyers. An FHA loan is a popular pick for many first-timers since it can be easier to qualify for and also requires a lower down payment.

- USDA: Normally, this loan serves qualified buyers purchasing in rural and some suburban areas. There’s also no down payment required. Your loan officer can help you determine if the property you have your eye on is eligible for a USDA mortgage, guaranteed by the United States Department of Agriculture.

- VA: Frequently used by active duty service members and veterans, as well as surviving spouses, the Department of Veteran Affairs secures VA mortgages. A VA loan has a zero down payment requirement, and loan limits were lifted in 2020.

The Gen Z and Millennial homebuyers surveyed by Freddie Mac also noted interest rates as another area of misunderstanding. Today’s mortgage rates have reached new lows, allowing homebuyers to get more (i.e., a larger or better-located home) within their budget. For those with strong job security right now, purchasing at a record-low rate can help homeownership to become even cheaper.

Working with a skilled loan officer can short-cut the homebuying process. During a time when financial savings matter, it can also offer much-needed guidance into how you can make your mortgage dollars stretch.

Go hard easy and go home fast

Can it really be that simple? With the right loan officer by your side, buying a house can be both easy and fast. Cornerstone loan officers have a need for speed and are fully equipped to help buyers close remotely.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.