The Bureau of Labor Statistics (BLS) just released its most recent jobs report. The report revealed that, because of the economic shutdown required by COVID-19, our unemployment rate soared to 14.7 percent.

Many sources project that next month’s rate may be higher. These numbers reflect unforeseen hardship affecting American families, with an impact that can’t be underestimated.

But it also doesn’t help anyone to overestimate the long-term repercussions of this pandemic.

Dozens of headlines have compared our current economic disruption to the Great Depression, and many of the articles have hinted at an Armageddon to come. Fortunately, several experts have spoken out against these alarming claims.

Today’s unemployment numbers aren’t terrifying

Most recently, Josh Zumbrun, the Wall Street Journal’s (WSJ) national economics correspondent, explained:

“News stories often describe the coronavirus-induced global economic downturn as the worst since the Great Depression…the comparison does more to terrify than clarify.”

Talking to your loan officer should feel like talking to a friend. If you have questions about how your job status could affect your ability to buy or own a house, click here to get answers.

He continued:

“From 1929 to 1933, the economy shrank for 43 consecutive months, according to contemporaneous estimates. Unemployment climbed to nearly 25 percent before slowly beginning its descent, but it remained above 10 percent for an entire decade… This time, many economists believe a rebound could begin this year or early next year.”

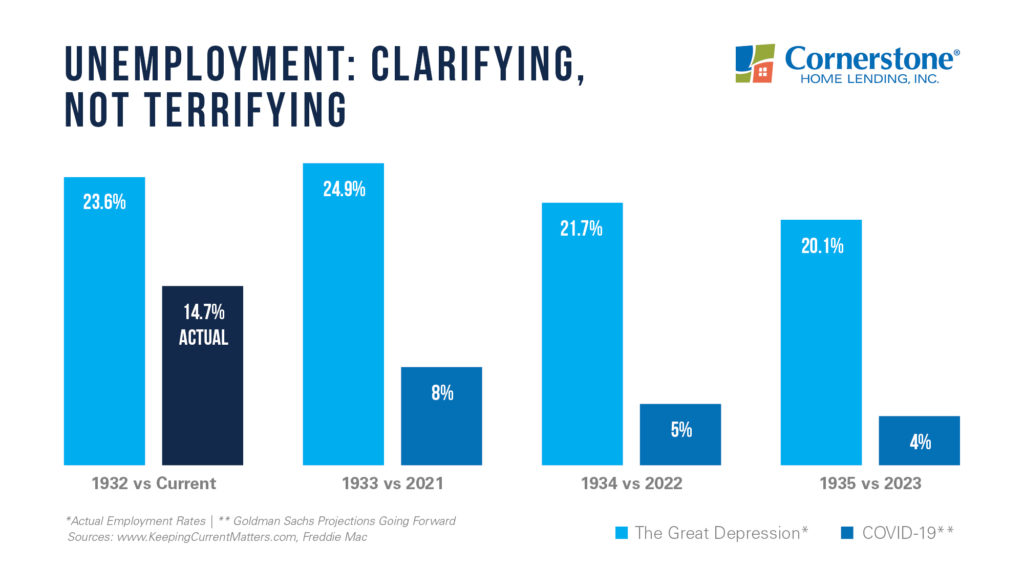

This graph compares our present-day unemployment numbers (actual, as well as projected) to what we saw in the Great Depression:

Look at the two unemployment situations side-by-side, and there’s a stark difference.

So, what makes our current situation unique? Right now, we’re not experiencing a structural economic collapse. Instead, we’re living amidst a planned shutdown needed to flatten the curve of the virus. As soon as COVID is contained, our economy will start to improve immediately. This shutdown is nothing like what took place in the 1930s.

Federal Reserve Chairman Ben Bernanke, who has extensively researched the Great Depression, was quoted in the same WSJ article as saying:

“The breakdown of the financial system was a major reason for both the Great Depression and the 2007-09 recession.” He went on to say that today – “the banks are stronger and much better capitalized.”

Our nation’s heart goes out to all the families and small businesses that are suffering.

Still, the BLS report found that 90 percent of all job losses will be temporary. Many are also receiving necessary help to survive this pause in employment. In the 1930s, those who lost jobs weren’t cushioned by government subsidies or government-backed employment insurance as is available today.

Currently, many families are being supported by unemployment benefits and an extra $600 per week. The government stimulus package is also helping numerous businesses to stay afloat. Of course, there are still difficulties. But this assistance is supplying much-needed relief until most people and companies can return to business as usual.

It helps to gain clarity on our present situation: It’s not the end, but it is a preplanned pause of the economy. When the pandemic ends, our country will recover, making comparisons to any other downturns moot.

As Bernanke says:

“I don’t find comparing the current downturn with the Great Depression to be very helpful. The expected duration is much less, and the causes are very different.”

Keeping you safe makes us happy

Whether it’s finding a way to make your monthly housing cost cheaper or helping you get a mortgage remotely so you don’t have to meet face-to-face, you’re our top priority. Have questions? We have answers. We’ve even extended our remote office hours to make it easier for you to connect.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.