Purchasing stocks or CDs, or even just using a savings account, are all common ways people try to build net worth. But recently, Jonathan Eggleston, an economist, and Donald Hays, a survey statistician, both from the U.S. Census Bureau, revealed what really impacts how much wealth we accumulate.

They said:

“The biggest determinants of household wealth [are] owning a home and having a retirement account.”

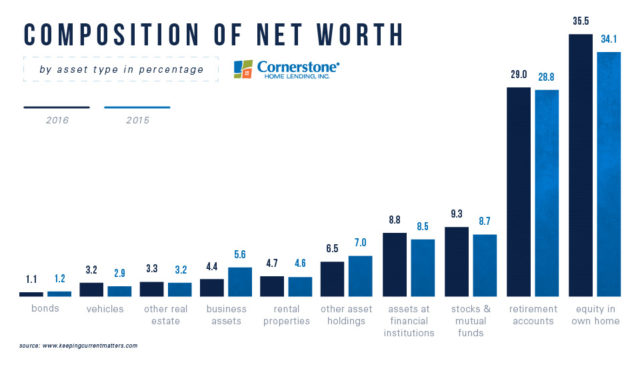

This can be seen in the chart below:

Homeownership: The simple tool that can increase your wealth in your sleep

Seeing that home equity comes out ahead for the composition of net worth isn’t surprising. Owning a home is known to be one of the most effective — and accessible — options for any family or individual to use to build their wealth without much effort.

The Census study supports this:

“Net worth is an important indicator of economic well-being and provides insights into a household’s economic health.”

Build wealth without trying? Get prequalified now and thank yourself later.

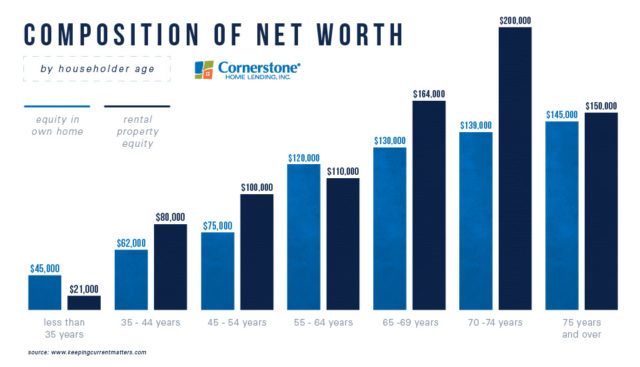

Increasing home equity can move your family in this economically healthy direction, contributing to significant financial gain. As the report above also noted, homeowners aren’t just building net worth through the houses they’re living in.

Many people also earn substantial equity by investing in rental properties:

John Paulson, the billionaire considered to be one of the most prestigious names in finance, summarizes:

“If you don’t own a home, buy one. If you own one home, buy another one, and if you own two homes, buy a third and lend your relatives the money to buy a home.”

Homeownership has both non-financial and financial benefits. Renters who are ready to make their monthly housing cost work for them can take an important first step by owning and beginning to build their investment. Homeowners have the chance to compound their already growing equity by investing in a second property.

Fact: You can start building wealth in 10 days

The sooner you move into your new home, the quicker you could see your equity increase. So why not get there faster? It doesn’t have to take over a month to buy a house. Connect with a local loan officer and find out how to get from contract to closing in a little over a week.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.