This is a year that will be hard to forget. The “new normal” has dramatically altered our ways of living. The 2020 housing market is not an exception, with historic and unparalleled changes that have defied what most people thought to be possible.

Here’s more insight into four fundamental areas that are shaping our never-before-seen climate.

4 factors lay the foundation for a record-setting real estate market

The current market conditions have experts scratching their heads and homebuyers picking out houses:

1. Housing market growth.

This spring, our economy was purposely put on hold to help manage the global health crisis. Many steps of the homebuying process were also affected. Fortunately, mortgage and real estate technology helped keep the industry moving. Business slowly resumed across the U.S. as waves of shelter-in-place orders ended.

The outcome? The housing market was totally transformed, climbing to remarkable highs from its former lows. Now, industry experts are calling this recovery exceptional and beyond expectations. Evidenced by purchase applications, pending home sales, and more, buyers have flooded back, and houses are selling rapidly.

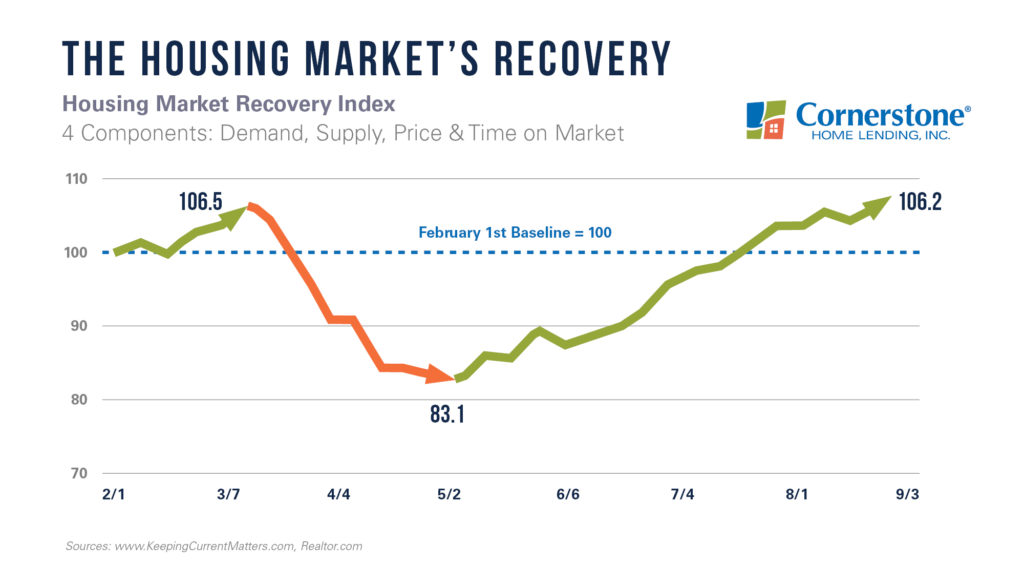

As Realtor.com’s Housing Market Recovery Index shows, the current market has exceeded its pre-pandemic numbers, growing in strength comparable to February 2020:

2. Historically low mortgage rates.

Another game-changer for 2020? Record-low rates, which have become one of the main motivators for today’s homebuyers. The average mortgage rate hit an all-time low numerous times this year, and it’s still staying within this record-breaking region.

When mortgage rates drop this low, homebuyers are granted a unique opportunity to increase their buying power, i.e., get more house for the amount of money used to purchase. This is especially important after spending multiple months at home; many buyers are looking for more space for remote work and virtual schooling.

Get in touch: Cornerstone loan officers have access to hundreds of nationwide loan products, plus in-house processing, underwriting, and funding, to get you to closing on time.

3. Ongoing home price appreciation.

Historically low inventory was a key driver of the housing price appreciation seen this year. Inventory was tight at the onset of the pandemic. It’s still far below the level required to sustain a healthy market. More sellers are slowly returning, but buyers are snatching up houses faster than they can be listed.

It’s a classic example of supply and demand, triggering home prices to increase. Selling an item that’s at high demand will automatically spike its price. If you’re thinking about selling your home this year, now may be the prime time to sell quickly and at a profit.

Bill Banfield, Quicken Loans EVP of Capital Markets, said:

“The pandemic has not stopped the consistent home price growth we have witnessed in recent years.”

4. Rising affordability.

Even as housing prices increase, affordability also continues to rise. This is another boost for today’s buyers. Experts have explained that all-time-low rates are helping to offset climbing prices, allowing a homebuyer’s purchase power to grow. If you want more room for an in-home office, classroom, or gym, it could be a good time to trade up to a larger space.

Mortgage News Daily reports:

“Those shopping for a home can afford 10 percent more home than they could have one year ago while keeping their monthly payment unchanged. This translates into nearly $32,000 more buying power.”

Historically low rates. Appreciating home prices. Growing affordability. An unanticipated market recovery. For real estate, 2020 may be a year unlike any other. These unusual opportunities for buyers and sellers are ones you may never see again in your lifetime.

Check your loan status on the fly

Always know where you are in the mortgage process with notifications and an easy-to-read loan status wheel. Upload the required documents and see what’s needed to complete your loan. Do it all remotely from your favorite device.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.