It’s been an unprecedented year, with our country facing its share of challenges. The spread of COVID-19, spikes in unemployment, and the subsequent recession are but a few examples. Amidst these hurdles, the homeownership rate in the U.S. continues to increase, indicating both strength in the housing market’s recovery and homebuyer confidence.

Falling rates are the ‘icing on the cake’

As the U.S. Census Bureau recently stated:

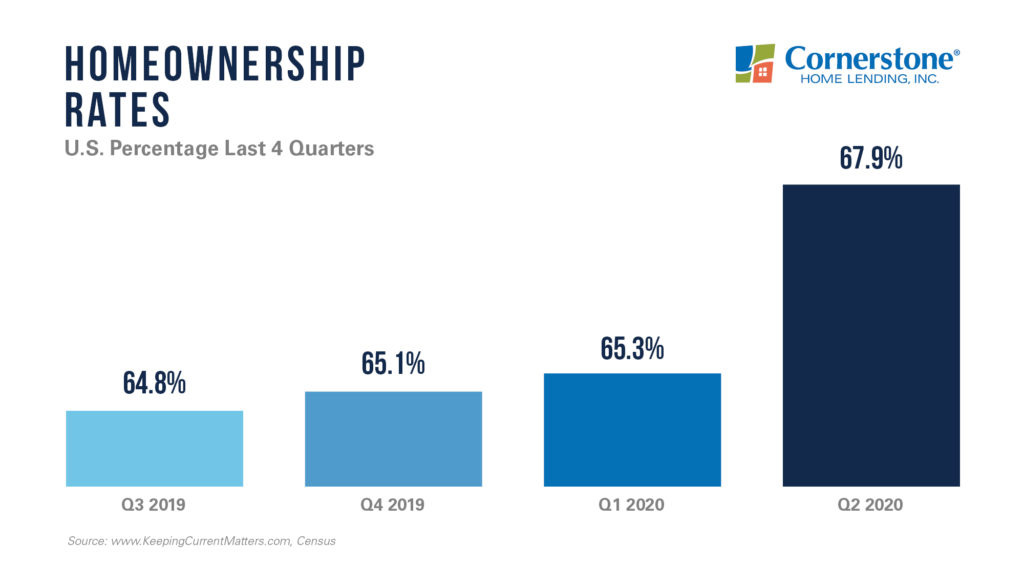

“The homeownership rate of 67.9 percent was 3.8 percentage points higher than the rate in the second quarter 2019 (64.1 percent) and 2.6 percentage points higher than the rate in the first quarter 2020 (65.3 percent).”

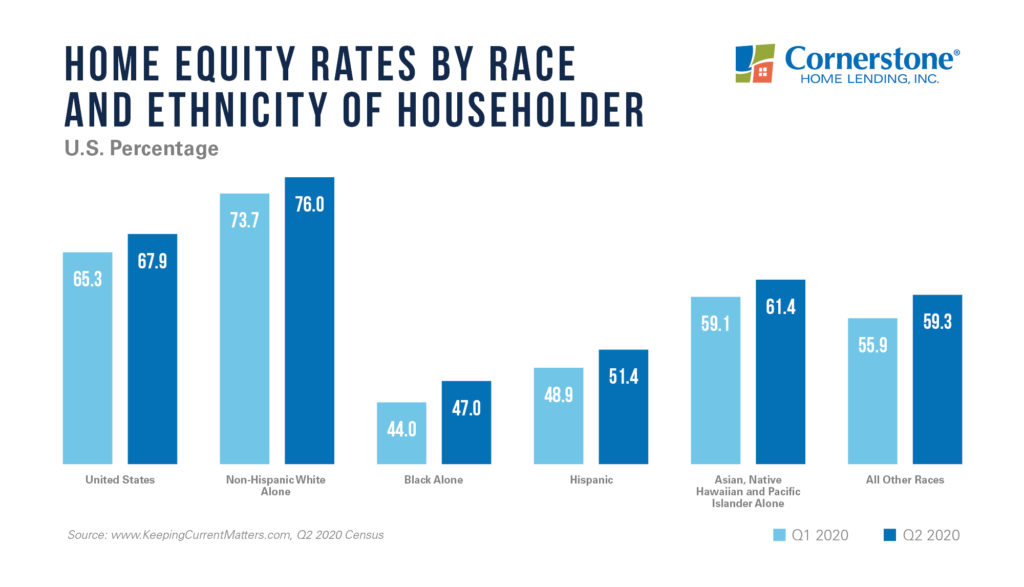

The numbers are also broken down by race and ethnicity:

Among the numerous reasons why our nation’s rate of homeownership continues rising, historically-low mortgage interest rates stand out as a leading factor. Rates currently sit around all-time lows, supporting affordability and allowing more homebuyers to enter today’s market.

Ralph McLaughlin, Haus Chief Economist, explains:

“Mortgage rates are the icing on the cake for households that were thinking about buying… They found an unexpected opportunity during the worst economic downturn America has seen since the Great Depression.”

Take back control of your loan. Starting now.

And, because of time spent sheltering in place, more prospective buyers have been searching for houses that have more space than their rentals. Homebuyers in this category are often younger and are helping drive the homeownership rate higher, Odeta Kushi, First American Deputy Chief Economist, notes.

Kushi says:

“Big jump in the homeownership rate today, mostly driven by younger households. We saw a spike in the number of owners, and a decline in the number of renters. This is the highest rate of homeownership since 2008.”

This is excellent news for new buyers, as well as the housing market. If you’ve been thinking about buying a home in 2020, now may be an ideal time to meet with a loan officer and assess your situation. It’s possible that record-low mortgage rates might remove any roadblocks and make it more affordable for you to own.

Low rates mean big buying power

When mortgage rates trend down — as they are right now, reaching historic lows — your buying power can get a boost, big-time. So, you could get more house for less with a lower rate. There’s one way to find out: Prequalify.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.