Given our current circumstances, this question is coming up a lot. Is the recent economic slowdown going to have an impact on housing prices? Taking a look at supply and demand, i.e., the big picture, can give us a clear idea of what lies ahead.

Entering the second part of the year, we’re looking at low housing inventory. The National Home Builders Association (NAHB) chief economist Robert Dietz says:

“As the economy begins a recovery later in 2020, we expect housing to play a leading role. Housing enters this recession underbuilt, not overbuilt. Estimates vary, but based on demographics and current vacancy rates, the U.S. may have a housing deficit of up to one million units.”

Since there’s an undersupply of homes for sale, we can expect to see pressure on housing prices. This simply means that homebuyers will pay more when supply is low, and demand is high.

Is this the #1 misconception homebuyers have today?

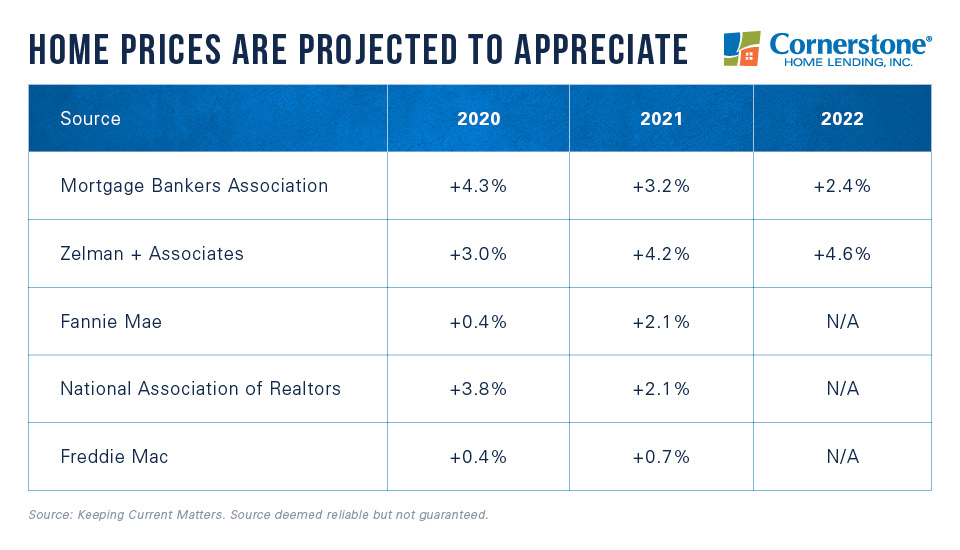

Multiple housing market authorities project that home prices will continue to appreciate through 2020 and likely into 2022. NAR data show that home prices actually increased year-over-year in 96 percent of markets in the U.S. in the first quarter of 2020 – in the midst of the coronavirus pandemic.

It’s common to believe that when real estate values rise, owning a house becomes more expensive. This isn’t necessarily the truth.

Most homebuyers use a mortgage to purchase a house. So, mortgage interest rates are a significant factor in determining affordability. The current mortgage rate has dropped to historically low levels, causing buying power to increase.

Looking for a better, faster, and friendlier way to mortgage? Get the app for free.

As Freddie Mac’s chief economist Sam Khater recently explained:

“The summer is heating up as record-low mortgage rates continue to spur homebuyer demand.”

A homebuyer’s income also plays a big part in the equation. Pre-COVID, the median income for a family increased by more than 5 percent within the past year, supporting affordability. This may still be the case for workers with strong job security.

NerdWallet’s First-Time Home Buyer Metro Affordability Report for Q1 2020 also found over half of the major metro areas in the U.S. to be cost-effective for most homebuyers. Cities like Indianapolis, Chicago, Philadelphia, Hartford, and Cleveland with high affordability ratings are among those considered first-time-buyer-friendly.

If you’re a homebuyer hoping to purchase this year, it helps to know that homeownership remains affordable even as housing prices increase.

We’re 100% committed to stellar service and closing on time

Not only does our in-house processing, underwriting, closing, and funding make mortgage easy, but it saves our borrowers time and money. Cornerstone beats the industry average and closes over four weeks faster:* Get prequalified and get remote five-star service without unnecessary delays.

*“Origination Insight Report.” Ellie Mae, April 2020.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.