Average rates show that buying now is better

Here are some highlights from the cost-across-time comparison:

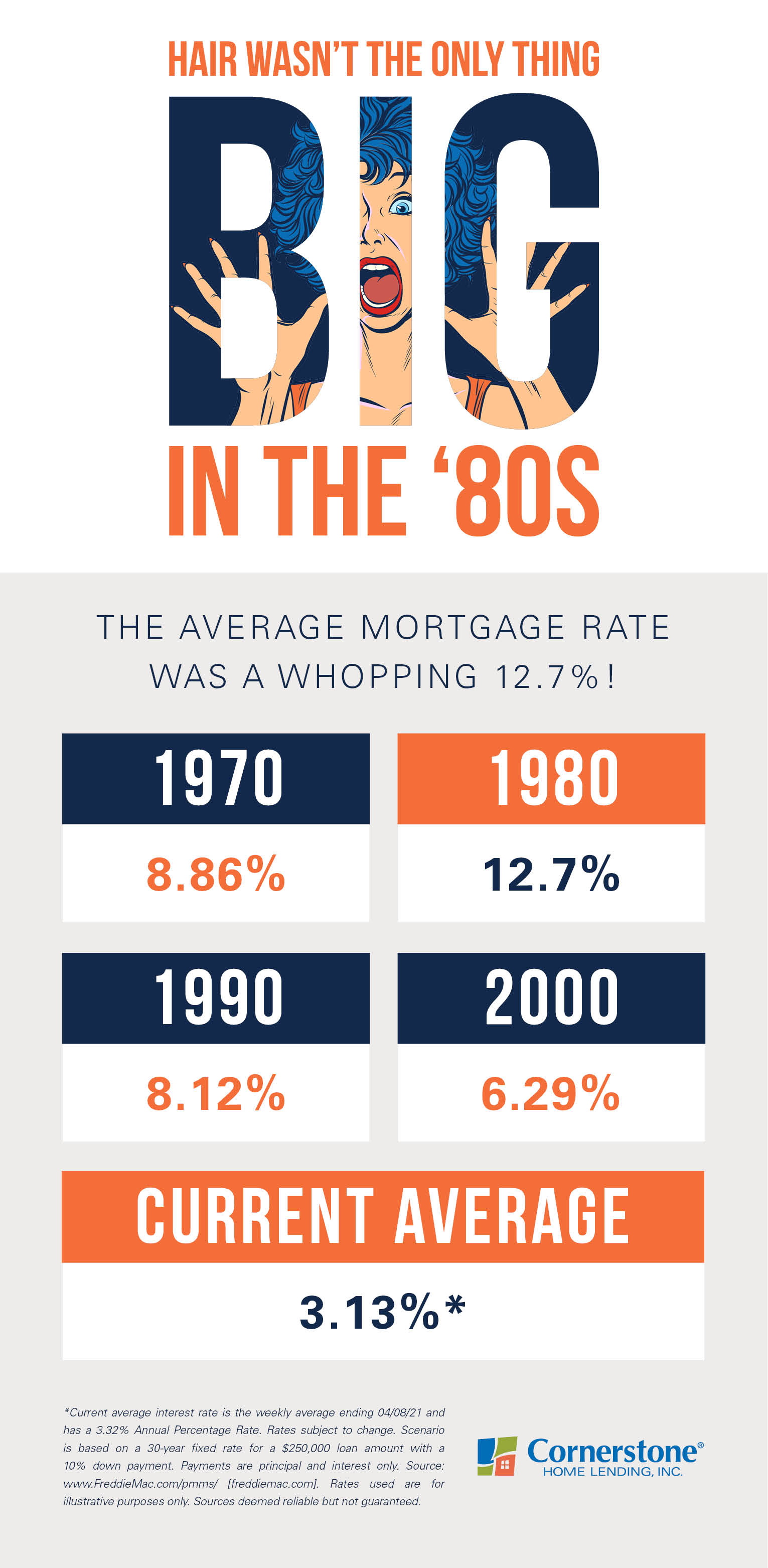

- It’s easy to put today’s low rates — now hovering around 3 percent — in perspective when we take a look back at mortgage rate averages over the past 40 years.

- Mortgage rates plummeted this past year. Now, they’ve started to rise. By the end of 2021, rates are expected to increase to around 3.6 percent.

- Your mortgage interest rate has a huge impact on your monthly mortgage payment. With today’s rates, you have the potential to save over $1,600 a month compared to just a few decades ago.*

- Today’s homebuyers are better off buying sooner rather than later and locking in a low rate while they can.

Rates are great. Why wait? Prequalify now.

It can depend on the amount of the home loan you qualify for, but even a half a percent increase in your interest rate could add hundreds to how much mortgage you’re paying each year.

In the 1970s, the average mortgage rate of 8.86 percent came with an average $1,986 monthly mortgage payment. In the 1980s, the average 12.7 percent rate came with a $2,707 monthly mortgage payment. In the 1990s, homeowners with an average 8.12 percent interest rate paid $1,855 a month in mortgage. And in the early 2000s, this came out to an average $1,546 monthly mortgage payment at a 6.29 percent rate.*

Today’s average 3.13 percent mortgage rate may come with a much more affordable $1,072 monthly payment.* You could pay over $1,600 less each month on your mortgage than you would have paid at peak rates in the 80s. Even with an expected increase in the next 12 months, rates still sit far below historic levels.

These historically low rates may seal the deal if you’re on the fence about buying.

To ensure you’re making the right decision, it can also help to ask two questions:

- Is it likely that home values will be higher in a year?

- Is also likely that mortgage rates will be higher in a year?

Coming at it from a strictly financial viewpoint, if you answer “yes” to one of the questions above, it’s a strong sign that you should consider buying a home now. If you answer both questions with a “yes,” you could definitely benefit from buying today.

While no one can guarantee what mortgage rates or home values will look like in 12 months, multiple housing authorities appear to be answering a definitive “yes” to both questions. Rates, as mentioned, are predicted to rise. Home values are also projected to keep appreciating.

What does this mean for you as a buyer? Let’s say we stick with the assumptions: that rates will rise to around 3.6 percent this year and that home values will appreciate by nearly 6 percent. Let’s also suppose you’re interested in buying a $250,000 home with a 10 percent down payment.

If you wait until next year to buy a house in this scenario, you could see financial repercussions like:**

- Paying as much as $15,000 more for your house.

- Needing an extra $1,500 for your down payment.

- Paying an additional $133/month for your mortgage payment (adding up to $1,596 more per year).

- Missing out on a $15,000 wealth increase through growing equity.

Of course, there are many factors to consider when preparing to buy a home. But if you look at it from a purely financial standpoint, buying now is likely to benefit you much more than purchasing next year.

Wait now, pay more later?

Buying at today’s lower rates can give you a lot to be thankful for. You’re getting a better rate than your older siblings did 10 years ago, your parents did 20 years ago, and your grandparents did 40 years ago. Because of this, many homebuyers find themselves facing a golden opportunity. See how much house you can afford before rates rise.

*MBS Highway payment estimate, 2021. Rates listed are for illustrative purposes only.

**“How Smart Is It to Buy a Home Today?” Keeping Current Matters, 2021.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.