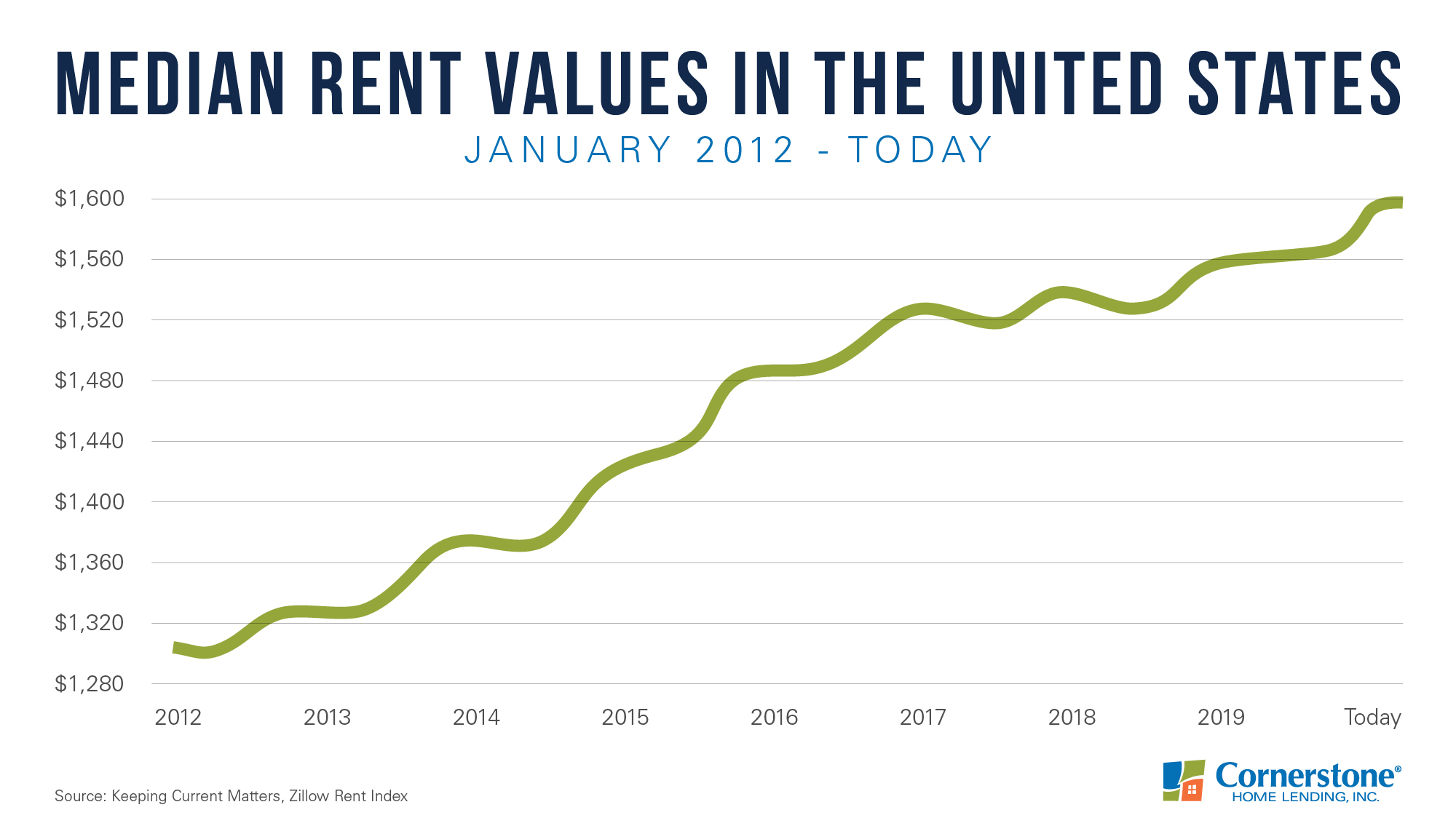

Since 2012, rents in the U.S. have been climbing. As a result, many renters bear a significant burden, trying to balance paying for monthly housing while also attempting to set aside funds for a down payment. But recently, rental prices have started to stabilize, creating a unique opportunity for renters to start saving more money to buy.

You’re probably paying $300 more in monthly rent

The Joint Center of Housing Studies of Harvard University just released America’s Rental Housing Report for 2020.

The results shed light on the financial roadblocks many renters are facing:

“Despite slowing demand and the continued strength of new construction, rental markets in the U.S. remain extremely tight. Vacancy rates are at decades-long lows, pushing up rents far faster than incomes. Both the number and share of cost-burdened renters are again on the rise, especially among middle-income households.”

Betcha didn’t know buying a house was up to 10-percent cheaper.* Click here to find out why.

The latest Zillow Rent Index, estimating the market-rate rent of all apartments and homes, sets the typical monthly rent in the United States at $1,600.

According to the index, median rent values have skyrocketed within the past eight years:

It’s not your imagination. But thankfully, there appears to be good news in sight.

Four of the major indices for rent confirm that rent spikes are finally starting to slow down across all categories:

- Apartment List – Using median rent statistics from the Census Bureau’s American Community Survey on recent movers, Apartment List’s National Rent Report for 2020 shows a 1.6-percent year-over-year rate of growth similar to the rate seen at the same time for the previous year. “The past five years also saw stretches of notably faster rent growth. Year-over-year rent growth stood at 2.6 percent in January 2018, and in January 2016, it was 3.3 percent, more than double the current rate,” the report explains.

- CoreLogic – Since peaking at 4.2 percent in February 2016, year-over-year rent increases have stalled. This is according to CoreLogic’s most recent Single Family Rent Index on single-family-only rentals listed in the MLS (Multiple Listing Service). Rent increases have remained stable at close to 3 percent, starting in early 2019.

- RENTCafé – An analysis of rent data from 260 of the largest U.S. cities indicates that, compared to last year, rents are just 3-percent higher. RENTCafé’s 2019 Year-End Rent Report finds this to be the smallest annual increase over the last 17 months, based on average rent data collected from large-scale, competitive, multi-family properties with 50-plus units.

- Zillow Rent Index – As linked above, Zillow shows rents only rose 2.6 percent within the past year.

Could renters be catching a break from nearly a decade’s worth of continuous price increases? As rents start to moderate, average wages are also beginning to rise. These two factors may make it possible to put aside significant savings — great news for the many renters who are tired of waiting to buy the home of their dreams.

Make last year’s rent this year’s mortgage payment

If you’re like most brand-new buyers, it’ll probably be at a lower price. Right now, mortgage rates are pretty close to rock-bottom. So, you could get a bigger house for a more affordable monthly price. Once you become a homeowner, your monthly housing cost will go toward building your own investment, not your landlord’s. Take a few minutes and get prequalified.

*”Renting vs. buying: Who knew owning a house was 10% cheaper? [INFOGRAPHIC].” HouseLoanBlog.net, Jan. 2020.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.