Over the past two years, the housing market has been unlike any we’ve ever seen. So, if you’re thinking about buying, it’s smart to do some digging. Use these helpful guidelines to determine if you should start home-shopping now or wait until summer.

4 things every buyer needs to know about this spring’s housing market

Maybe you’re a renter who wants to start building something permanent (in the form of home equity that’s been growing at an astonishing rate). Or perhaps you already own a house and are ready to swap out your starter for your family’s forever place.

Even with the recent economic changes related to the pandemic, market factors show there’s no need to put your dreams on hold. In fact, reports from ShowingTime, a supplier of real estate showing management technology, found that winter homebuyers never hibernated. Spring and summer homebuyer activity is expected to climb even higher.

In a market that’s still hot, there are advantages to buying now instead of later. Because:

1. Housing prices will keep going up.

Based on CoreLogic’s latest U.S. Home Price Insights report, home prices have appreciated over 19 percent in the last 12 months alone. And, the report projects that home prices will not drop but should continue to increase by nearly 4 percent year-over-year.

This robust home price growth is seen throughout the country; the FHFA Price Index also confirms double-digit home price appreciation in all nine regions of the U.S. Some housing experts say 2022 home prices may rise even higher — by as much as 7.4 percent.

Housing prices keep moving upward because buyer demand hasn’t slowed. There’s also a long-term shortage of listings. While housing inventory levels are expected to also increase in 2022, experts estimate that inventory may still be half of what it was pre-pandemic. Since homes are a commodity influenced by supply and demand, at least a moderate price appreciation is likely.

If you’re ready to buy a house, it may cost you more to wait.

Connect with a local loan officer who knows the ins and outs of today’s market and can help you close fast.

2. Mortgage rates have started to rise.

They’ve hit multiple record lows, but now, mortgage rates are reaching their highest points within the last two years. Freddie Mac’s Primary Mortgage Market Survey shows the 30-year fixed rate to be under 4 percent. According to Freddie Mac projections, rates are expected to rise moderately by the end of the year.

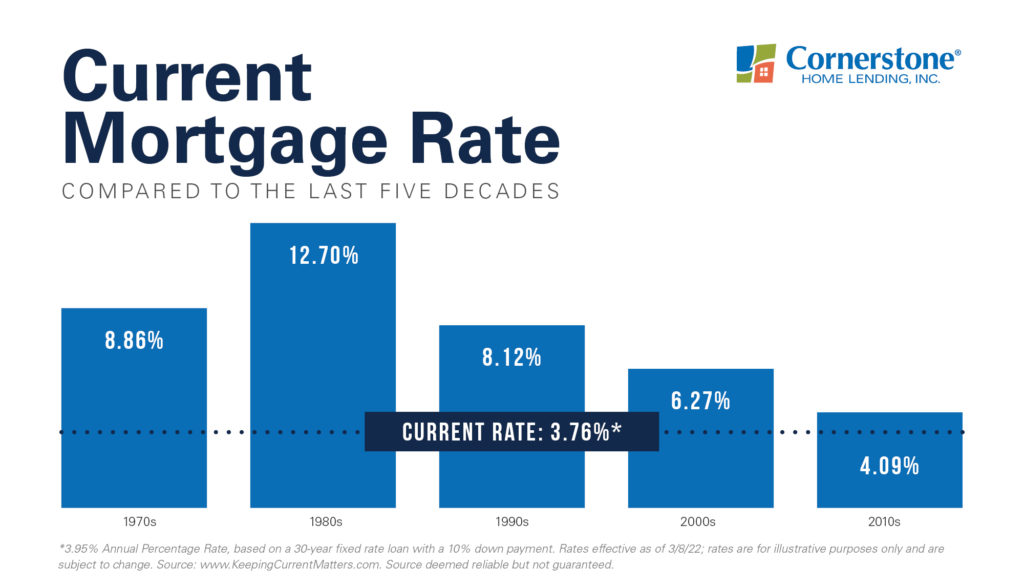

It’s important to note that, though rates have increased, they remain historically low. Mortgage rates sit far below the averages of the past 50 years:

But even when mortgage rates rise slightly, they still have a direct impact on your monthly payment. That’s why waiting to purchase until later in the year is a gamble: Rates are inching up, which causes your monthly housing cost to automatically increase.

3. Either way, you’re paying someone’s mortgage.

Some renters may feel uncomfortable with the idea of taking on a mortgage and might put off buying their first house. But unless you happen to be living with a loved one rent-free, you’re going to be putting money toward a mortgage — whether it’s yours or your landlord’s.

As a homeowner, the monthly payment for your mortgage will function like “forced savings.” Each time you pay on your mortgage, your money will help to begin building your home equity with the potential to cash out on it in a few years. Monthly rent, in contrast, contributes to a landlord’s home equity and will most likely help their worth increase.

This may be an ideal time to start putting your monthly housing expense to work for you.

4. You can start your next chapter.

The actual cost of homeownership can be broken down like this: a home’s market value coupled with the current interest rate. As mentioned, rates and home prices still appear to be increasing. But what if these factors weren’t on the table? Would you still prefer to wait?

This can tell you much more about the reason you want to buy and if it’s worth it to delay. Financial factors matter. But ultimately, you can’t put a price on having a secure place to raise your family; more room for kids, pets, and remote work; total control over how you decide to customize and renovate; and a deeper connection to your community.

The fact that now is an ideal time to buy is the icing on the cake.

Signs point to a unique opportunity for spring homebuyers

Housing prices and mortgage rates are both expected to rise. Buying sooner is a simple way to save. Prequalify from anywhere to find out what’s possible.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.