These are the highlights:

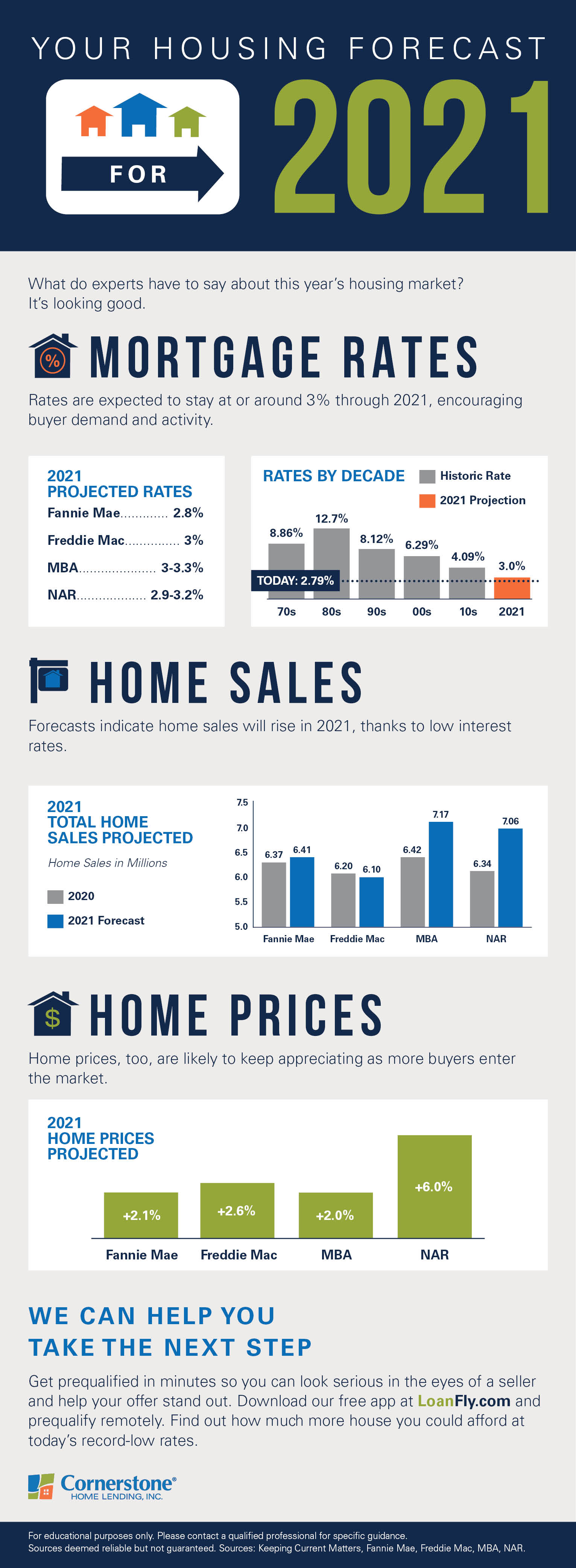

- The expert outlook on the 2021 housing market is optimistic.

- Mortgage rates are expected to stay low, and increased buyer demand is anticipated to spur more home sales and keep driving up housing prices.

- With such a competitive market, it’s smart to reach out to a local loan officer, prequalify early, and prepare to buy.

Is there a Cornerstone office near you? We’re lending in 38 states (and the District of Columbia).

What will the 2021 housing market look like? 4 experts weigh in

The recovery of the 2020 housing market was unanticipated, helping to power economic growth nationwide. Looking at the year ahead, can such a real estate boom continue?

This is what four industry professionals have to say:

1. Lawrence Yun, National Association of REALTORS® (NAR) Chief Economist.

For 2021, Yun expects rates to be similar or slightly higher, potentially ticking up to 3 percent. “So, mortgage rates will continue to be historically favorable,” he says.

2. Danielle Hale, Realtor.com Chief Economist.

As for home sales, Hale predicts they will increase by 7 percent. She adds that home prices may “rise another 5.7 percent on top of 2020’s already high levels.”

3. Robert Dietz, National Association of Home Builders (NAHB) Senior VP and Chief Economist.

Because home builder confidence has reached record highs, Dietz projects that single-family construction gains will continue — though a lower growth rate than 2019 is expected. A slowdown in new home sales growth is also possible as an increasing number of sales have come from new build homes that haven’t begun construction.

“Nonetheless, buyer traffic will remain strong given favorable demographics, a shifting geography of housing demand to lower-density markets, and historically low interest rates,” Dietz says.

4. Mark Fleming, First American Chief Economist.

Mortgage rates are likely to “remain low for the foreseeable future,” Fleming says. “Millennials will continue forming households, keeping demand robust, even if income growth moderates.”

And though homebuilders have been working hard to construct more houses, the big housing supply shortage should continue through the year, potentially causing home price appreciation to stay high.

Unbelievably, mortgage rates dropped to all-time lows 16 times in 2020. This makes the average home significantly cheaper — possibly costing you tens of thousands of dollars less over the lifetime of your mortgage.

Whether you plan to buy or sell your home this year, it’s a good time to take advantage. Moving right now, in particular, when mortgage rates are at record lows could provide you with more opportunities — expanding your price range and your options even while inventory is limited.

I love waiting to close on my dream house (said no homebuyer ever)

We hear you. That’s why we’re working hard behind the scenes to process mortgages quickly and efficiently so you don’t have to wait. You’re this close to owning your new place.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.