These are the highlights:

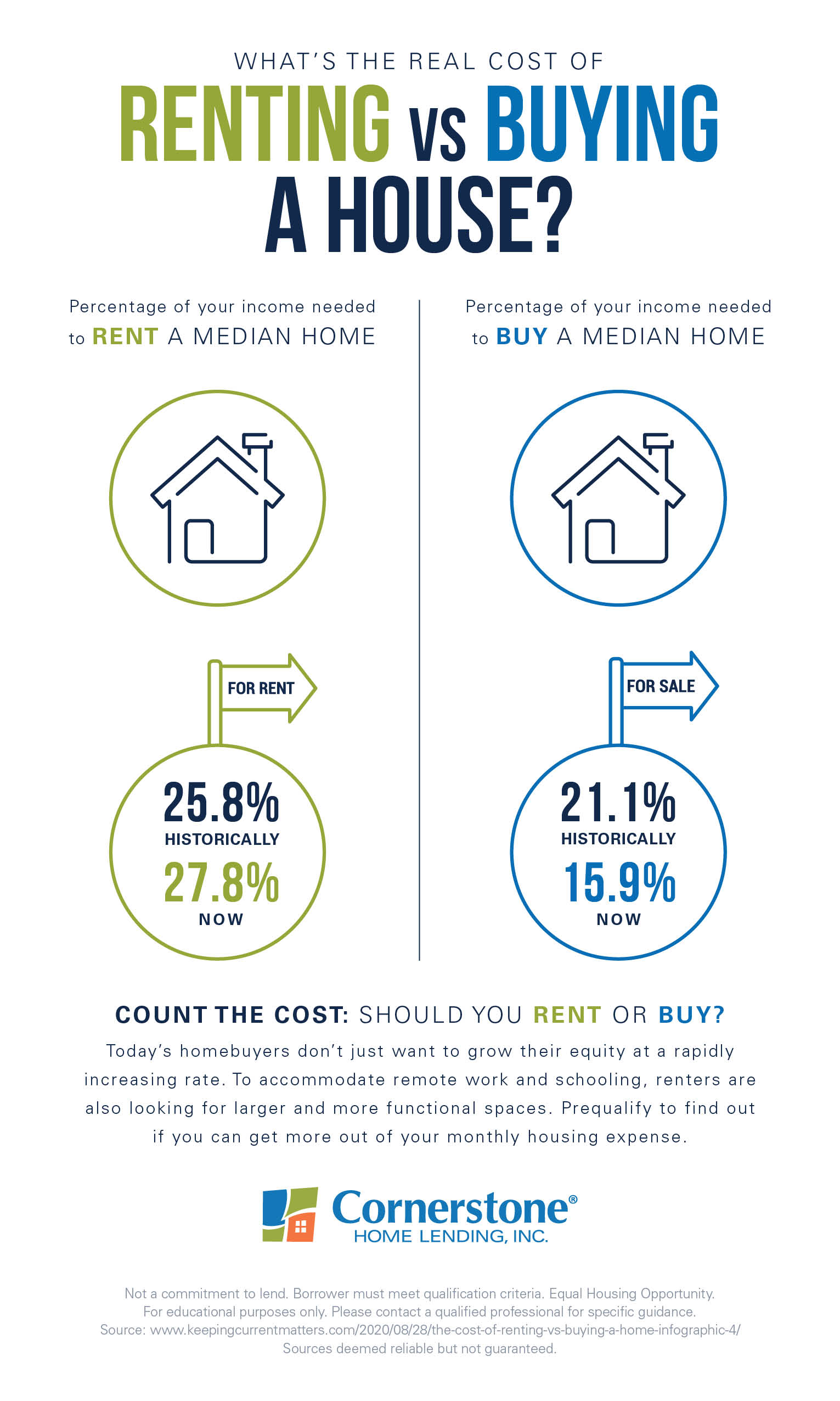

- Historically, it’s been a tossup between renting and buying a house. But as we’re experiencing an unprecedented recovery of the housing market, today’s numbers are much different.

- The percentage of income required to rent a median-priced house sits at 27.8 percent, compared to the 15.9 percent required to purchase. Now, the choice is easy.

- The amount needed to afford a home at median price is decreasing, while the amount needed to rent continues to rise. Record-low mortgage rates also make buying a home more attractive, offering a buying power increase.

One of the biggest determinants of household wealth is owning a home. You won’t get the same benefit from renting. Take the first step and prequalify.

Not owning a house can cost more than you think

As Zillow recently reported, housing has become an even bigger priority amidst the pandemic:

“In 2020, homes went from the place people returned to after work, school, hitting the gym or vacationing, to the place where families do all of the above. For those who now spend the majority of their hours at home, there’s a growing wish list of what they’d change about their homes, if possible.”

In addition to this growing need for more indoor and outdoor space, there are at least five financial reasons to consider homeownership:

- Homeownership works like forced savings.

- It gives you tax breaks.

- It helps you lock in your monthly cost of housing.

- It’ll cost you less than renting.

- It’s the only investment you can live in.

Then there’s the fact that research shows that a homeowner’s net worth is 44 times more than the worth of a renter. One argument in favor of renting is that it cuts the cost of home repair and taxes, but it helps to remember that all these expenses incurred by a landlord are already lumped into your monthly rent payment — plus any profit they make.

You might be surprised how much you can save

Today’s housing market is filled with opportunities, and renters are taking advantage. Historically low mortgage rates are giving many first-timers more buying power than they expected. Wondering how much house you can afford, and how it stacks up to your monthly rent? Find out now.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.