Winter has come. If you’ve been thinking about making a move, it’s time to answer the question: Is this the right season to buy?

4 things every homebuyer needs to know about this winter’s housing market

Maybe you’re sick of worrying about how much your rent may increase. You also might want to start growing your family’s wealth by building your home equity. Or, you could be like so many homeowners ready to trade up to a larger place to accommodate remote work and/or schooling.

Whatever your motivation might be for buying a house, this winter’s a smart season to do it. Because:

1. Housing prices are expected to rise.

CoreLogic’s Home Price Insights showed that housing prices appreciated by 18.1 percent over the past 12 months. This was the biggest annual jump seen in the CoreLogic Home Price Index’s 45-year history. The report also projects that prices will rise by roughly 2.5 percent through the upcoming year.

Other forecasts estimate 2022’s home price appreciation to be as high as 8.4 percent.

Compared to other seasons, housing prices are typically lower in the winter. But home prices are no longer bottoming out. High demand, caused by record-low mortgage rates related to the pandemic, coupled with low inventory (housing supply) has triggered prices to rise. There aren’t any benefits of waiting.

Winter’s for renters. Prequalify in minutes and find out how much more you could save when you buy.

2. Mortgage rates are currently low.

After reaching record lows multiple times throughout the pandemic, Freddie Mac’s Primary Mortgage Market Survey indicates that the fixed mortgage rate has just recently climbed to around 3 percent. In the next 12 months, housing market experts predict these rates will begin to increase.

Freddie Mac, the Mortgage Bankers Association, and the National Association of REALTORS® all agree: Rates will surpass 3 (and possibly even 4) percent in 2022.

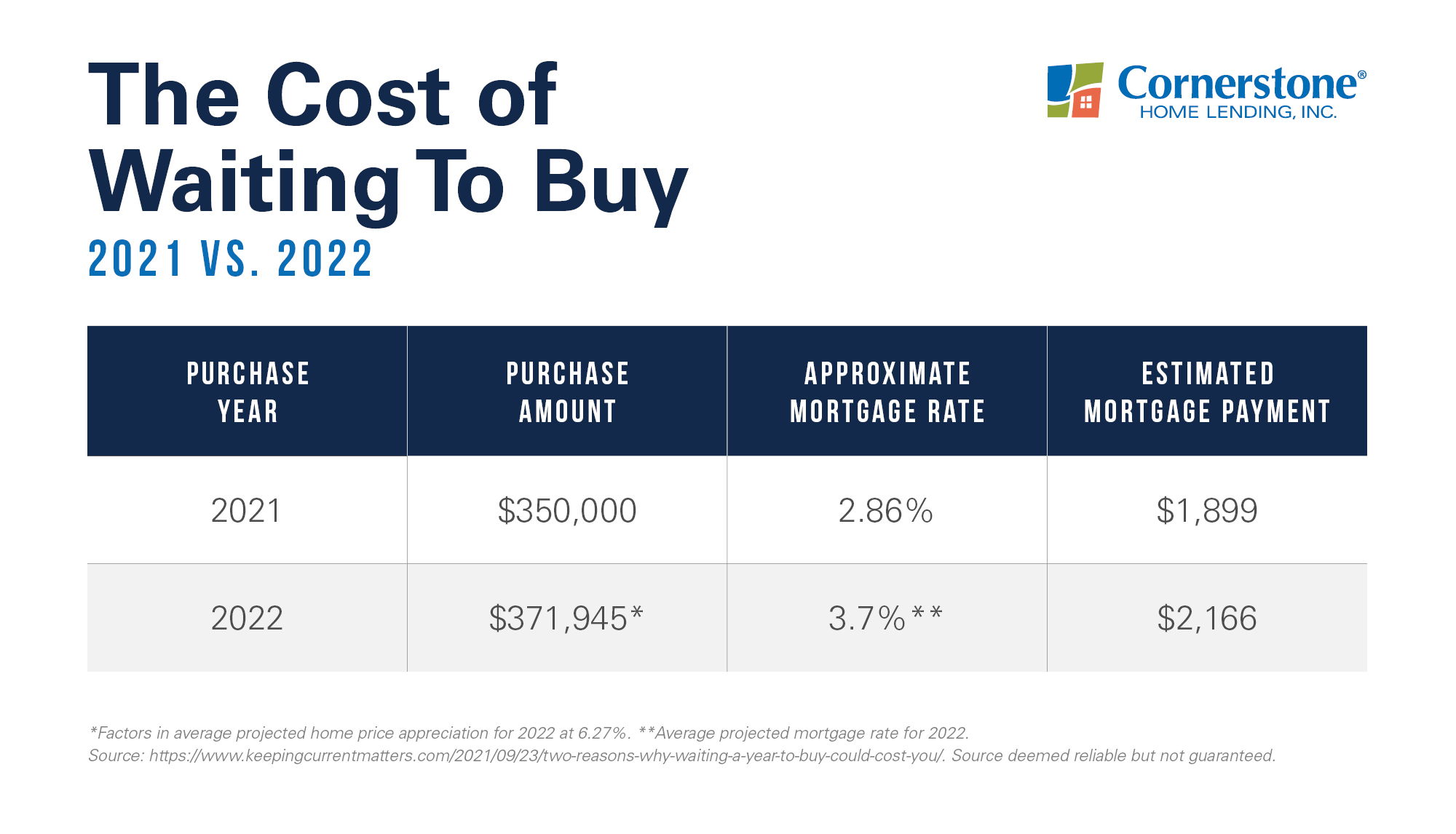

Mortgage rates impact your monthly payment. Buying a home before the next rate increase could potentially save you hundreds of dollars a year on your mortgage. Waiting a year to buy, on the other hand, means your monthly housing expense is likely to increase for a home of the same price.

3. No matter where you live, you’re paying a mortgage.

Some renters put off buying because they don’t know if they’re ready to take on the responsibility of a mortgage. But unless you happen to be living with friends or family rent-free, you’re already paying someone’s mortgage — your landlord’s or your own.

When you become a homeowner, your mortgage payment turns into your “forced savings” plan, allowing you to build home equity. (Owners are currently worth over 40-times more than renters.)

As this equity grows, you can cash out on it later for unforeseen expenses, home upgrades, a small business, weddings, and more. Renting only continues to build your landlord’s equity and doesn’t help you use your monthly housing cost to your advantage.

4. Your next chapter awaits.

Two components go into the cost of owning a home: current mortgage rates and home prices. Right now, both rates and housing prices are expected to increase. If they weren’t rising, would you still wait?

Your main motivator for buying a home can tell you when you should act.

Wanting a safe place to grow your family, more control over renovations, extra room for working remotely, and a bigger backyard for kids and pets are all strong reasons to start hunting now instead of later. In this case, the money-saving benefits of buying sooner are the icing on the cake.

Get you home faster?

We already wow our borrowers with our bend-over-backward service and commitment to on-time closings. Learn how winter buyers are using our super-speedy, in-house processing to get home sooner than they expected.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources deemed reliable but not guaranteed.