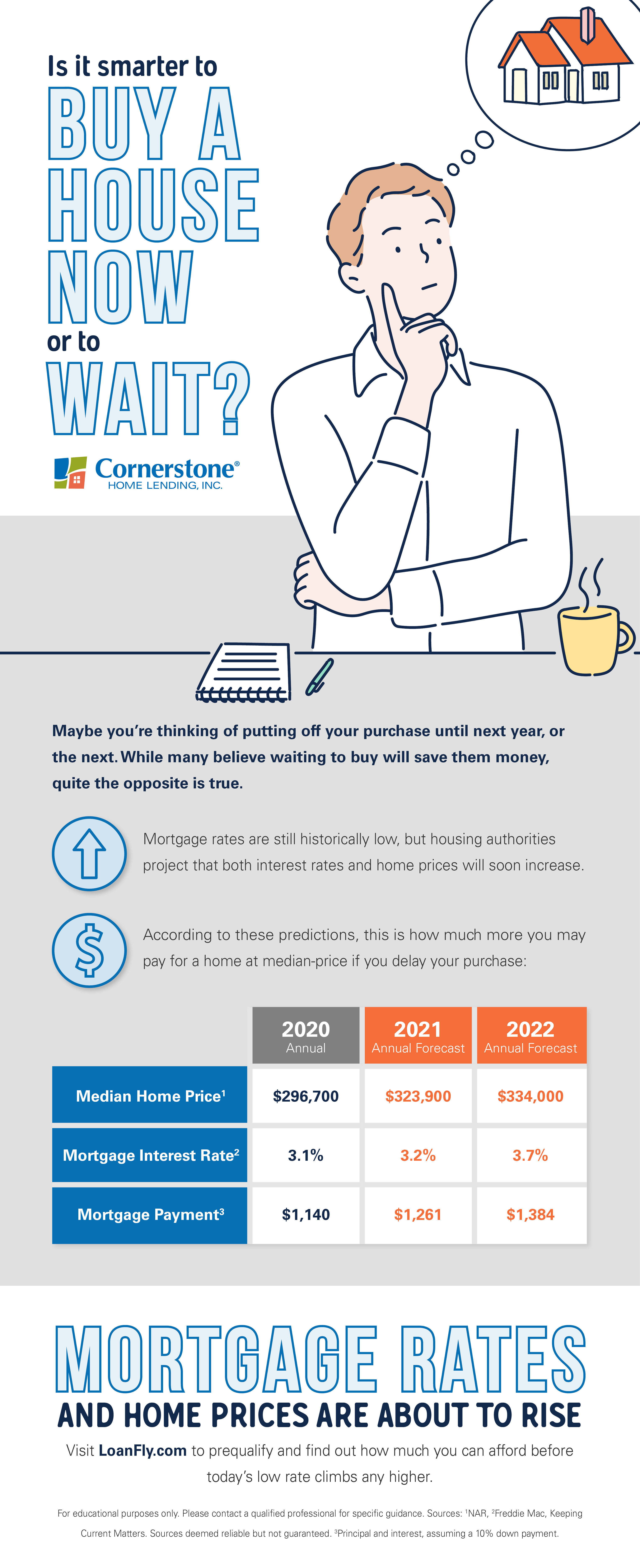

Let’s take a closer look*:

- In today’s market, the idea that waiting to buy a home will save you money couldn’t be further from the truth.

- Mortgage rates hover around record lows but are anticipated to rise as our economy continues its rebound.

- Even a modest rate increase — as noted in the chart above — may add hundreds to your monthly mortgage payment.

Once you become a homeowner, the odds are in your favor. You’ll quickly start accruing wealth, or home equity. The latest data from the Federal Reserve’s Survey of Consumer Finances confirms that a homeowner’s net worth may be over 40 times greater than that of a renter.

6 strong reasons to own a home if you’re on the fence

Some of the perks of homeownership include:

1. Earning money instead of spending it on rent.

Housing prices have increased, and right alongside, rents are going up too. And so:

- It may look like a better deal to rent than buy at face value — cheaper in the short-term and a helpful option for some renters, depending on circumstance.

- But in the next five years, renters are going to miss out on a major growth of their housing investment.

- Over the next five years, home prices are expected to appreciate by 3.9 percent per year on average and to increase by 26 percent cumulatively, according to Zillow’s recent Home Price Expectations Survey.

So, let’s say you buy a $277,000 median-priced home in 2021. If you only look at the projected increase in the price of that home, how much equity will you earn over the next five years? Since home prices are predicted to rise by an average of 3.9 percent a year, you’ll have gained $10,803 in equity in just one year. Over a five-year period, your equity could increase by more than $54,000.

*Note that this figure does not take into account your monthly principal mortgage payments.

2. Growing your investment.

As seen in the rent-versus-buy example above:

- Americans could create more benefits by owning a home than any other type of investment.

- For many people, delaying the purchase of a home can dramatically decrease the ability to grow equity and gain financial stability.

- Waiting to save up for a large down payment might actually cost you thousands; you may be better off buying with a small down payment (or using a no-down-payment loan program) than paying more for a house later.

Home equity is likely to be one of the largest portions of your family’s overall net worth. Not only is homeownership something to be proud of, but it also offers you and your family the chance to build equity you can borrow against in the future. Now it makes sense why, for the past eight years, real estate has beat stocks as Americans’ number one preferred long-term investment.

Who said buying a house had to be hard? Download the app that makes prequalifying for a mortgage, searching for houses, uploading loan docs, and staying in touch with your loan officer easy.

3. Locking in a set monthly payment.

With most loan types, owning a home means securing your monthly mortgage payment. No longer will you be at the whim of landlords, apartment buildings, and condo complexes that may exercise their right to raise rents unexpectedly.

Many tenants have been told to count on rents rising each year, due to a combination of maintenance costs and inflation. Monthly rent can also spike because of demand in a popular area. Not so with homeownership.

4. Reaping the tax savings.

There’s the ability to build an investment over time, and then there’s the annual icing on the cake:

- Buying a home comes with a good deal of responsibility, as well as quite a few advantages.

- The current tax laws let you write off the first $10,000 of your property taxes, along with some mortgage interest.

- So, if your house payment is similar to your former rent payment, then the financial benefits at tax time alone are worth it.

You may also be able to indirectly lower your property taxes by filing a homestead exemption. This is done through your local or county tax assessor’s office.

5. Saving automatically.

It’s simple but super-effective. Investing in homeownership turns your house into a “forced savings vehicle.” Over time, this could allow you to fund tuition, vacations, weddings, retirement planning, or care for an aging family member.

Assuming this moderate amount of price appreciation, it only takes a few years (or less) for your home to become a valuable asset. It can serve as collateral for a loan or yield you a nice return upon selling. And aside from no longer paying your landlord’s mortgage or helping to grow their equity, buying a home can be the foundation for starting a small business.

6. Strengthening local communities.

When you buy a house and join a neighborhood, you’re not just helping your family:

- You’re also supporting everyone around you.

- Owning a home has been proven to help reinforce the family unit and surrounding communities.

- These non-financial benefits of homeownership, like a feeling of pride and accomplishment, aren’t found on a ledger or 1040.

Ninety-one percent of homeowners report feeling stable, successful, and secure because of owning a house. And 83 percent say that, throughout the pandemic, their home has made them feel safe. Owning a home only adds to this invaluable sense of safety by helping you become rooted in your community.

Should I wait to buy a house? It never hurts to ask.

Waiting may be the right choice if you’re paying down debt or don’t plan to stay put for a while. But keep in mind that waiting too long in today’s market can put the cost of your dream house out of reach. Want to find out where you stand? Download our free LoanFly app and prequalify from anywhere.

*“Should I Buy Now or Wait? [INFOGRAPHIC].” Keeping Current Matters, 2021.

For educational purposes only. Please contact a qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.