Now that we’ve reached the second half of 2021, it’s apparent: Today’s housing market is breaking records. A very specific set of circumstances are bringing opportunities for both homebuyers and sellers. Here’s a closer look at which four factors are creating this never-before-seen market.

The 4 reasons that today’s housing market is unlike any other

Right now, we’re seeing unique conditions like:

1. A housing inventory shortage.

Early in the year, the number of available houses for sale plummeted to its all-time low. Thankfully, housing inventory levels have slowly begun to rise.

The recent Monthly Housing Market Trends Report from realtor.com states:

“In July, newly listed homes grew by 6.5 percent on a year-over-year basis, and remained stable on a month-over-month basis. Typically, fewer newly listed homes appear on the market in the month of July compared to June. This year, homes are continuing to be listed at seasonally-elevated rates later into the summer season, a welcome sign for a tight housing market.”

For buyers desperately in need of more listings, this is exciting news. And yet, though small inventory gains have been made, total housing inventory is still tight in most parts of the U.S. As a result, it’s still a seller’s market, so homeowners have the upper hand when they choose to sell and move.

2. Bidding wars and high buyer competition.

When you couple today’s continued housing shortage with a boom in buyer demand, you get a housing market rife with bidding wars and competition.

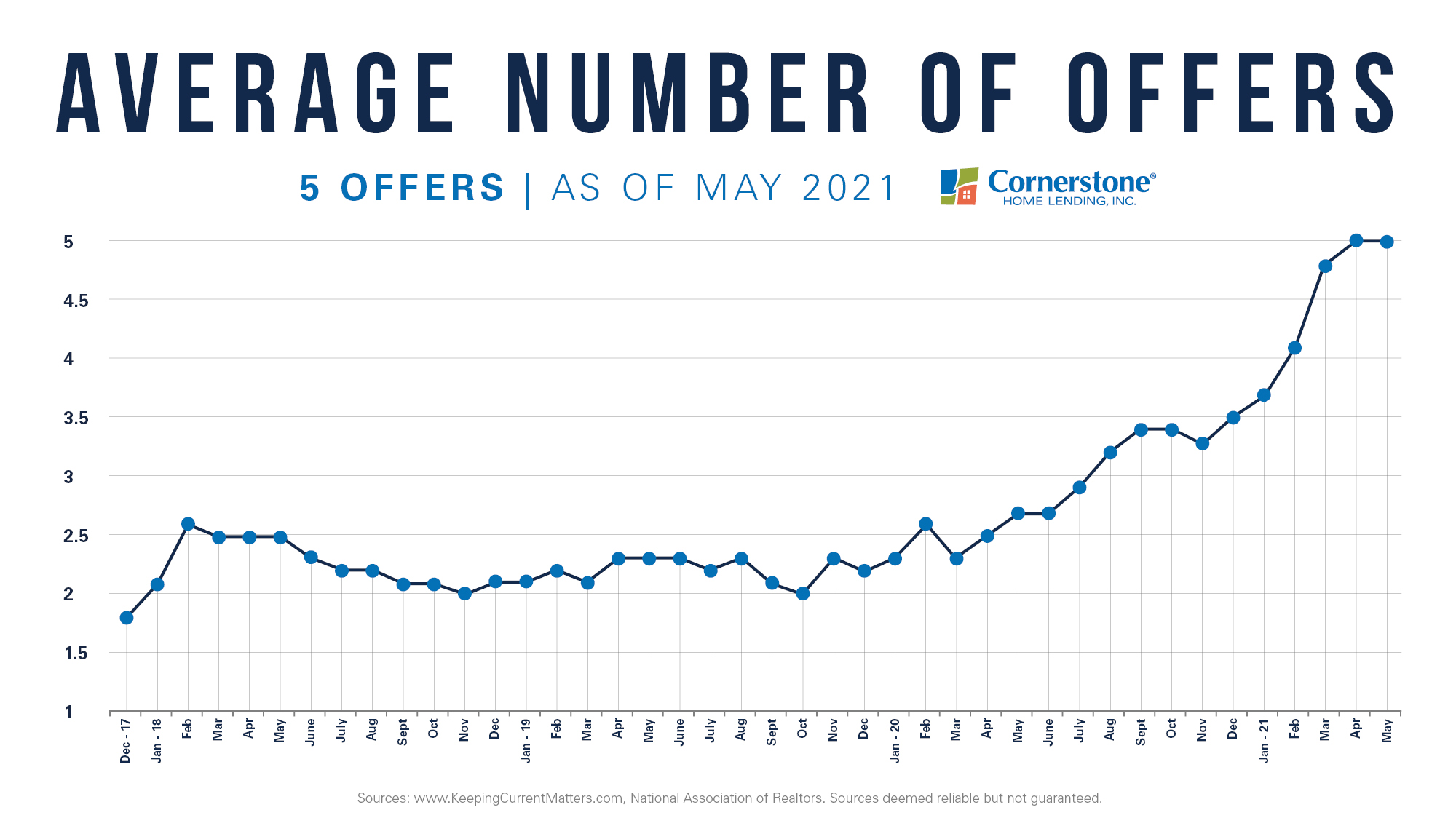

Right now, it’s not uncommon for buyers to bid well above asking price to ensure their offer will get noticed. The buyers who can afford it are opting to pay in cash (or use a like-cash early loan approval program), while others are happy to waive contingencies just to get their offer accepted. In 2021, the average number of offers on a house also broke records — making it a prime time to sell.

This graph depicts the number of offers received by home sellers on average in peak months this year, according to the National Association of REALTORS® Confidence Index:

If you’re a homebuyer, it’s critical to work with a skilled, local real estate agent who can help you put your strongest offer on the table. In this kind of fast-paced market, it’s also essential to prequalify early with a local loan officer, and even gain full loan approval, to help your offer stand out.

3. Climbing home prices.

Buyer demand is also causing home values to appreciate. Within the past year, home prices have increased nationwide.

CoreLogic’s Home Price Index (HPI) confirms that, as of May, U.S. home prices had risen 15.4 percent year-over-year:

“The May 2021 HPI gain was up from the May 2020 gain of 4.2 percent and was the highest year-over-year gain since November 2005. Low mortgage rates and low for-sale inventory drove the increase in home prices.”

Rapidly appreciating home values can be credited as to why real estate continues to be ranked by Americans as one of the top long-term investments. If you’re thinking about selling, this also supports the fact that it’s an ideal time to list your home and leverage an even greater return.

Lower your payments, get a bigger house, and find a better school district? Prequalify now.

4. Rising home equity.

Your home equity will automatically increase each month when you pay your mortgage. It’ll also increase when the value of your home appreciates. Because home prices are appreciating, homeowners are seeing unprecedented equity gains in every state.

“…homeowners with mortgages (which account for roughly 62 percent of all properties) have seen their equity increase by 19.6 percent year-over-year, representing a collective equity gain of over $1.9 trillion, and an average gain of $33,400 per borrower, since the first quarter of 2020.”

This is a big advantage for today’s homeowners. As a homeowner, you could refinance and cash out on your equity to fund your future goals. Or, you could sell your current home and use your equity to secure your dream house.

The takeaway: Current — likely to be once-in-a-lifetime — market conditions show that it’s a great time to be a buyer or a seller. For homebuyers, more homes are becoming available, and mortgage rates still hover around historic lows, making homebuying affordable. For sellers, record equity gains may increase your profit when you sell and make it possible to move up into the next price range.

Want to have an ‘excellent experience from preapproval to close?’

“This is my third time going through the homebuying process. From helping me organize for my preapproval, to providing support and advice while bidding on homes, to a speedy closing, I was impressed by the professionalism, efficiency, and transparency. Stacia at Cornerstone is a mortgage rockstar!” Whether you’re buying or selling, we’re here to help. Connect with a local loan officer now.

While refinancing could make a significant difference in the amount you pay each month, there are other costs you should consider. Plus, your finance charges may be higher over the life of the loan.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.