Here are the highlights:

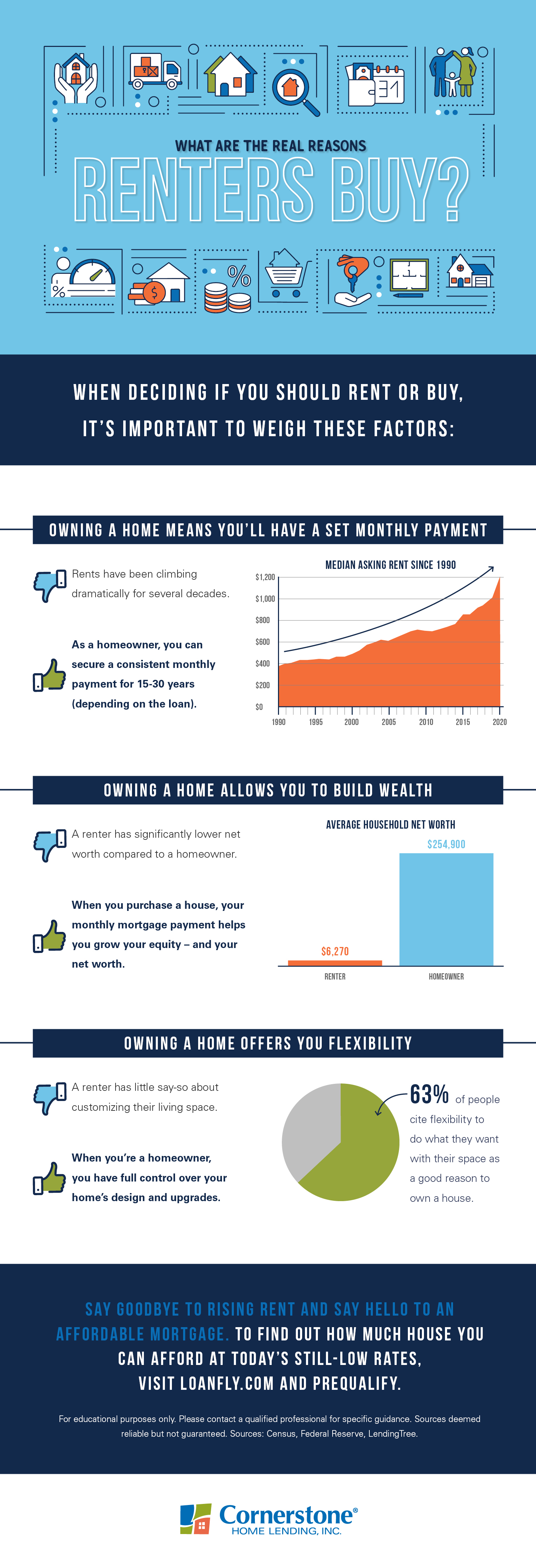

- When determining if it’s better to rent or buy, these top three factors must be taken into account.

- Buying a home can offer you a stable monthly payment, while helping to grow your wealth. It also gives you a lot more flexibility compared to renting.

- If you want to experience these benefits of homeownership and others, reach out to a local loan officer to learn about your options.

Will it cost you more to rent or to buy? Use our handy calculator to find out.

Is it better to rent or buy? How to tell when the time is right

Within the past year and a half, homebuyer demand has boomed as mortgage rates dropped, triggered by the economic changes caused by the pandemic. Meanwhile, rents hit their highest recorded point in many parts of the U.S. ATTOM Data Solutions’ 2021 Rental Affordability Report confirms that it continues to be cheaper to buy a house than to rent.

The report states:

“Owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 572, or 63 percent, of the 915 U.S. counties analyzed for the report.”

Understanding the data is one thing. But how do you know if you’re in an ideal position to buy?

You may be ready to purchase a home if you fit one or more of these criteria. Do you?

- Know where you want to live.

- Have confidence in your job location.

- Feel comfortable with a longer commitment for a long-term reward.

- Want to build wealth over time.

- Think you could benefit from more tax deductions.

- No longer want to ask your landlord’s permission for housing changes or upgrades.

Renting a house, condo, or apartment makes sense in those times when you need a shorter commitment. A one-year lease is common. Along with your monthly rent, you may also have to budget for utilities and could be required to pay a small investment of your first and last month’s rent.

When used as a short-term option, renting can give you the chance to get to know an area and decide if it’s where you want to live. If traffic is unbearable, or the neighbors aren’t so nice, you can leave at the end of your lease and sample another part of town.

Renting may be the better move for you right now if you:

- Are new to town.

- Just got a new job with realistic possibilities of movement or relocation.

- Don’t want a long-term commitment.

- Enjoy the perks of a community pool, onsite gym, and other amenities.

But the big draw of homeownership is that it makes money. That’s why, across the board, most financial advisors recommend buying when you can afford it.

This is also why real estate is still considered Americans’ number one investment, beating out stocks and gold. Real estate appreciation is often the single largest contributor to a family’s long-term wealth. Unlike renting, a portion of your mortgage payment goes toward reducing your loan principal each month. This acts as a steady drip that increases your home equity over time.

Equity is the difference between your home’s value, factoring in price appreciation, and the amount you owe on your mortgage. Home equity is surging in today’s market, driven up by a combination of low housing inventory and strong buyer demand. CoreLogic’s latest data shows that the average homeowner has gained $51,500 in equity within the last year.

If you’re a renter who’s thinking about buying, seeing the potential for such rapid equity gains may be enough to solidify your decision. Mortgage rates are expected to rise over the next year. Buying sooner, if your circumstances allow, will enable you to jump on this equity “wave” and start building your investment.

In addition to its undeniable financial benefits, many Americans value homeownership because of the many personal payoffs it provides.

According to the 2021 National Homeownership Market Survey, six out of the nine benefits people receive from owning a home have a non-financial (emotional) impact; reasons to own include stability, safety, pride, community belonging, achievement of a milestone, and a sense of accomplishment.

When you’re ready to stop renting:

We’re ready to help. Get in touch with a local loan officer who can assess your unique needs, determine how much house you can afford, and help you find a mortgage you feel good about.

For educational purposes only. Please contact your qualified professional for specific guidance.

Sources are deemed reliable but not guaranteed.